In the digital age, teenagers are increasingly finding opportunities to build financial independence, often starting with small ventures that align with their interests and capabilities. While traditional methods like part-time jobs or freelance work remain foundational, the rise of cryptocurrency and other digital assets has introduced new avenues for financial growth, albeit with significant caveats. For adolescents, the key lies in balancing curiosity with caution, leveraging their tech-savviness without exposing themselves to undue risks. This approach not only fosters responsibility but also equips them with skills that transcend mere monetary gain, shaping their long-term mindset toward financial literacy and strategic planning.

The journey of earning money at 13 begins with understanding the basics of financial autonomy, a concept that extends beyond immediate profit. Teenagers often start by exploring simple income streams, from babysitting to selling handmade crafts, which provide hands-on experience in budgeting and managing resources. These activities serve as a stepping stone, teaching essential principles like setting prices, tracking expenses, and meeting deadlines. As they gain confidence, they might branch into more complex ventures, such as content creation or digital marketing, where their online presence can be monetized through platforms like YouTube, TikTok, or Etsy. This evolution reflects a natural progression toward self-reliance, as teens learn to identify opportunities that match their skills and passions.

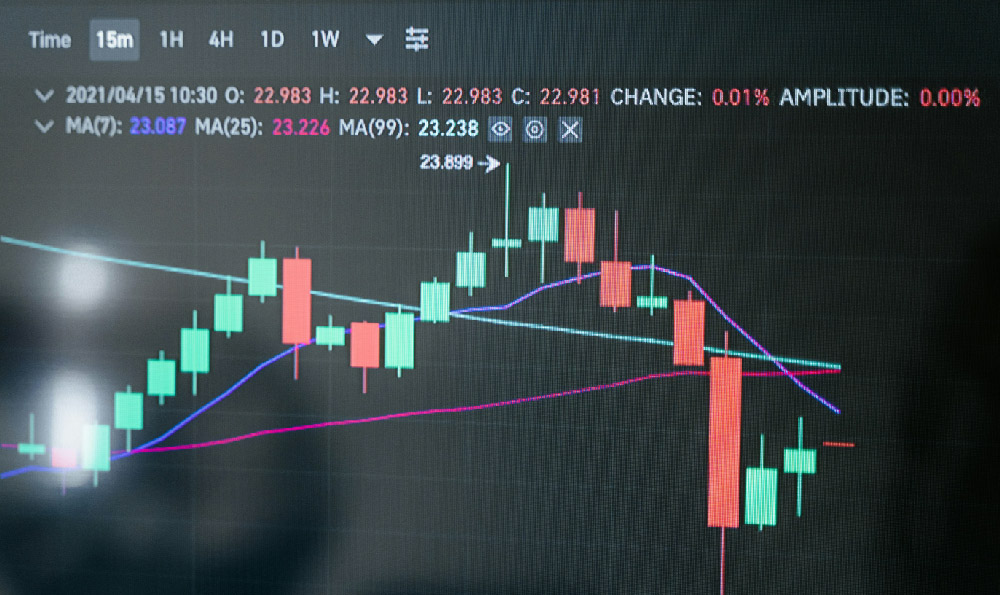

However, the allure of crypto investments for young investors warrants careful consideration. While the market offers potential for high returns, it is equally volatile, with prices fluctuating rapidly due to factors like regulatory changes, technological advancements, and global economic shifts. For a 13-year-old, engaging in such activities without adequate knowledge can lead to significant financial losses. Instead, the focus should be on building a solid foundation through education and experimentation with low-risk alternatives. This might include setting up a savings account, investing in index funds, or using micro-investment apps designed for beginners. By starting with these tools, teens can grasp the fundamentals of compound interest, diversification, and risk assessment before venturing into more complex markets.

A critical aspect of financial education for teenagers is recognizing the difference between short-term gains and long-term wealth. For instance, while art or music gigs may yield quick cash, they often lack sustainability. Conversely, investing in crypto requires a deeper understanding of market dynamics and a willingness to accept uncertainty. Parents and mentors play a pivotal role in this process, acting as guides who help teens navigate the financial landscape. They can introduce concepts like budgeting, saving, and the importance of a diversified portfolio, ensuring that young investors are not tempted by the illusion of easy money.

Moreover, the digital world offers unique opportunities for teens to develop entrepreneurial acumen. Online tutoring, virtual assistant services, or even participating in affiliate marketing can provide income streams that align with their tech-savvy nature. These activities not only teach the value of hard work but also expose teens to the nuances of digital platforms, customer engagement, and scalability. The critical lesson here is that money-making requires time, effort, and a willingness to learn from setbacks, rather than relying on luck or speculative bets.

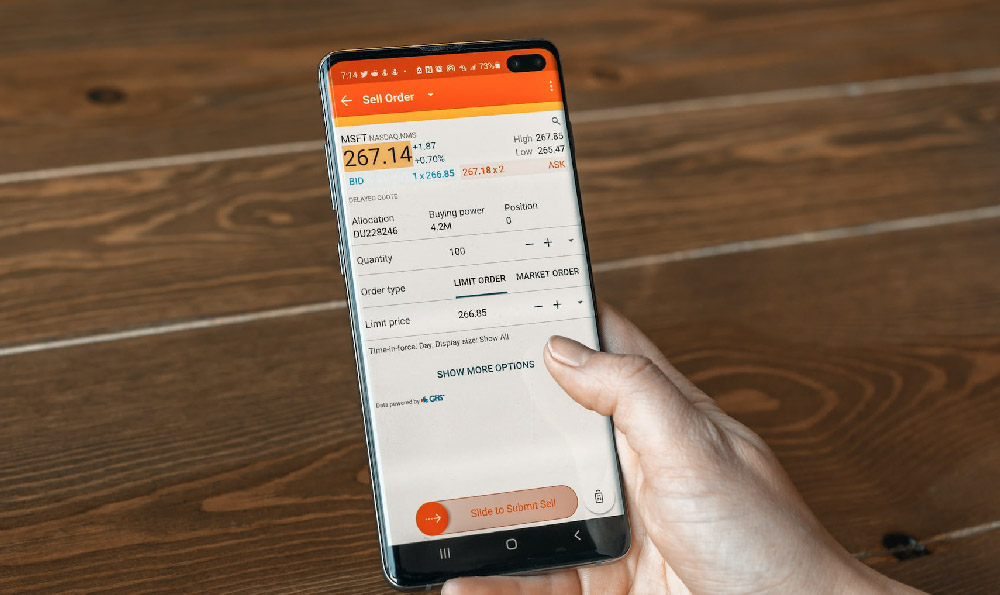

For those intrigued by the crypto space, it is essential to approach it with a clear understanding of its risks. Educational resources like beginner-friendly YouTube tutorials, accredited online courses, or books on blockchain technology can demystify the market without encouraging premature involvement. Engaging in sandbox environments, such as demo accounts or simulated trading platforms, allows teens to experiment with trading strategies without risking real capital. This preparatory phase is invaluable, as it cultivates critical thinking and analytical skills necessary for informed decision-making.

Another dimension of financial empowerment for teenagers is the cultivation of a growth mindset. This involves recognizing that income generation is a skill that improves with experience, not an instant achievement. Whether through part-time work, creative endeavors, or financial education, teens must embrace the idea that setbacks are part of the learning process. For example, a young entrepreneur might face initial rejection when pitching an idea, but this failure becomes a valuable lesson in refinement and resilience. Such an attitude not only enhances their ability to adapt but also builds a strong foundation for future success.

In addition to practical skills, teenagers must also develop emotional intelligence when managing money. This includes understanding the psychological aspects of investing, such as the temptation to chase quick profits or the fear of loss. By learning to regulate emotions and make rational decisions, teens can avoid common pitfalls like impulsive trading or overleveraging. This emotional maturity is often overlooked but is crucial for sustained financial growth, as it enables individuals to remain grounded amidst market fluctuations.

The digital age also presents opportunities for teens to engage in micro-investing or fractional investing, platforms that allow them to invest small amounts in various assets. These tools democratize access to financial markets, enabling young investors to start with minimal capital while learning about asset allocation and market trends. However, it is imperative to emphasize the importance of thorough research and risk management, as even small amounts can be lost if decisions are made without proper understanding.

Ultimately, the goal of earning money at 13 should be about building a comprehensive understanding of financial systems, not just acquiring wealth. This includes learning to identify legitimate opportunities from potential scams, understanding the importance of diversification, and developing a plan for long-term financial security. By fostering these skills early, teens can navigate the complexities of the financial world with confidence, ensuring that their ventures are both sustainable and educational.

In conclusion, the path to financial growth for teenagers is multifaceted, requiring a balance between practical experience and theoretical knowledge. Whether through traditional jobs, digital ventures, or financial education, the focus should be on building a foundation that supports long-term success. This journey not only enhances their ability to manage money but also cultivates a mindset that values responsibility, resilience, and strategic thinking. By approaching money-making with curiosity and caution, teens can unlock their potential for financial independence while protecting their resources from unnecessary risks.