Retirement is a phase where financial independence becomes a key focus, but the transition from working to living on savings can be daunting. Crafting a sustainable retirement income strategy requires more than just saving— it involves diversifying revenue streams, understanding long-term financial goals, and leveraging tools that align with both personal aspirations and global market trends. While many seek traditional employment, alternative approaches are gaining traction, offering flexibility and resilience in uncertain economic climates. The modern retiree often explores a mix of passive income, creative ventures, and strategic investments to maintain or grow wealth. However, the path to post-retirement earnings is not one-size-fits-all, as individuals must adapt to their unique circumstances, risk tolerance, and available resources.

A strong foundation for retirement income begins with reassessing existing financial assets. For retirees who have accumulated sufficient funds to cover basic living expenses, the focus shifts to generating additional revenue without compromising quality of life. This often involves a combination of strategies, such as reinvesting pensions into diverse portfolios, renting out property, or cultivating side businesses that align with personal skills. The key lies in balancing short-term needs with long-term growth, ensuring that income sources are both reliable and scalable. For example, dividend-paying stocks provide recurring cash flow, while rental properties offer stable returns through property value appreciation and monthly rent. These methods not only supplement retirement savings but also create a buffer against inflation and market volatility.

However, passive income is not always the sole solution. Many retirees opt for part-time work or consulting roles, especially in fields where expertise remains valuable. This approach allows for flexibility, as individuals can choose work that fits their schedule and interests. Moreover, remote opportunities such as freelancing, content creation, or online teaching can provide income without the need for physical presence. These ventures often rely on digital skills, which are increasingly in demand in the gig economy. Retirees with transferable skills may find themselves in high-demand niches, from tech support to virtual coaching, even if they step away from traditional careers. The advantage of such work is that it can be pursued alongside other income sources, creating a multifaceted approach to financial security.

Another avenue for retirement income involves leveraging personal networks and community resources. Collaborative efforts with peers, such as forming investment clubs or co-owning businesses, can amplify returns and reduce risks. Additionally, retirees may explore opportunities in real estate, such as property flipping, rental management, or subdivision development, which can yield substantial profits when executed with care. The role of location is critical here, as urban markets often offer higher rental yields compared to rural areas, though property values may fluctuate based on economic conditions. Strategic approaches include selecting assets that appreciate over time while covering maintenance costs through rental income or leases.

For those looking to generate income after retirement, technology-driven solutions are becoming increasingly accessible. Digital platforms enable retirees to monetize hobbies, skills, or assets through affiliate marketing, online courses, or e-commerce ventures. Moreover, crowd-funding and peer-to-peer lending models offer alternative ways to generate interest or capital gains while supporting values such as sustainability or community impact. The key is to align these opportunities with personal interests and financial goals, whether that means creating content, offering professional services, or investing in socially responsible ventures.

Financial planning also involves understanding the interplay between income and expenses. Retirees must optimize consumption patterns while ensuring that savings grow faster than costs. This may require reevaluating spending habits, adopting frugal practices, or investing in cost-effective solutions that maximize returns. For instance, automating investments through robo-advisors can reduce fees and improve efficiency, while budgeting apps help track expenses in real-time. These tools, combined with a proactive mindset, enable retirees to navigate financial uncertainties with greater confidence.

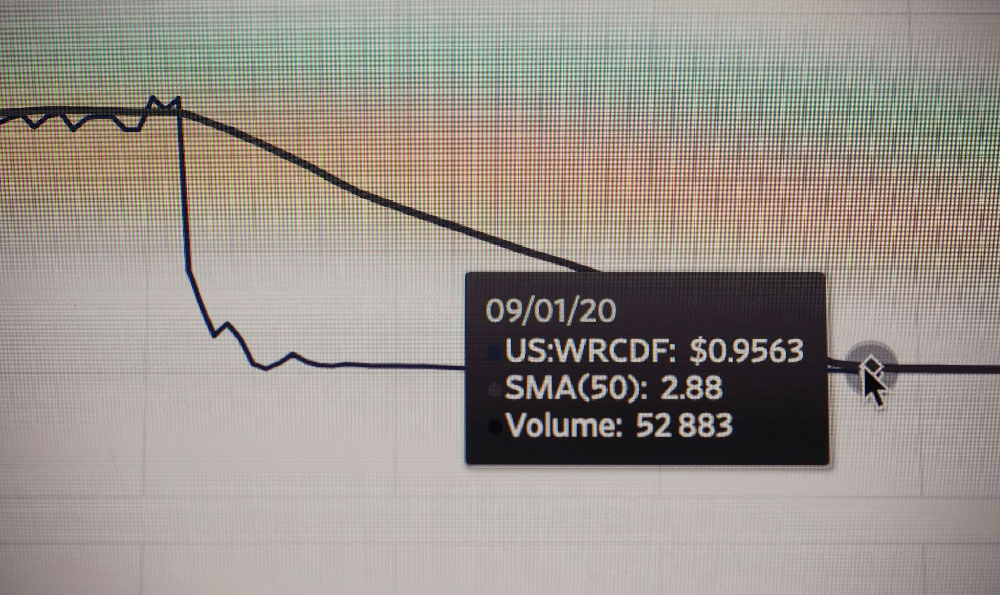

Beyond traditional income sources, retirees may explore unconventional methods that align with personal passions or global trends. For example, the rise of cryptocurrency and NFTs has opened new avenues for investment, though these come with higher risks and volatility. Similarly, retirement communities are emerging as hubs where individuals can generate income through shared resources, mentorship, or collective ventures. These models often promote intergenerational collaboration, allowing retirees to share knowledge and skills with younger generations while building networks of mutual support.

Ultimately, the goal of retirement income is to ensure long-term financial stability and the freedom to pursue personal interests. While the journey may involve trial and error, the key lies in continuous learning, adapting to changing circumstances, and staying informed about emerging opportunities. By combining passive income, active ventures, and strategic investments, retirees can create a sustainable financial model that supports their lifestyle and goals. The challenge is not just about earning money after retirement, but about building a mindset of financial resilience that allows for flexibility, growth, and peace of mind.