Investing in the share market can be a powerful way to grow your wealth over time. However, it's crucial to approach it with a well-thought-out strategy and a clear understanding of the risks involved. Diving in without proper preparation can lead to significant losses. Before venturing into the world of stocks, several key factors deserve your attention.

First and foremost, determine your investment goals. What do you hope to achieve by investing in the stock market? Are you saving for retirement, a down payment on a house, your children's education, or simply seeking to generate extra income? Clearly defining your goals will influence the type of investments you choose and the timeline you set for achieving them. For example, if you are investing for retirement, you can generally afford to take on more risk with a longer time horizon, allowing you to potentially benefit from higher returns. Conversely, if you need the money in the near future, a more conservative approach is likely more suitable.

Closely tied to your goals is your risk tolerance. How comfortable are you with the possibility of losing money? The stock market inherently involves risk, and the value of your investments can fluctuate. Understanding your risk tolerance is essential because it will guide you in selecting investments that align with your comfort level. If you are risk-averse, you might prefer investing in stable, dividend-paying stocks or diversified index funds. If you are more risk-tolerant, you might be willing to invest in growth stocks or emerging markets, which have the potential for higher returns but also carry greater risk.

Equally important is your investment time horizon. How long do you plan to stay invested in the market? A longer time horizon allows you to ride out market fluctuations and potentially benefit from long-term growth. Short-term investing is generally riskier because there is less time to recover from potential losses. Ideally, you should consider investing in the stock market only with money you won't need for at least five years, and preferably longer. This allows your investments to weather market cycles and potentially generate significant returns over time.

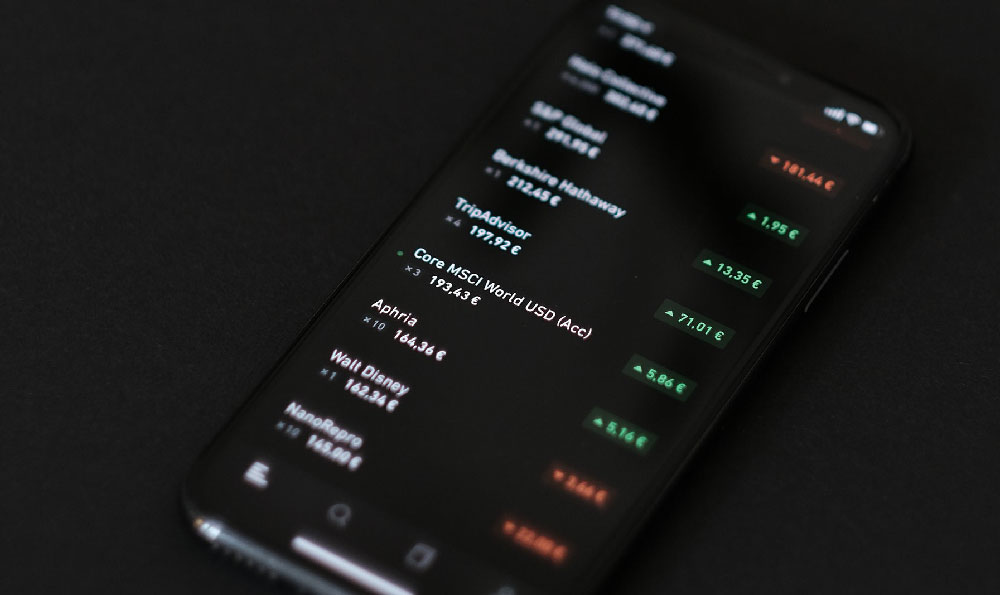

Once you've assessed your goals, risk tolerance, and time horizon, it's time to research and understand different investment options. The stock market offers a wide range of choices, from individual stocks to mutual funds and exchange-traded funds (ETFs). Individual stocks offer the potential for high returns, but they also come with higher risk. Thoroughly research any company you're considering investing in, analyze its financial statements, understand its business model, and assess its competitive position within its industry. Mutual funds and ETFs offer diversification, which can help reduce risk. Mutual funds are actively managed by professional fund managers who select investments based on their research and analysis. ETFs, on the other hand, typically track a specific index, such as the S&P 500, and offer a passive investment approach.

Consider the fees associated with different investment options. Mutual funds often charge higher fees than ETFs due to active management. Brokerage accounts also have fees associated with trading and account maintenance. These fees can eat into your returns, so it's important to compare fees before making any investment decisions. Look for low-cost index funds or ETFs, and consider using a discount brokerage that offers competitive trading fees.

Develop a diversified investment portfolio. Don't put all your eggs in one basket. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. This helps reduce risk by mitigating the impact of any single investment on your overall portfolio. A diversified portfolio might include stocks, bonds, and real estate, as well as investments in both domestic and international markets.

Before investing any real money, consider practicing with a virtual stock trading simulator. These simulators allow you to buy and sell stocks using virtual money, giving you the opportunity to learn how the market works without risking any real capital. This can be a valuable way to gain experience and test your investment strategies before committing real funds.

Finally, commit to continuous learning and stay informed about market trends and economic developments. The stock market is constantly evolving, and it's important to stay up-to-date on the latest news and analysis. Read financial publications, follow reputable financial analysts, and consider taking online courses or workshops to enhance your financial knowledge. Don't rely solely on the advice of others; do your own research and make informed decisions based on your own understanding of the market.

Remember, investing in the share market is a long-term game. Don't get discouraged by short-term market fluctuations. Stay disciplined, stick to your investment plan, and focus on your long-term goals. With careful planning, research, and a commitment to continuous learning, you can increase your chances of achieving financial success through stock market investing.