The allure of rapid wealth accumulation is a powerful magnet, drawing individuals from all walks of life to explore avenues promising exponential returns. In the context of cryptocurrency, where fortunes have indeed been made in seemingly short periods, the question of "the quickest way to get rich" becomes particularly potent. However, it's crucial to preface any discussion on this topic with a heavy dose of reality and caution. The pursuit of rapid riches carries inherent risks, and while opportunities for significant gains exist, so too does the potential for substantial losses.

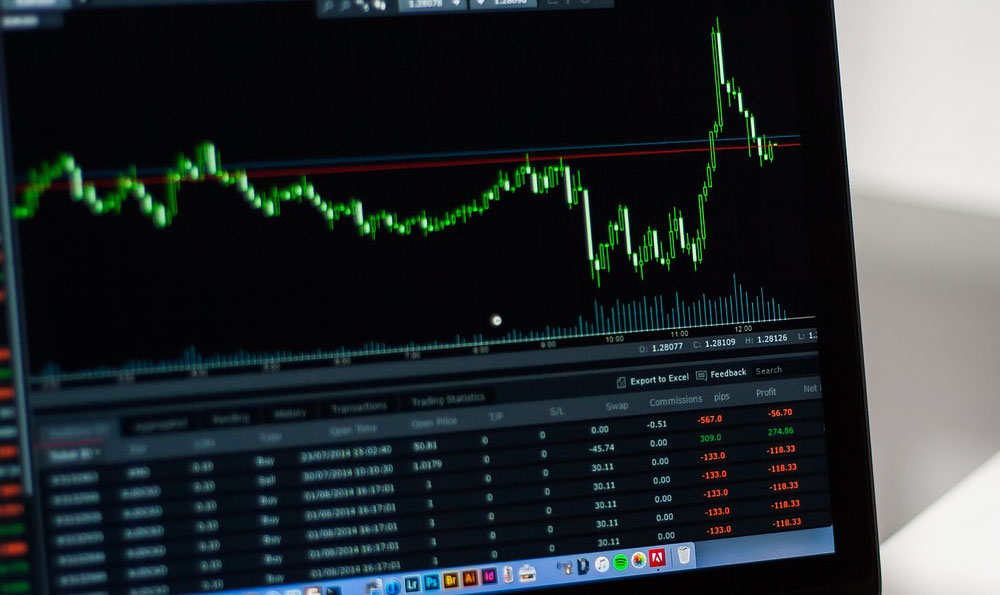

The crypto market, by its very nature, is characterized by extreme volatility. This volatility, while creating opportunities for profit, also amplifies the risk. Understanding the underlying dynamics that drive these fluctuations is paramount. Factors such as regulatory announcements, technological advancements, macroeconomic events, and even social media trends can exert significant influence on the prices of cryptocurrencies. A deep understanding of these drivers is necessary to make informed investment decisions.

One approach that some investors consider in their pursuit of rapid wealth is high-leverage trading. Leveraging allows you to control a larger position with a smaller amount of capital. While this can amplify profits significantly when the market moves in your favor, it also magnifies losses when the market moves against you. High leverage is a double-edged sword, and it's generally advised only for experienced traders with a high risk tolerance and a thorough understanding of risk management techniques. A single wrong trade with high leverage can wipe out a significant portion, or even all, of your investment.

Another strategy often associated with rapid wealth accumulation in crypto is investing in new or emerging projects, often referred to as "altcoins" or "shitcoins." These projects are typically characterized by low market capitalization and high growth potential. The allure is that if the project gains traction and adoption, the value of the tokens can skyrocket. However, this approach is extremely risky. Many of these projects are scams or simply fail to deliver on their promises, leaving investors with worthless tokens. Thorough research is absolutely essential before investing in any altcoin. This research should include evaluating the project's whitepaper, assessing the team behind the project, analyzing the tokenomics, and understanding the competitive landscape. It's also crucial to be aware of the potential for pump-and-dump schemes, where a group of individuals artificially inflate the price of a token and then sell their holdings at a profit, leaving other investors holding the bag.

Participating in Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs), or other forms of token sales is another avenue some explore. These events offer the opportunity to invest in a project at an early stage, potentially at a lower price than what it might trade for on exchanges later on. However, the ICO/IEO landscape is fraught with risks. Many projects fail to deliver on their promises, and some are outright scams. Due diligence is crucial, and it's essential to only invest what you can afford to lose.

Beyond specific investment strategies, the quickest way to get rich, if such a thing exists, is often predicated on luck. Identifying a project early that achieves widespread adoption, or timing the market perfectly, requires a degree of luck that cannot be consistently replicated. Building a sustainable investment strategy focused on long-term growth requires a different approach. This includes diversifying your portfolio across different asset classes, investing in established cryptocurrencies with strong fundamentals, and consistently rebalancing your portfolio to maintain your desired asset allocation.

Furthermore, safeguarding your investments is paramount. The crypto space is rife with scams and security breaches. Always use strong passwords and enable two-factor authentication on all your accounts. Be wary of phishing attempts and never click on suspicious links. Store your cryptocurrencies in a secure wallet, preferably a hardware wallet. Regularly back up your wallet and keep your private keys safe.

Ultimately, the pursuit of rapid riches in the crypto market should be tempered with a healthy dose of skepticism and a strong commitment to risk management. There are no guaranteed shortcuts to wealth, and the faster you try to get rich, the higher the risk you're likely to take. A more prudent approach involves educating yourself about the market, developing a well-defined investment strategy, managing your risk effectively, and being prepared for the inevitable ups and downs. Building wealth takes time and effort, and while the crypto market offers the potential for accelerated growth, it also carries significant risks. Focus on building a sustainable investment portfolio that aligns with your financial goals and risk tolerance, rather than chasing after fleeting opportunities for rapid riches. Remember, the tortoise often beats the hare.