The allure of Robinhood Riches is undeniable. The platform, with its sleek interface and commission-free trading, has democratized access to the stock and cryptocurrency markets, drawing in millions of new investors eager to participate in the potential for financial gains. The question, however, remains: can you really make money on Robinhood, and if so, how do you navigate the inherent risks and maximize your chances of success?

The short answer is yes, it is possible to make money on Robinhood, but it's crucial to approach it with a realistic understanding of the market and a well-defined investment strategy. The platform itself doesn't guarantee profits; it merely provides the tools and access. Success hinges on the user's knowledge, discipline, and risk tolerance. Many have indeed capitalized on opportunities present within Robinhood, but many others have also experienced significant losses, highlighting the importance of informed decision-making.

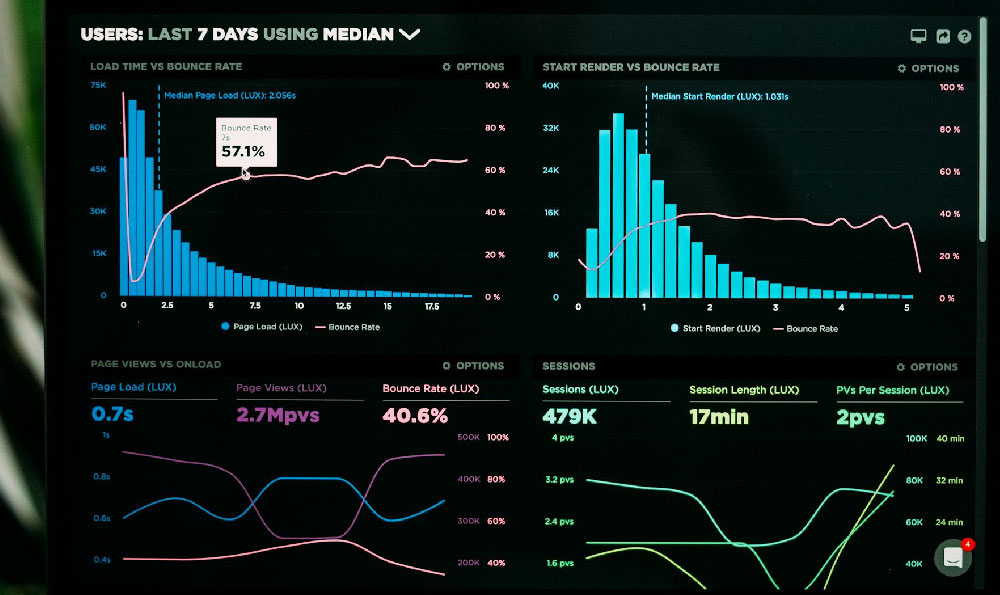

One of the most important aspects to consider when delving into crypto or any investments is proper and thorough research. Before you invest a single dollar, research and educate yourself on the specific cryptocurrency or asset you are considering. Understand its underlying technology, its use case, its market capitalization, and the team behind it. Don't rely solely on hype or social media sentiment. Consult reputable sources, read whitepapers, and analyze market trends. Understanding the fundamentals of the asset is paramount. This foundation will guide your decisions, allowing you to make calculated bets rather than speculative guesses. Due diligence requires sifting through vast amounts of data, separating reliable information from biased opinions and often misleading marketing materials. It demands a critical and analytical mindset, questioning assumptions and seeking independent validation.

A well-defined investment strategy is absolutely crucial. Avoid the temptation of chasing quick gains or following popular trends blindly. Instead, develop a strategy that aligns with your financial goals, risk tolerance, and time horizon. Are you aiming for long-term growth, short-term profits, or a combination of both? Are you comfortable with high-risk, high-reward investments, or do you prefer a more conservative approach? Determine your objectives and construct a plan that reflects them. This plan should outline your entry and exit points, your position sizing, and your risk management techniques. Remember, discipline is key. Stick to your plan, even when the market fluctuates, and resist the urge to make impulsive decisions based on emotion. Consider dollar-cost averaging (DCA), a strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This can help mitigate the impact of volatility and smooth out your returns over time.

Risk management is an indispensable component of any successful investment endeavor. The crypto market is notoriously volatile, and even seasoned investors can experience losses. Never invest more than you can afford to lose. Diversify your portfolio across multiple assets to reduce your exposure to any single investment. Use stop-loss orders to limit potential losses on individual trades. These orders automatically sell your asset if it falls below a certain price, protecting you from catastrophic declines. Understand the risks associated with leverage, which amplifies both potential gains and potential losses. While leverage can increase your profits, it can also quickly wipe out your capital if the market moves against you.

Beyond simply purchasing and holding cryptocurrency, consider exploring other potential income streams that are available to you. Staking, for example, allows you to earn rewards by holding certain cryptocurrencies in a designated wallet and participating in the network's consensus mechanism. Lending platforms enable you to lend out your cryptocurrency to borrowers and earn interest. These options can provide passive income, augmenting your overall returns. However, be aware of the risks involved, such as smart contract vulnerabilities and the potential for impermanent loss in decentralized finance (DeFi) platforms. Thoroughly research any platform before entrusting it with your funds.

Finally, stay informed and continuously learn. The cryptocurrency market is constantly evolving, with new technologies, regulations, and trends emerging regularly. Keep abreast of the latest developments by reading industry news, attending webinars, and following reputable experts. Be wary of scams and fraudulent schemes, which are unfortunately prevalent in the crypto space. Always verify the legitimacy of any project or platform before investing. Education is the best defense against these threats. Remember, investing is a marathon, not a sprint. Approach it with patience, discipline, and a commitment to continuous learning, and you can significantly increase your chances of achieving your financial goals. Be patient, avoid the trap of instant gratification, and focus on long-term growth. With a combination of knowledge, strategy, and risk management, you can navigate the exciting, yet volatile, world of crypto investing and potentially build your own success story.