Okay, I understand. Here's an article exploring the question of wise investing and the possibility of getting rich, aimed at providing a comprehensive and informative overview.

The pursuit of financial security and, for some, outright wealth is a common human aspiration. While “getting rich” is a subjective concept and often a misleading benchmark, understanding how to invest wisely is a crucial step towards achieving one's individual financial goals, whether those goals involve early retirement, comfortable living, or leaving a lasting legacy. Investing wisely isn’t about overnight success stories; it’s about cultivating a long-term strategy based on informed decisions, disciplined execution, and a realistic understanding of risk and return.

The foundation of wise investing lies in establishing a solid financial plan. This plan should incorporate a clear understanding of your current financial situation – income, expenses, debts, and assets – and your future financial goals, including the timeframe for achieving them. Are you saving for retirement in 30 years, a down payment on a house in 5 years, or your children's education in 10? Your goals dictate the types of investments that are appropriate for your circumstances. A younger investor with a longer time horizon can generally tolerate more risk than an older investor nearing retirement.

Once you have a clear financial plan, you can begin to explore different investment options. These options can be broadly categorized into several asset classes, each with its own risk and return profile. Stocks, or equities, represent ownership in a company and offer the potential for high growth, but they also come with higher volatility. Bonds, or fixed income investments, represent loans to governments or corporations and generally offer lower returns but are also less volatile than stocks. Real estate can provide both income and appreciation, but it also requires significant capital investment and ongoing management. Alternative investments, such as commodities, private equity, and hedge funds, can offer diversification and potentially higher returns, but they often come with higher fees and less liquidity.

Diversification is a cornerstone of wise investing. Spreading your investments across different asset classes, industries, and geographic regions can help to mitigate risk. The principle is simple: by not putting all your eggs in one basket, you reduce the potential impact of any single investment performing poorly. A well-diversified portfolio should be designed to withstand market fluctuations and generate consistent returns over the long term. This doesn't mean simply owning a large number of random investments. True diversification requires a strategic allocation of assets based on your risk tolerance and investment goals.

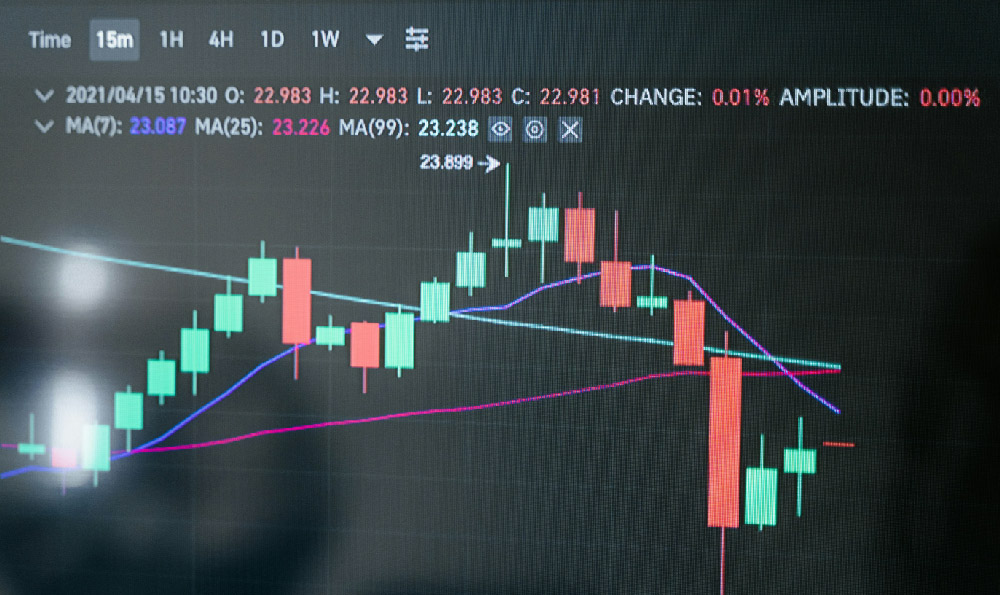

Beyond asset allocation, understanding the underlying principles of specific investments is crucial. For example, before investing in a particular stock, you should research the company's financials, its competitive landscape, and its management team. Similarly, before investing in a bond, you should understand the issuer's creditworthiness and the bond's maturity date. This requires diligent research and a willingness to stay informed about market trends and economic developments. Ignoring fundamental analysis and relying solely on "hot tips" or market hype is a recipe for disaster.

Another key aspect of wise investing is managing costs. Investment fees, including management fees, trading commissions, and expense ratios, can significantly erode your returns over time. Choosing low-cost investment options, such as index funds or exchange-traded funds (ETFs), can help to minimize these costs and maximize your returns. Even small differences in fees can have a significant impact on your long-term investment performance.

The emotional side of investing is often overlooked, but it can be just as important as the financial aspects. Fear and greed can lead to impulsive decisions that can derail your investment strategy. Market downturns can be frightening, but selling investments during a downturn can lock in losses. Similarly, market booms can be tempting, but chasing high-flying stocks without understanding their underlying value can lead to bubbles and subsequent crashes. Developing a disciplined investment approach and sticking to your long-term plan can help you to avoid these emotional pitfalls. Automating your investments, such as setting up regular contributions to your retirement account, can also help to remove some of the emotional temptation to deviate from your plan.

Now, addressing the question of whether getting rich is possible through wise investing. The answer is complex and depends on several factors, including your starting capital, your investment timeframe, your risk tolerance, and your investment skill. While there are no guarantees of riches, consistent, disciplined investing over a long period of time can significantly increase your chances of achieving financial independence and building substantial wealth. Compounding, the process of earning returns on your initial investment and subsequent earnings, is a powerful force that can accelerate wealth creation over time.

However, it's crucial to have realistic expectations. "Getting rich" quickly is often associated with high-risk investments, which carry a significant risk of loss. While some individuals may strike it rich through speculative investments, the vast majority of successful investors build wealth gradually through a diversified portfolio of assets and a long-term perspective. Furthermore, the definition of "rich" is subjective and varies from person to person. For some, it may mean having enough money to retire comfortably. For others, it may mean having enough money to pursue their passions or give back to their community.

Finally, it's important to acknowledge that investing is not the only path to wealth. Entrepreneurship, career advancement, and even plain luck can also play a role. However, even in these cases, wise investing can help to preserve and grow your wealth over time. Ultimately, wise investing is about making informed decisions, managing risk, and staying disciplined. It's a journey, not a destination, and it requires ongoing learning and adaptation. It's about creating a financial future that aligns with your values and allows you to live the life you desire. And while “getting rich” might be the ultimate goal for some, the true reward of wise investing lies in the peace of mind that comes from knowing you are in control of your financial future.