Medium money, often envisioned as a comfortable financial cushion, is a subjective concept. What constitutes "medium" varies greatly depending on individual circumstances, location, lifestyle aspirations, and financial goals. For some, it might mean having enough savings to cover unexpected expenses and perhaps a down payment on a home. For others, it could represent the financial freedom to pursue passions without the constant pressure of a paycheck. Defining your own "medium money" target is the crucial first step towards achieving it. This involves a thorough assessment of your current financial situation, a clear articulation of your financial goals, and an honest evaluation of your risk tolerance.

Earning medium money is not about getting rich quick; it’s about consistent effort, smart financial decisions, and a long-term perspective. There are numerous avenues to explore, each with its own set of risks and rewards. One of the most traditional and reliable methods is through employment. Securing a stable job with opportunities for advancement and salary increases is a foundational element. Continuously improving your skills and knowledge through education, training, and professional development can significantly boost your earning potential. Negotiating salary increases and seeking promotions are essential strategies for maximizing your income within your chosen career path. Beyond a regular job, many individuals supplement their income through side hustles. The gig economy has exploded in recent years, offering a plethora of opportunities to earn extra money in areas like freelance writing, graphic design, virtual assistance, online tutoring, delivery services, and more. These side hustles not only provide additional income but also allow you to develop new skills and explore different career paths.

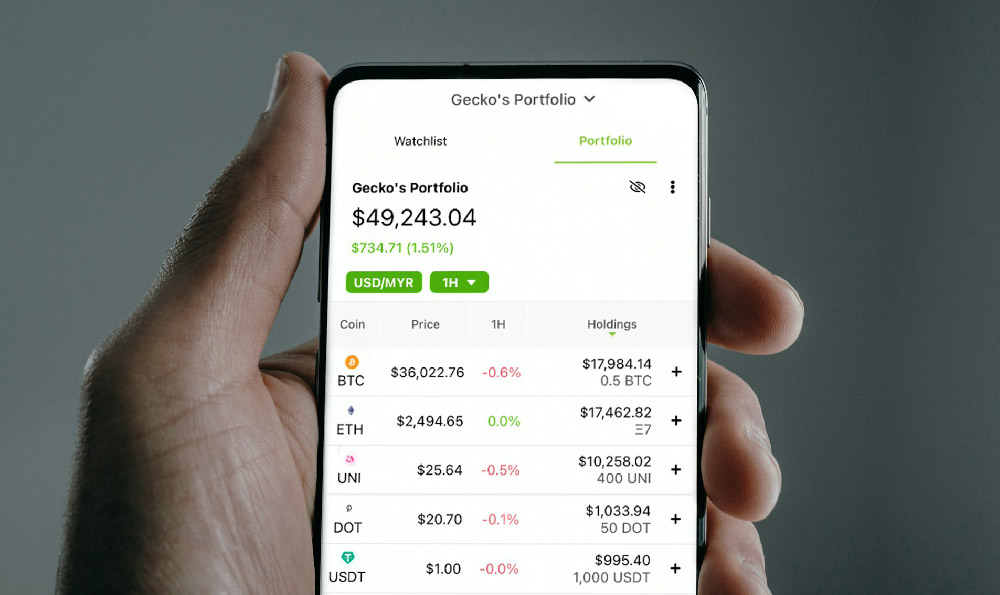

Furthermore, entrepreneurship offers another pathway to potentially higher earnings. Starting your own business, whether it’s a small online store or a brick-and-mortar establishment, allows you to control your income and pursue your passions. However, entrepreneurship requires significant dedication, hard work, and risk-taking. Thorough market research, a solid business plan, and sufficient capital are essential for success. Investing is a critical component of building wealth and achieving your financial goals. Investing your money wisely can generate passive income and accelerate your progress towards reaching your "medium money" target. Various investment options are available, each with its own risk profile and potential returns. Stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate are among the most common investment vehicles. Diversification is key to mitigating risk. Spreading your investments across different asset classes and sectors can help to cushion your portfolio against market volatility. Real estate, while often considered a long-term investment, can provide both rental income and potential appreciation in value. However, real estate investments require significant capital and involve responsibilities such as property management and maintenance. Alternative investments, such as cryptocurrency and peer-to-peer lending, offer the potential for high returns but also carry significant risks. These investments are generally more suitable for experienced investors with a high-risk tolerance.

The "best" way to earn medium money is highly personalized and depends on individual circumstances, skills, and risk tolerance. There's no one-size-fits-all solution. It’s essential to combine different strategies to create a diversified approach. For example, someone might work a full-time job, pursue a side hustle, and invest in a mix of stocks, bonds, and real estate. The ideal combination will depend on your specific goals, timeline, and risk tolerance.

Beyond simply earning money, managing your finances effectively is crucial for building wealth. Creating a budget is the first step towards understanding your income and expenses. Tracking your spending and identifying areas where you can cut back can free up more money for saving and investing. Paying off debt, especially high-interest debt such as credit card debt, is essential for improving your financial health. Reducing your debt burden frees up more cash flow and reduces your overall financial stress. Saving diligently is also paramount. Aim to save a portion of your income each month, even if it’s a small amount. Automating your savings can make it easier to stick to your savings goals. Open a high-yield savings account or investment account to earn interest on your savings.

Finally, remember that building wealth is a marathon, not a sprint. It takes time, discipline, and patience to achieve your financial goals. Don't get discouraged by setbacks or market fluctuations. Stay focused on your long-term goals and continue to make smart financial decisions. Seek professional financial advice from a qualified financial advisor if you need help developing a financial plan or managing your investments. A financial advisor can provide personalized guidance based on your specific circumstances and goals. They can help you to assess your risk tolerance, develop an investment strategy, and stay on track towards achieving your financial objectives. Continuously educating yourself about personal finance and investing is also crucial for making informed decisions. Read books, articles, and blogs on personal finance topics. Attend workshops and seminars to learn from experts in the field. By staying informed and engaged, you can take control of your finances and work towards achieving your financial goals. Ultimately, the journey to "medium money" is about creating a secure and fulfilling financial future. It requires a combination of earning, saving, investing, and managing your finances effectively. With dedication, discipline, and a long-term perspective, you can achieve your financial goals and live the life you desire.