As the digital landscape continues to evolve, the concept of evaluating performance is becoming increasingly relevant across various sectors, including both the traditional film industry and the emerging world of virtual currencies. While it might seem like an unusual pairing at first glance, drawing parallels between the two can provide valuable insights into how success and failure are measured in different markets. In this context, the term "box office revenue" serves as a metaphor for the financial influx or outflow of a cryptocurrency project, a perspective that can deepen our understanding of investment dynamics.

The film industry, much like cryptocurrency markets, operates on a cycle of anticipation, investment, and reward. When a new movie is released, studios and investors alike monitor its box office performance to gauge public reception and profitability. Similarly, in the realm of virtual currencies, an investor observes the movement of funds, technological advancements, and market trends to assess the potential of a coin or token. However, unlike the cinematic industry, where the outcome is often predetermined by marketing and production, the world of virtual currencies is highly volatile and subject to a myriad of external factors, such as regulatory changes, technological breakthroughs, and market sentiment.

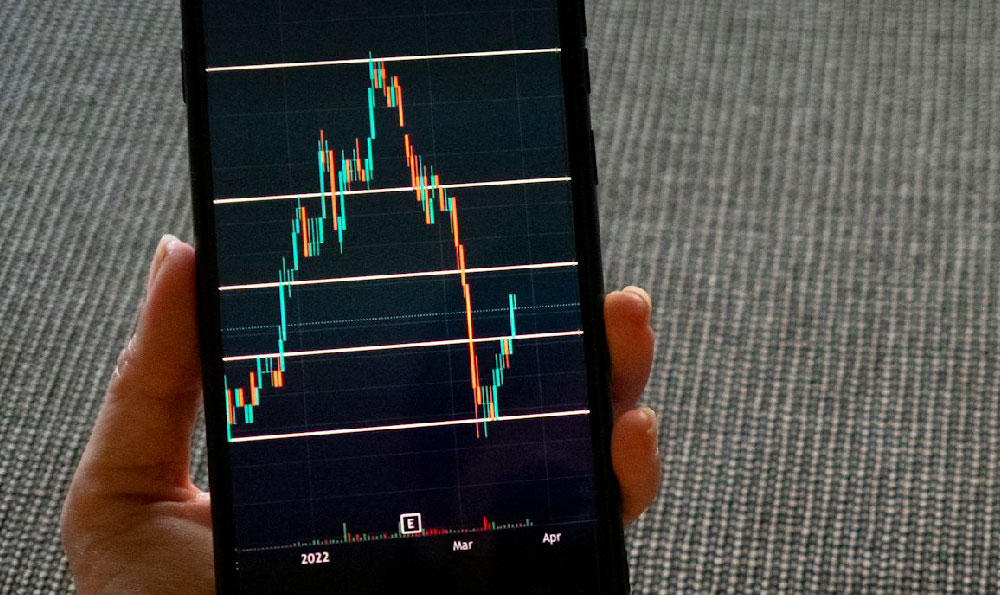

Exploring the intersection of these two domains reveals several key principles that are worth considering. For instance, understanding the "open" of a cryptocurrency project is akin to the premiere of a film. Just as a film's initial reception can set the tone for its entire lifecycle, a coin's market debut can influence its long-term trajectory. The first few days after a cryptocurrency launch are often marked by significant price fluctuations, driven by speculative trading and network effects. These early-stage dynamics can be compared to the box office performance of a movie in its opening weekend, where initial interest and buzz determine the starting point of its commercial success.

In the film industry, the revenue streams are diverse and extend beyond just the box office. There are ancillary income sources, such as streaming platforms, merchandise sales, and international distribution. Likewise, in virtual currencies, the value and utility of a coin are influenced by a range of factors, including its applications in real-world scenarios, community engagement, and technological integration. A cryptocurrency with strong utility, such as a token that powers a blockchain-based platform for content distribution, may see sustained growth even if its initial value is not the highest.

The importance of market trends cannot be overstated, whether in the cinematic or financial sense. The release of a new movie can impact the box office performance of existing films, especially if it competes for audience attention. For example, the emergence of a major franchise or a highly anticipated sequel can divert viewers from other releases, affecting their financial returns. Similarly, in the world of virtual currencies, the introduction of a new coin with innovative features or strong partnerships can draw investors away from other projects, influencing their financial outcomes.

When analyzing the potential of a new cryptocurrency, it is essential to consider both its intrinsic value and its ability to attract and maintain investor interest. Just as a film's narrative and characters play a critical role in its box office success, a cryptocurrency's foundation and unique features determine its long-term viability. Additionally, factors such as marketing strategies, community support, and technological advancements can significantly impact its market performance.

In the context of virtual currencies, the term "box office revenue" can be reimagined as the total value of transactions, user adoption rates, and overall market capitalization. These metrics, much like a film's box office performance, can provide a snapshot of its current status and potential for future growth. However, unlike traditional industries, where data is often predictable, the world of virtual currencies is marked by unpredictable swings and rapid changes, requiring investors to remain adaptable and informed.

Investors in the cryptocurrency market must also consider the broader economic environment, similar to how film studios analyze consumer spending patterns and cultural trends. The demand for digital assets is influenced by macroeconomic factors such as inflation, interest rates, and geopolitical events, which can impact the overall market sentiment. Much like the film industry, which is shaped by trends in entertainment consumption, the virtual currency market is influenced by trends in technology adoption and economic uncertainty.

Finally, the need for caution in both industries is paramount. In the cinematic sector, overhyping a film can lead to a drop in audience expectations and subsequent box office disappointment. Similarly, in the cryptocurrency market, overconfidence or speculative investing without thorough due diligence can result in significant financial losses. By adopting a long-term strategy and focusing on sustainable growth, investors can mitigate risks and enjoy greater returns, much like a film studio that prioritizes quality over short-term gains.

In conclusion, while the film industry and virtual currency markets may seem worlds apart, they share common principles of performance evaluation and risk management. By applying the same level of thoroughness and strategic thinking used in analyzing a movie's box office success, investors can better navigate the complexities of the virtual currency market. The key to success in both domains lies in understanding the underlying factors, diversifying approaches, and remaining vigilant against potential pitfalls. As technology continues to blur the lines between industries, the ability to adapt and innovate will become even more crucial in achieving long-term financial growth and success.