Okay, I understand. Here's an article addressing the question "How can I invest, and what are the benefits of hedge funds?" written in English, meeting your specified requirements regarding length, structure, and tone:

Investing is a vast and multifaceted landscape, offering a multitude of paths for individuals seeking to grow their wealth. Before venturing into any specific investment vehicle, it’s crucial to establish a solid foundation by understanding your risk tolerance, financial goals, and time horizon. Are you saving for retirement decades down the line, or a down payment on a house in the near future? Are you comfortable with the possibility of losing a significant portion of your investment in exchange for potentially higher returns, or do you prioritize preserving your capital above all else? Answering these questions will help you define your investment strategy and guide you towards suitable asset classes.

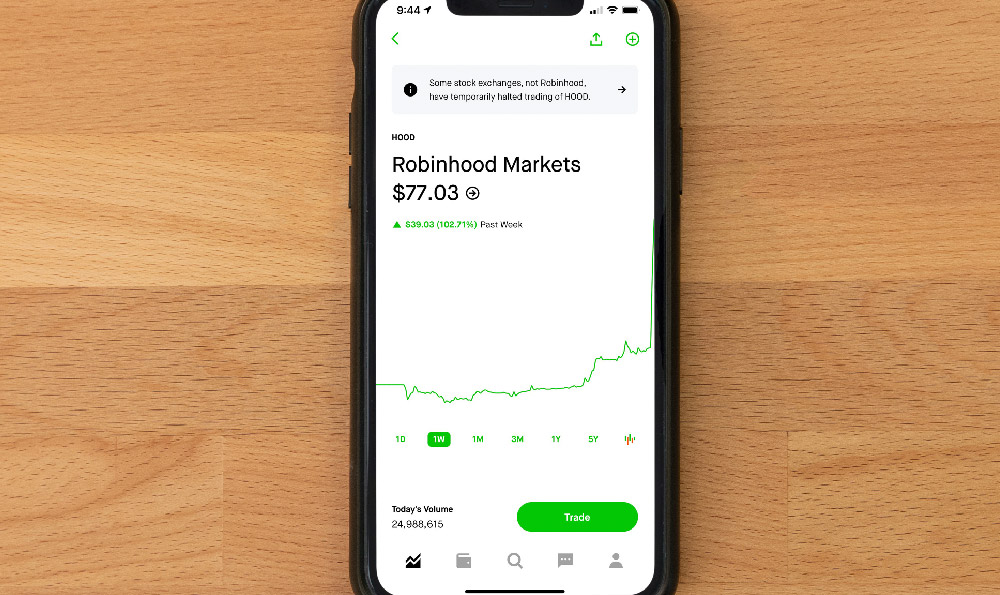

The most fundamental investment option is typically the stock market. Investing in stocks essentially means buying ownership shares in publicly traded companies. The potential for growth is significant, as the value of your shares can increase substantially if the company performs well. However, the stock market is inherently volatile, and stock prices can fluctuate dramatically based on a wide range of factors, including economic conditions, industry trends, and company-specific news. A common and diversified approach to stock market investing is through index funds or ETFs (Exchange Traded Funds), which track a specific market index like the S&P 500. This allows you to gain exposure to a broad range of companies without having to individually select stocks, thereby reducing risk.

Bonds represent another core asset class. When you buy a bond, you are essentially lending money to a government or corporation. In return, you receive periodic interest payments and the return of your principal at the bond's maturity date. Bonds are generally considered less risky than stocks, as their prices tend to be less volatile. However, they also offer lower potential returns. Bond investments can be made directly by purchasing individual bonds or indirectly through bond funds, which pool money from multiple investors to purchase a portfolio of bonds. Factors influencing bond prices include interest rate changes and the creditworthiness of the issuer.

Real estate is another tangible asset class offering diverse investment opportunities. You can invest directly by purchasing residential or commercial properties, either for personal use or as rental income generating assets. Real estate can appreciate in value over time, and rental income can provide a steady stream of cash flow. However, real estate investments also come with significant responsibilities, including property management, maintenance, and dealing with tenants. Additionally, real estate can be relatively illiquid, meaning it may take time to sell your property if you need access to your capital. REITs (Real Estate Investment Trusts) provide a more liquid way to invest in real estate, as they are publicly traded companies that own and manage income-producing real estate properties.

Beyond these core asset classes lie alternative investments, which often include assets like commodities (e.g., gold, oil), private equity, and hedge funds. These investments can offer the potential for higher returns and diversification benefits, but they also typically come with higher risks and require a more sophisticated understanding. Which leads us into the realm of hedge funds.

Hedge funds are investment partnerships that use pooled funds to employ a variety of complex strategies to generate returns. Unlike mutual funds, which are typically restricted to certain investment styles and leverage limitations, hedge funds have greater flexibility in their investment approaches. They may use techniques such as short selling, leverage, derivatives, and arbitrage to profit from market inefficiencies or anticipated price movements.

One of the primary perceived benefits of hedge funds is their potential to generate absolute returns, meaning positive returns regardless of the overall market conditions. This is achieved through active management and the use of strategies designed to profit from both rising and falling markets. For example, a hedge fund might use a long-short equity strategy, where it simultaneously buys undervalued stocks (long positions) and sells overvalued stocks (short positions). This strategy aims to profit from the relative performance of the two sets of stocks, regardless of whether the overall market goes up or down.

Another potential benefit of hedge funds is diversification. Because they often invest in a wide range of asset classes and employ a variety of strategies, hedge funds can help to reduce the overall risk of a portfolio. By adding hedge fund investments, an investor can potentially reduce their portfolio's correlation to traditional asset classes like stocks and bonds, thereby improving its risk-adjusted returns.

However, it is crucial to understand that hedge funds are not without their risks and drawbacks. They are typically more expensive than traditional investment options, charging both management fees (a percentage of assets under management) and performance fees (a percentage of profits generated). These fees can significantly reduce an investor's net returns. Hedge funds are also typically less transparent than mutual funds, making it difficult to fully understand the risks associated with their investments. Furthermore, many hedge funds have limited liquidity, meaning that investors may not be able to redeem their investments on short notice.

Moreover, the performance of hedge funds can be highly variable, and not all hedge funds are successful. While some hedge funds have consistently generated strong returns, others have underperformed the market. Therefore, it is essential to conduct thorough due diligence before investing in a hedge fund, carefully evaluating the fund's investment strategy, track record, and risk management practices. Investing in hedge funds is generally considered suitable only for sophisticated investors who understand the risks involved and have the financial resources to absorb potential losses. Due to their complex nature, often high minimum investment amounts, and regulatory constraints, access to hedge funds is often limited to accredited investors – individuals or institutions meeting certain income or net worth thresholds.

In conclusion, investing is a journey that requires careful planning, diversification, and a thorough understanding of your own financial situation and risk tolerance. While stocks, bonds, and real estate form the foundation of many investment portfolios, alternative investments like hedge funds can offer the potential for enhanced returns and diversification benefits. However, it is essential to approach hedge fund investments with caution, carefully weighing the potential risks and rewards before allocating capital. Thorough research, professional advice, and a clear understanding of the fund's strategy are crucial for navigating the complex world of hedge funds and making informed investment decisions. Remember that no investment guarantees a profit, and past performance is not indicative of future results.