Can Part-Time Work Hit 38 Hours? Truth About US Overtime Rules & When You're Being Exploited

The notion of "part-time" work conjures up images of shorter shifts, flexible schedules, and fewer hours than the traditional 40-hour grind. Yet, an increasing number of workers find themselves punching schedules hovering around 36, 37, or even 38 hours per week. This lands squarely in a gray zone within US overtime regulations, raising a critical question: Can your job legally classify you as part-time while demanding near-full-time hours, especially that 38-hour mark? The answer is steeped in legal nuance and potential exploitation.

Dissecting the "Part-Time" Label: Legally Vacant, Practically Exploited

First, a crucial point often misunderstood: The Fair Labor Standards Act (FLSA) – the bedrock federal law governing overtime pay – provides no formal definition for "full-time" or "part-time" employment. These classifications are typically creations of the employer's personnel policies, industry practice, or sometimes specific benefit plans.

-

What Truly Matters: The FLSA focuses relentlessly on a single, critical metric: wages paid relative to hours worked. Its core mandate is clear: Ensure nonexempt employees receive at least the federal minimum wage ($7.25/hour) and overtime pay of at least one and one-half times their regular rate for all hours worked beyond 40 in a single workweek.

-

The 40-Hour Threshold: This is the sacred line. Regardless of whether an employer calls you part-time, full-time, temporary, seasonal, or project-based, if you are non-exempt under the FLSA and work over 40 hours in a workweek, you are legally entitled to overtime pay. The label attached to your position is irrelevant to this right.

The 38-Hour Phenomenon: Strategic Avoidance, Not Accident

Why is 38 hours a recurring theme for so-called part-time positions? It's rarely a coincidence. This number sits strategically below the FLSA's 40-hour overtime trigger, allowing employers to maximize labor without incurring extra costs. Several factors contribute to this practice:

- Profit Margin Leverage: Avoidance of the 1.5x overtime premium directly boosts operating margins, particularly in low-wage, high-turnover sectors like retail, fast food, hospitality, and warehousing.

- Workforce Flexibility: Employers maintain a larger pool of "part-time" staff who can be deployed heavily during peak periods (hitting 38 hours) and scaled back easily during slower times without triggering layoff protocols often associated with full-time roles. Workers become effectively "full-time" when it benefits the company, but without the accompanying commitments like consistent hours or access to benefits often reserved for officially designated "full-time" status.

- Benefit Avoidance: While legally distinct from overtime pay, many employers tie eligibility for crucial benefits (health insurance, retirement plans, paid time off) to being classified by the employer as "full-time," often meaning 30-40+ hours consistently per week. Schedules hovering close to that threshold – like 38 hours – frequently fall short intentionally, denying workers access without crossing the FLSA overtime line.

The Worker's Reality: Caught in the Classification Labyrinth

For employees, a schedule fluctuating near 38 hours labelled part-time creates a frustrating and precarious situation:

- Financial Uncertainty: Rarely hitting the golden 40 hours means never qualifying for lucrative overtime pay, making income inconsistent and often insufficient. Getting scheduled for 39 or 40 hours becomes an exception, not the norm.

- Benefit Exclusion: The persistent gap between scheduled hours (e.g., 38) and the employer's defined full-time threshold (e.g., 35 or 40 hours for benefits) locks many out of vital health insurance and retirement savings plans. This gap is frequently calculated on an average basis over a "look-back" period (often 3-12 months), making it easily manipulated.

- Schedule Instability: "Flexibility" often flows one way: the employer's. Workers face fluctuating hours week-to-week, making it incredibly difficult to budget, arrange childcare reliably, or secure a predictable second job.

- Diminished Livelihood: Lack of predictable near-full-time hours makes building financial security or career progression virtually impossible within such roles, trapping workers in a cycle of economic instability without the official anchor points of full-time status. Workers experiencing this describe a constant state of being "on call" without the formal designation or pay.

Legal Standing: Walking the Precarious Line (for Employers)

Operating with substantial numbers of so-called part-time workers at 38 hours weekly is generally legal under the strict letter of the FLSA regarding overtime payment – because overtime, strictly speaking, only starts after hour 40.

- The Core Principle: As long as an employer pays minimum wage for all hours worked up to 40 and adequately pays time-and-a-half for any hours over 40 (should they occur) to non-exempt employees, they are satisfying the FLSA's overtime requirements. Calling the employee "part-time" doesn't violate this.

Crucial Distinction: Overtime Pay (FLSA) vs. Benefit Eligibility (Employer Policy) Confusing these two distinct concepts is common. The FLSA mandates overtime pay after 40 hours, irrespective of FT/PT labels. Benefit eligibility (health, PTO, retirement) is determined entirely by the employer's own plan documents and internal classifications, often pegged to specific hour thresholds over defined periods, separate from FLSA overtime rules. An employee denied benefits solely due to official "part-time" status at 38 hours, despite working near-full-time schedules, has no recourse under the FLSA for those benefits. Their recourse lies internally (company benefits appeals) or potentially under state laws or ERISA (federal benefits law), not the FLSA overtime regulations.

- State Nuances: This is where the landscape gets more complex. Several states enforce stricter regulations:

- California: Known for aggressive labor laws. Requires daily overtime (1.5x) after 8 hours in a single day and double-time (2x) after 12 hours in a day.

- Colorado: Mandates daily overtime (1.5x) after 12 hours worked.

- Oregon: Requires daily overtime (1.5x) after 10 hours in a day.

- State-Specific Minimum Wages: Many states (30+ and DC) have minimum wages far exceeding the federal $7.25/hour.

- Predictive Scheduling Laws: Cities and states like Oregon, New York City, San Francisco, Seattle, and Chicago mandate advance notice of schedules, restrictions on last-minute changes, and "predictability pay" for changes or on-call shifts, impacting operations where frequent schedule changes are the norm.

Employers operating across multiple jurisdictions face a significant compliance burden. What's legal under federal FLSA overtime rules for 38 hours might trigger significant penalties in states with daily overtime or predictive scheduling obligations. Companies relying on the 38-hour "part-time" model nationally often fail to adequately navigate these diverse state requirements.

Action Steps: Protecting Yourself as an Employee

If you're labeled part-time but consistently work near full-time hours, understand your rights and potential actions:

- Understand Your Exemption Status: Are you truly non-exempt? Salaried employees aren't automatically exempt; specific duties and salary tests apply. Don't assume.

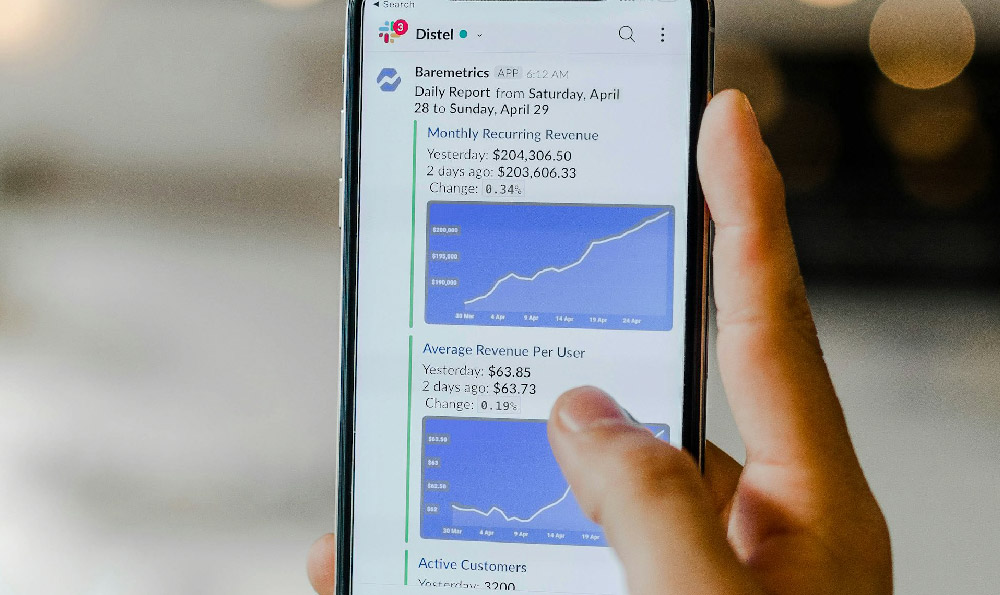

- Scrutinize Your Pay Stub Religiously: Meticulously track your own hours. Compare them to pay stubs.

- Is all time worked (including training, off-the-clock work, required pre/post-shift tasks) accurately recorded and paid at least the required minimum wage?

- Were you paid 1.5x your regular rate for any hours exceeding 40 in the workweek? Be vigilant against "work week" manipulation.

- Know Your Employer's "Full-Time" Definition: Request the official policy regarding FT/PT classification and the specific hour thresholds (weekly average? over how many weeks?) for benefits eligibility. Get this in writing.

- Report Violations: If you suspect overtime pay violations (e.g., not getting 1.5x pay for hours over 40), report it to:

- U.S. Department of Labor Wage and Hour Division (WHD): File a complaint confidentially online or by phone. Retaliation for filing is illegal but notoriously difficult to prove immediately. They investigate FLSA and Federal Contractor violations.

- Your State Labor Department: Handles state-specific wage and hour laws. They often enforce stricter daily overtime or minimum wage regulations. Reporting here can be crucial if state law provides greater protection than FLSA.

- Document Everything: Maintain detailed personal records of shifts worked (start/end times, breaks – taken or missed), schedule changes, directives to work off-the-clock, pay stubs, and communications with supervisors/managers about hours or pay. A physical notebook kept outside of work is essential.

- Seek Legal Counsel: If facing persistent wage theft (unpaid overtime, unpaid minimum wage for all hours), significant benefit denial issues under ERISA, or illegal retaliation (demotion, reduced hours, termination for complaints), consult with an employment attorney specializing in wage and hour violations. Many offer free consultations or work on contingency (only paid if you win).

From my perspective, while technically legal under federal overtime rules at the surface level, the widespread scheduling of "part-time" employees for 38+ hours weekly represents a fundamental manipulation of the spirit of labor protections. It exploits workers desperate for hours without offering the stability, income security, or benefits commensurate with near-full-time work. This practice perpetuates economic vulnerability for millions and highlights a significant weakness in relying solely on an 80-year-old hourly threshold to define economic justice in the modern workplace. This legal gray area demands legislative attention.

Employers lean heavily on the federal FLSA's structure while disregarding the significant worker burden created by consistent near-capped labor without the accompanying security. State interventions, while helpful, create a patchwork insufficient to fully address this nationwide phenomenon of near-full-time burden without the designation.

Questions & Answers:

Q: Is it illegal for my employer to schedule me as a "part-time" worker for exactly 38 hours per week?

A: No, based solely on the federal Fair Labor Standards Act (FLSA), it is generally not illegal to call someone part-time and schedule them for 38 hours per week. The FLSA does not define part-time status; its focus is on wage payment. Crucially, employers must pay at least the federal (or state, if higher) minimum wage for all hours up to 40, and any true hours worked over 40 must be paid at 1.5x the regular rate, regardless of how the position is labeled. However, consistently scheduling near 40 hours without designating workers as full-time may violate benefit plan obligations under ERISA or specific state laws.

Q: If I work exactly 38 hours, can I demand overtime pay?

A: No. Under federal FLSA rules, overtime pay (1.5x your regular rate) is only mandated for hours worked over 40 in a single workweek. If you work only 38 hours, federal law does not require overtime pay. Some states have laws requiring overtime or premium pay (e.g., 1x after 8 or 10 hours in a day), so check your state's specific laws. You are also always entitled to receive at least the applicable minimum wage for every hour worked, including those 38 hours.