Okay, I understand. Here's an article exploring the effectiveness of William O'Neil's CAN SLIM method in stock investing, without explicitly using the title, bullet points, or numbered lists, and avoiding phrases like "firstly" or "secondly."

Is the CAN SLIM methodology, popularized by William J. O'Neil in his seminal book "How to Make Money in Stocks," a genuine pathway to consistent profitability in the often unpredictable world of the stock market? This question has echoed through trading floors and online forums for decades, with proponents and skeptics offering their perspectives. To effectively address it, a deep dive into the principles of CAN SLIM, its strengths, weaknesses, and practical application is essential.

CAN SLIM, an acronym representing seven key characteristics of winning stocks, offers a structured, rules-based approach to stock selection. The "C" stands for Current Quarterly Earnings Per Share. O'Neil emphasizes the importance of investing in companies demonstrating strong, accelerating earnings growth in the most recent quarter. This signifies a company whose business is currently thriving, unlike those relying on past performance or future projections. The focus isn't just on positive earnings, but on a substantial increase compared to the same quarter of the previous year. A minimum of 20-25% earnings growth is generally considered a benchmark.

The "A" represents Annual Earnings Growth. While current earnings are crucial, sustained profitability is equally vital. O'Neil advocates for seeking companies with a history of increasing annual earnings. This demonstrates a consistent track record of success and suggests the company possesses a robust business model capable of withstanding market fluctuations. Look for companies that have shown a history of increasing their earnings per share year after year, ideally over the last three to five years.

"N" signifies New Products, New Management, New Highs. O'Neil believed that innovative companies often experience the most significant growth. These "new" elements could include groundbreaking products or services, a change in management signaling a fresh approach, or the stock price hitting new highs, indicating strong market demand and investor confidence. A company introducing a disruptive technology or expanding into a new market often represents a compelling investment opportunity.

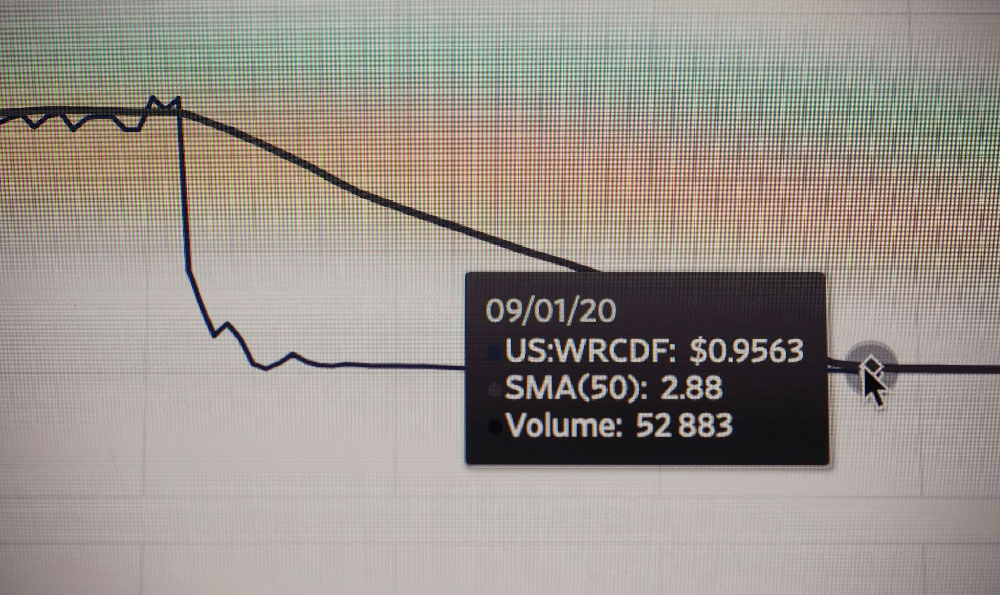

"S" stands for Supply and Demand. This component focuses on understanding the stock's trading volume and its impact on price. O'Neil believed that significant price increases should be accompanied by above-average volume, indicating strong institutional buying. Analyzing volume patterns helps determine whether a price move is genuine and sustainable or simply a short-term anomaly. He also advised investors to pay attention to the float (the number of shares available for public trading). A smaller float can lead to more volatile price swings when demand increases.

The "L" represents Leader or Laggard. O'Neil stressed the importance of investing in leading companies within their respective industries. These leaders tend to outperform their peers and exhibit stronger growth characteristics. Identifying industry leaders involves comparing their earnings growth, sales growth, and return on equity to those of their competitors. Investing in a "laggard," a company that is underperforming its industry peers, is generally discouraged.

"I" stands for Institutional Sponsorship. Institutional investors, such as mutual funds, pension funds, and hedge funds, play a significant role in the stock market. Their involvement can provide a substantial boost to a stock's price. O'Neil advised seeking companies with increasing institutional ownership, as this indicates strong confidence in the company's prospects. However, it's essential to remember that excessive institutional ownership can also create increased volatility if these institutions decide to sell their shares.

Finally, "M" signifies Market Direction. O'Neil emphasized the importance of understanding the overall market trend. Even the best stocks can struggle in a bear market. Identifying and aligning with the market's direction is crucial for maximizing profits and minimizing losses. He recommended using market indicators, such as the S&P 500 or the Nasdaq Composite, to gauge the overall market sentiment. Waiting for a confirmed uptrend before making significant investments is a key principle of CAN SLIM.

However, the CAN SLIM method isn't without its critics and inherent limitations. Its emphasis on growth can lead to investing in high-valuation stocks that are vulnerable to significant price corrections if growth expectations aren't met. Furthermore, the reliance on technical analysis and chart patterns can be subjective and may not always accurately predict future price movements. The emphasis on recent earnings may also overlook companies with temporarily suppressed earnings due to external factors but possessing strong long-term potential.

Moreover, the rigid adherence to the CAN SLIM criteria can sometimes lead to missing out on value opportunities. Companies that don't perfectly fit the CAN SLIM mold but possess strong fundamentals and attractive valuations might offer significant long-term returns. Adaptability and critical thinking are, therefore, vital supplements to the CAN SLIM methodology.

In conclusion, while CAN SLIM offers a robust and structured approach to stock selection, it's not a guaranteed path to riches. It should be viewed as a framework rather than an infallible formula. Its success hinges on the investor's ability to apply it diligently, adapt it to changing market conditions, and supplement it with sound fundamental analysis and risk management practices. Understanding the underlying principles, recognizing its limitations, and integrating it into a broader investment strategy are crucial for determining if CAN SLIM can unlock consistent profitability in the stock market. The key lies not just in following the rules, but in understanding the reasoning behind them and tailoring them to individual investment goals and risk tolerance. Ultimately, success requires a combination of disciplined methodology, continuous learning, and a healthy dose of skepticism.