Investing in startups can be an alluring prospect. The potential for exponential returns, the thrill of backing the next big thing, and the opportunity to be involved in groundbreaking innovation – these are all powerful motivators. However, beneath the surface of these glittering possibilities lies a landscape fraught with risk, demanding careful consideration and a well-informed approach. This guide is designed for beginners, providing a roadmap through the complexities of startup investing and helping you determine if it aligns with your financial goals and risk tolerance.

Before diving in, it’s critical to understand the fundamental difference between investing in established companies and investing in startups. Established companies, particularly those publicly traded, have a proven track record, readily available financial data, and often pay dividends. Startups, on the other hand, are typically young, privately held companies with limited operational history, limited financial transparency, and no guarantee of future success.

The most significant risk associated with startup investing is the high probability of failure. Many startups simply don’t make it. They might run out of funding, fail to find a viable market for their product or service, or be outcompeted by larger, more established players. The failure rate is notably higher than that of established businesses. You should be prepared to lose your entire investment. It's not just a possibility, but a significant likelihood.

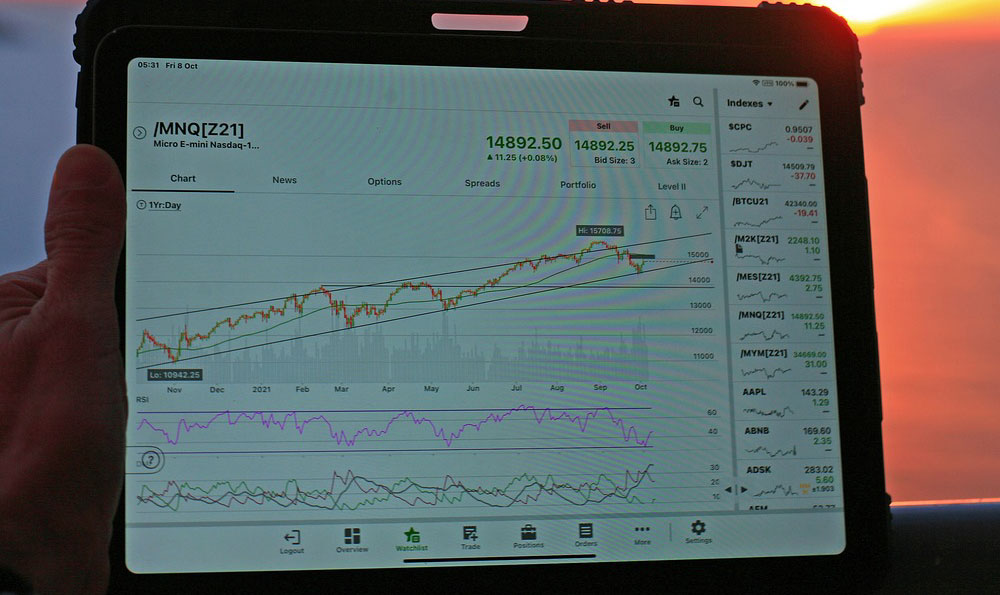

Another major risk is illiquidity. Unlike publicly traded stocks that can be bought and sold relatively easily on the stock market, startup investments are generally illiquid. This means it can be difficult, if not impossible, to sell your shares quickly if you need the money or want to change your investment strategy. There is no readily available market for these shares. You are essentially locked into your investment until a liquidity event occurs, such as an acquisition or an initial public offering (IPO). This can take years, if it happens at all.

Valuation is another challenge. Determining the true value of a startup is notoriously difficult. Unlike established companies with readily available financial data and market capitalization, startup valuations are often based on projections, assumptions, and comparisons to other startups in the same industry. These valuations can be subjective and inflated, leading to overpaying for your shares. You need to critically assess the valuation and understand the assumptions that underpin it. Relying solely on the startup's own assessment can be a costly mistake.

Despite these considerable risks, the potential rewards of startup investing can be substantial. The most obvious reward is the potential for high returns. If a startup is successful and experiences rapid growth, your investment can multiply many times over. Consider early investors in companies like Google, Amazon, or Facebook – their initial investments generated extraordinary returns.

Beyond financial returns, there's also the opportunity to be involved in something innovative and groundbreaking. Startup investing allows you to support entrepreneurs and contribute to the development of new technologies and solutions that can address pressing global challenges. This can be a deeply rewarding experience for investors who are passionate about specific industries or causes.

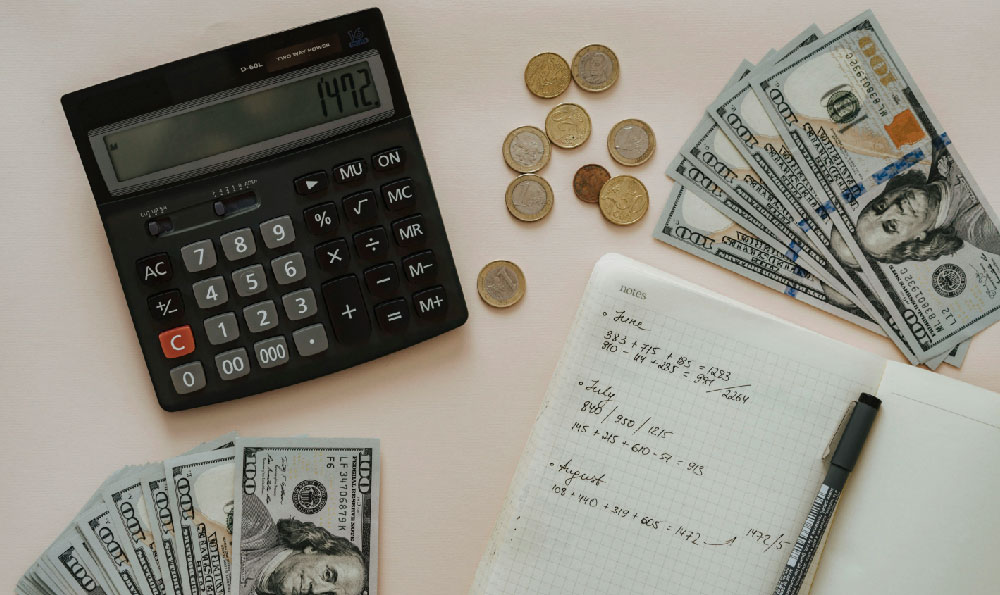

Diversification is key to mitigating the risks associated with startup investing. Never put all your eggs in one basket. Instead, spread your investments across multiple startups in different industries and at different stages of development. This reduces the impact of any single failure on your overall portfolio. A general rule of thumb is to allocate only a small percentage of your overall investment portfolio to startups – an amount you can afford to lose without significantly impacting your financial well-being.

Due diligence is also crucial. Before investing in any startup, conduct thorough research and analysis. This includes evaluating the startup's business plan, management team, market opportunity, competitive landscape, and financial projections. If possible, talk to other investors or industry experts to get their perspective. Don't be afraid to ask tough questions and challenge the startup's assumptions. A strong management team with a proven track record is a critical indicator of potential success.

Consider the stage of the startup. Early-stage startups are riskier but potentially offer higher returns, while later-stage startups are less risky but may offer lower returns. Understanding the different stages and their associated risks and rewards will help you make informed investment decisions. Typically, angel investors invest in very early-stage companies, while venture capitalists invest in later stages.

Understand the investment structure. Startup investments are often made through complex legal structures, such as convertible notes or preferred stock. Make sure you understand the terms of the investment, including your rights and obligations as an investor. Seek legal and financial advice if needed. Knowing what type of equity you are buying, and its implications, is essential.

Finally, be patient. Startup investments are typically long-term investments. It can take years for a startup to mature and generate returns. Don't expect to see a quick profit. Be prepared to hold your investment for the long haul. The journey of a startup is often a marathon, not a sprint.

In conclusion, investing in startups can be a potentially lucrative but inherently risky undertaking. By understanding the risks and rewards, conducting thorough due diligence, diversifying your investments, and being patient, you can increase your chances of success. However, remember that startup investing is not for everyone. It is best suited for sophisticated investors with a high-risk tolerance and a long-term investment horizon. If you are a beginner, it is wise to start small, learn from your experiences, and seek professional advice before committing significant capital. The key is to approach it with eyes wide open and a realistic understanding of the challenges and opportunities involved.