Cryptocurrency investment has become a popular avenue for generating income from home, offering unique opportunities that blend technology, market dynamics, and financial strategy. However, navigating this space requires a deep understanding of both the potential rewards and the inherent risks. As an expert in this field, it's essential to approach such topics with a balanced perspective, analyzing the ever-evolving landscape to identify sustainable methods that align with personal financial goals. The key lies not only in selecting the right assets but also in mastering the tools and principles that distinguish successful investors from those who fall prey to speculative pitfalls.

One of the most critical aspects of capitalizing on cryptocurrency opportunities is understanding the market's cyclicality and volatility. Unlike traditional financial markets, crypto operates 24/7, influenced by global events, regulatory changes, and technological advancements. To thrive in this environment, investors must study historical trends to anticipate potential movements. For instance, the emergence of decentralized finance (DeFi) platforms has created new avenues for earning passive income through yield farming, liquidity provision, or staking. These mechanisms allow individuals to participate in blockchain ecosystems without requiring constant supervision, making them ideal for those seeking to generate returns from home. However, the complexity of DeFi protocols demands a thorough understanding of smart contract security, which is why investors should prioritize projects with transparent code and audited systems.

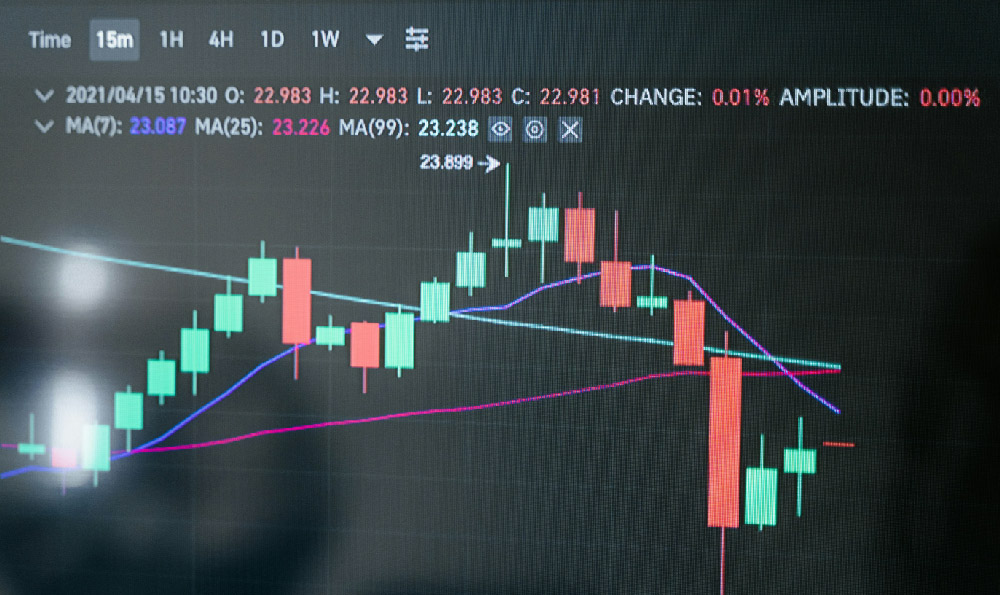

Technical indicators play a pivotal role in decision-making for those aiming to maximize returns. Tools like moving averages, relative strength index (RSI), and Bollinger Bands help decipher market sentiment and price patterns. For example, a bullish RSI reading combined with a rising trend line often signals a potential upward shift, whereas an overbought condition paired with declining volume might indicate a market correction. Investors who leverage these metrics effectively can make data-driven choices, mitigating emotional biases that often lead to poor outcomes. It's important to note that while these indicators can provide valuable insights, they should never be used in isolation. Combining them with fundamental analysis—such as evaluating a cryptocurrency's adoption rate, team credibility, or use case—creates a multi-dimensional approach that reduces uncertainty.

For those looking to capitalize on remote income potential, strategies like day trading or swing trading offer flexibility. Day traders focus on short-term price fluctuations, exploiting market inefficiencies through rapid buy-sell cycles. Swing traders, on the other hand, aim to capture medium-term trends by holding assets for several days to weeks. Both approaches require disciplined risk management, as the fast-paced nature of crypto markets can lead to significant losses if not properly controlled. A key technique in this regard is the use of stop-loss orders, which automatically sell an asset when it reaches a predetermined price, preventing emotional decisions during market downturns. Similarly, investors can diversify their portfolios across multiple cryptocurrencies and market segments to balance risk and reward, ensuring that a single asset's underperformance doesn't jeopardize overall gains.

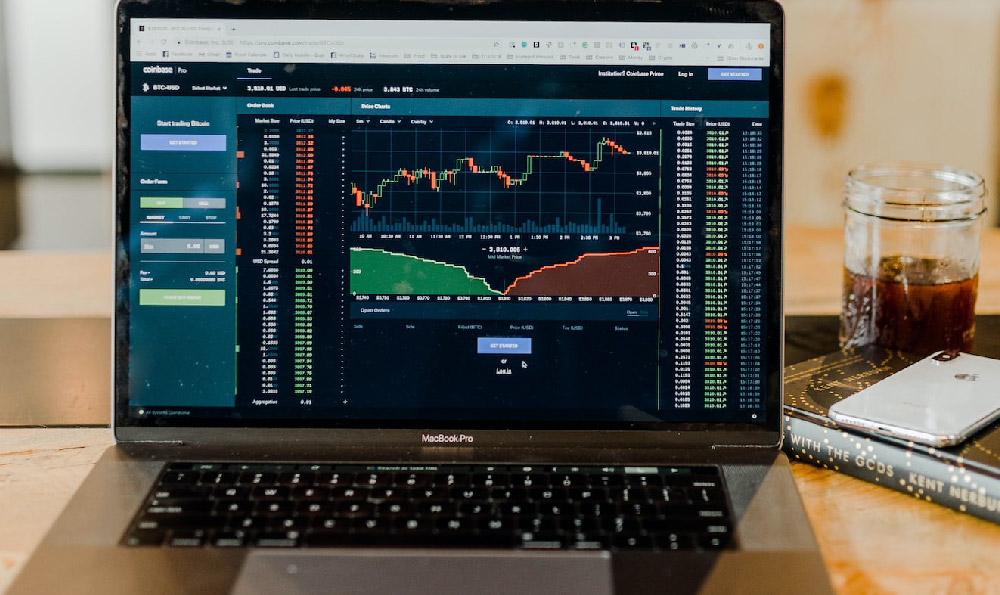

The rise of automated trading platforms has further streamlined the process for those seeking to generate income from home. These tools leverage algorithms to execute trades based on predefined parameters, allowing users to engage with the market without constant monitoring. However, the effectiveness of these platforms hinges on their underlying code and the accuracy of their strategies. Investors should scrutinize the platform's track record, transparency, and user feedback before committing capital. Additionally, the use of machine learning models to predict market trends can provide an edge, though they are not foolproof and should be complemented with manual oversight.

To avoid investment traps, individuals must remain vigilant against common risks such as rug pulls, market manipulations, and phishing attacks. Many high-yield projects in the crypto space have been exposed as scams, where developers siphon funds and vanish, leaving investors with significant losses. Building a robust research methodology is essential, including verifying the project's whitepaper, assessing the team's credentials, and analyzing community engagement on social media platforms. For instance, a project with a strong, active developer community and real-world applications is more likely to deliver sustained value than one driven by hype and anonymous founders.

Moreover, the integration of blockchain technology into everyday services presents unconventional opportunities for remote income generation. From providing online education through NFT-based platforms to participating in decentralized governance models, individuals can leverage their skills and interests to create value. However, these avenues require a clear understanding of the underlying technology and its implications. For example, contributing to open-source blockchain projects can offer both financial and reputational rewards, as developers often distribute tokens to contributors.

The ultimate goal of any investment strategy is to create a sustainable income stream while protecting capital. This necessitates a combination of risk assessment, portfolio diversification, and continuous learning. By staying informed about market developments, refining technical analysis skills, and adopting a disciplined approach, investors can navigate the complexities of cryptocurrency markets with confidence. It's crucial to remember that while quick returns are tempting, long-term growth often requires patience, adaptability, and a deep understanding of the market's fundamental drivers. Through careful planning and strategic execution, individuals can unlock the potential of virtual currencies as a tool for financial empowerment.