The world of cryptocurrency investment has evolved into a complex and dynamic landscape, where the interplay of technological innovation, market sentiment, and macroeconomic factors creates both unparalleled opportunities and significant risks. As an investor navigating this terrain, it is essential to approach the market with a combination of analytical rigor and strategic foresight. While the allure of high returns often drives participation, the reality is that sustained success in this space requires a deep understanding of market cycles, technical tools, and the psychological undercurrents that influence price movements. This intricate dance between data and intuition forms the foundation of a prudent investment approach, allowing participants to mitigate volatility while capitalizing on long-term growth potential.

At the heart of cryptocurrency investment is the recognition of market trends, which are often shaped by a mix of technological breakthroughs and regulatory developments. For instance, the emergence of layer-2 solutions and the continued adoption of blockchain technology by enterprises have created a narrative of innovation that drives institutional interest. However, this optimism must be tempered with caution, as macroeconomic variables such as inflation rates and interest policies can create headwinds for crypto assets. Investors who integrate both technological and macroeconomic analysis are better positioned to anticipate shifts in market sentiment and adjust their portfolios accordingly. The ability to discern between speculative hype and fundamental value is a critical skill in this environment, requiring a balanced perspective that avoids the pitfalls of overreliance on any single factor.

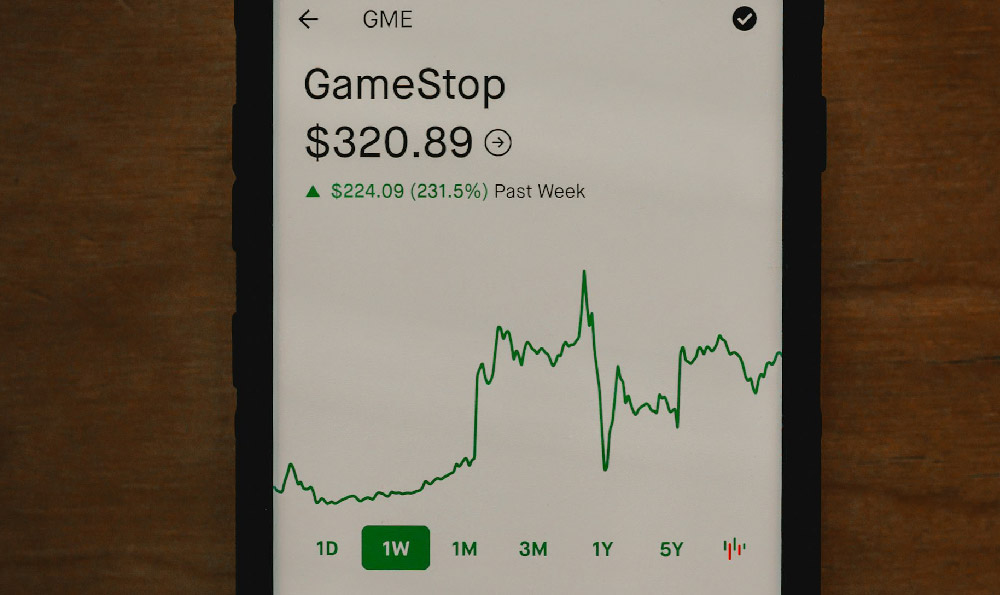

Technical indicators serve as a compass for investors seeking to navigate the volatile waters of cryptocurrency trading. While price action alone is insufficient to make informed decisions, tools such as moving averages, relative strength index (RSI), and volume analysis provide actionable insights into market momentum and potential reversals. For example, a prolonged bull run may be accompanied by a divergence between price and RSI, signaling an overbought condition that could precede a correction. Similarly, volume spikes in conjunction with price breaks often indicate a shift in market consensus, offering early warning signs for trend reversals. Mastery of these indicators, however, demands a disciplined approach, as their interpretation is subject to the broader context of market dynamics and investor behavior. Seasoned traders emphasize the importance of combining technical analysis with fundamental research to avoid false signals that may mislead novice investors.

For those seeking to build a sustainable investment strategy in cryptocurrency, diversification is a cornerstone principle. This does not simply mean spreading investments across multiple assets, but also considering the geographic and institutional dimensions of the market. For example, the rise of stablecoins and the integration of blockchain technology into traditional finance have created a more interconnected ecosystem, where risks and opportunities are not confined to a single jurisdiction or asset class. Investors who adopt a diversified approach are better able to withstand market fluctuations, as the correlation between different cryptocurrencies often diminishes during periods of volatility. Additionally, the inclusion of hedging mechanisms, such as derivatives or cross-chain assets, can further stabilize portfolios while preserving exposure to growth potential. A strategic framework that incorporates diversification and risk management is essential for long-term resilience in this unpredictable market.

One of the most critical challenges in cryptocurrency investment is the psychological trap of greed and overconfidence, which can lead to impulsive decisions and significant losses. The historical pattern of market cycles reveals that many investors enter the market at peak prices, driven by the fear of missing out (FOMO), only to face steep declines as the cycle corrects. To avoid such pitfalls, investors must cultivate a mindset of patience and discipline, aligning their actions with long-term objectives rather than short-term price movements. The use of stop-loss orders and trailing stops is a practical tool for managing risk, allowing investors to protect their capital while maintaining the flexibility to ride upward trends. Moreover, a commitment to continuous learning and self-awareness enables traders to recognize their emotional biases and make decisions based on logic rather than intuition. This psychological resilience is often as valuable as technical expertise in the long run.

In a market defined by rapid innovation and regulatory uncertainty, the ability to identify emerging trends is a key differentiator between successful and average investors. For example, the rise of decentralized finance (DeFi) and the development of non-fungible tokens (NFTs) have created new paradigms for value creation, offering opportunities that extend beyond traditional cryptocurrency trading. However, these trends also require careful evaluation, as their long-term sustainability is often subject to market adoption and technological maturity. Investors who remain vigilant to these factors are better able to position themselves for growth, while avoiding the speculative risks associated with unproven concepts. The integration of fundamental analysis into investment decisions ensures that speculative bets are not made in isolation, fostering a more rational and measured approach to market participation.

Ultimately, the path to success in cryptocurrency investment is not a straight line but a journey marked by adaptability, discipline, and a willingness to embrace complexity. The market’s volatility may be a challenge, but it is also a source of opportunity for those who approach it with a comprehensive understanding of its underlying drivers. Whether through the strategic use of technical indicators, the diversification of holdings, or the management of psychological risks, the key to sustained growth lies in maintaining a balance between ambition and caution. In an environment where the rules of the game are constantly evolving, the investor who remains informed, patient, and agile is the one most likely to thrive.