Okay, I'm ready. Here's an article based on the title "Ready to Invest in Real Estate? Where Do You Begin?" written with the requested style and length:

The allure of real estate investment is undeniable. Visions of passive income, property appreciation, and financial security dance in the heads of aspiring landlords and house flippers. But transforming that vision into reality requires more than just enthusiasm; it demands a strategic approach, thorough research, and a clear understanding of the landscape. Stepping into the world of real estate investing is a significant decision, and knowing where to start is paramount to your success.

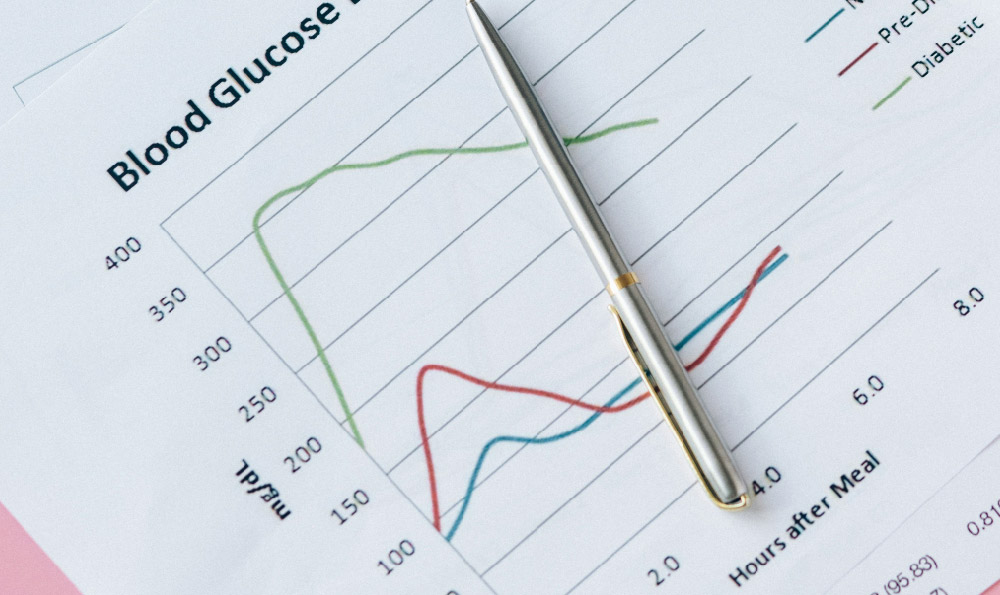

The very first thing a prospective real estate investor should undertake is a brutally honest self-assessment. What are your financial resources? How much capital can you realistically allocate to this venture without jeopardizing your current financial stability? Consider not just the down payment but also closing costs, potential renovation expenses, property taxes, insurance, and ongoing maintenance. It’s crucial to build a safety net, a contingency fund that can cushion you from unexpected repairs or vacancies. Ignoring this aspect can quickly turn your investment dream into a financial nightmare.

Beyond the monetary aspect, assess your risk tolerance. Are you comfortable with the potential for market fluctuations, tenant issues, and the illiquidity often associated with real estate? Different investment strategies carry varying levels of risk. Fix-and-flips, for example, offer the potential for rapid returns but also expose you to the risks of construction delays, cost overruns, and market downturns. Buy-and-hold properties provide a more stable, long-term investment but require patience and a commitment to property management. Accurately gauging your risk appetite will help you select an investment strategy that aligns with your personality and financial goals.

Next, educate yourself. The real estate market is complex and ever-evolving. Don't rely solely on anecdotal advice or get-rich-quick schemes. Instead, immerse yourself in reputable resources. Read books on real estate investing, attend seminars and webinars, and follow industry experts. Understand key concepts such as capitalization rate, cash flow, return on investment (ROI), and loan-to-value ratio (LTV). Familiarize yourself with local zoning regulations, building codes, and landlord-tenant laws. Knowledge is your shield in this arena, protecting you from costly mistakes and enabling you to make informed decisions.

With a solid foundation of knowledge, it's time to define your investment goals and strategy. What are you hoping to achieve through real estate investing? Are you seeking passive income, capital appreciation, or a combination of both? Are you interested in residential or commercial properties? Will you focus on single-family homes, multi-family units, or condominiums? Your answers to these questions will guide your property search and investment decisions.

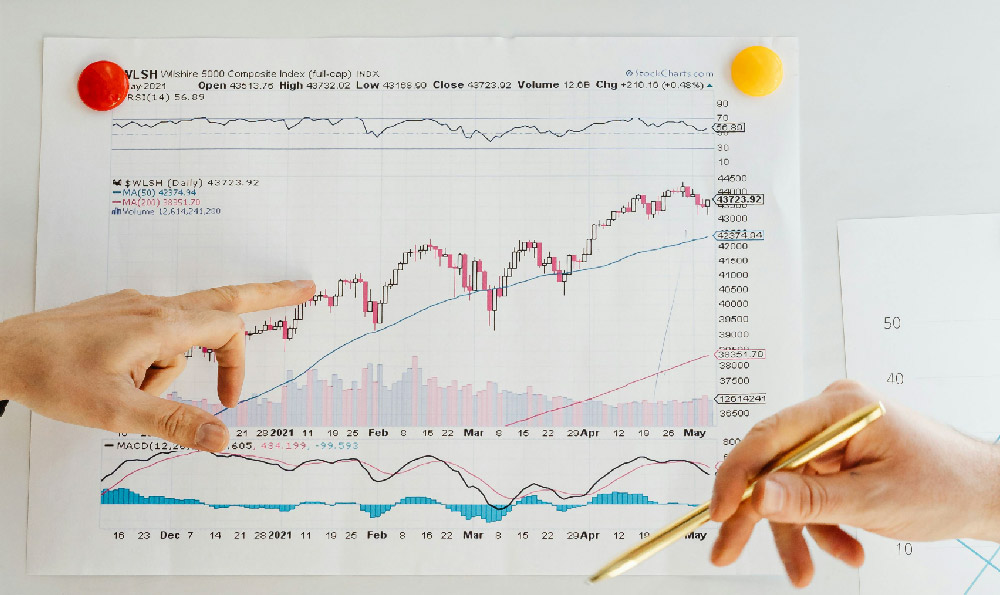

Once you have a clear investment strategy, start researching potential markets. Consider factors such as population growth, employment rates, median income, and crime rates. Look for areas with strong rental demand, low vacancy rates, and a diverse economy. Researching market trends will allow you to identify neighborhoods with the greatest potential for growth and profitability. Drive around potential areas, talk to local residents, and observe the overall condition of the properties. This boots-on-the-ground research can provide valuable insights that are not always apparent in online data.

As you narrow down your search, assemble a reliable team of professionals. This should include a real estate agent with expertise in investment properties, a mortgage lender who can help you secure financing, a real estate attorney to review contracts and ensure legal compliance, and a qualified home inspector to assess the condition of potential properties. Building strong relationships with these professionals will provide you with valuable support and guidance throughout the investment process.

Financing is a critical aspect of real estate investing. Explore different financing options, such as conventional mortgages, FHA loans, and private lenders. Understand the terms and conditions of each loan, including interest rates, down payment requirements, and repayment schedules. Obtain pre-approval for a mortgage before you start actively searching for properties. This will demonstrate to sellers that you are a serious buyer and give you a competitive edge in the market. Consider also the potential for leveraging your investment through financing, but always do so responsibly and within your risk tolerance.

Now the real work begins: evaluating potential properties. Don't let emotions cloud your judgment. Focus on the numbers and conduct thorough due diligence. Analyze the property's income and expenses, calculate its cash flow, and estimate its potential return on investment. Consider the age and condition of the property, potential repair costs, and the likelihood of future appreciation. Don't be afraid to walk away from a deal if the numbers don't make sense. Patience and discipline are essential qualities for successful real estate investors.

When you find a property that meets your criteria, make an offer. Be prepared to negotiate with the seller, and don't be afraid to counteroffer if necessary. Once your offer is accepted, conduct a thorough inspection of the property to identify any potential problems. If the inspection reveals significant issues, you may be able to renegotiate the purchase price or back out of the deal altogether.

After the inspection, secure your financing and finalize the purchase. Work closely with your real estate attorney to ensure that all legal documents are properly executed. Once the closing is complete, you are officially a real estate investor.

The journey doesn't end with the purchase. Effective property management is crucial for maximizing your returns. Decide whether you will manage the property yourself or hire a professional property management company. If you choose to self-manage, be prepared to handle tenant screening, rent collection, maintenance requests, and evictions. Treat your tenants with respect, respond promptly to their needs, and maintain the property in good condition.

Real estate investing is not a get-rich-quick scheme. It requires hard work, dedication, and a long-term perspective. But with careful planning, diligent research, and a commitment to continuous learning, you can build a successful real estate portfolio and achieve your financial goals. Embrace the challenges, learn from your mistakes, and celebrate your successes. The path to real estate riches may be paved with hard work, but the rewards can be substantial.