Creating a secure online payment method for virtual currency investments involves a meticulous process that balances technological proficiency with strategic foresight. As the digital asset market evolves, understanding how to establish reliable financial infrastructure is crucial for both novice and experienced investors. The first step in this endeavor is selecting a trustworthy digital wallet that aligns with your investment goals—whether you prioritize privacy, speed, or compatibility with specific blockchain networks. Hardware wallets, for instance, offer enhanced security through offline storage, making them ideal for holding significant amounts of cryptocurrency. However, their complexity may require users to invest time in learning encryption protocols and secure key management practices. Software wallets, on the other hand, provide convenience for frequent trading but necessitate robust cybersecurity measures such as multi-factor authentication and regular software updates to mitigate risks of hacking or unauthorized access.

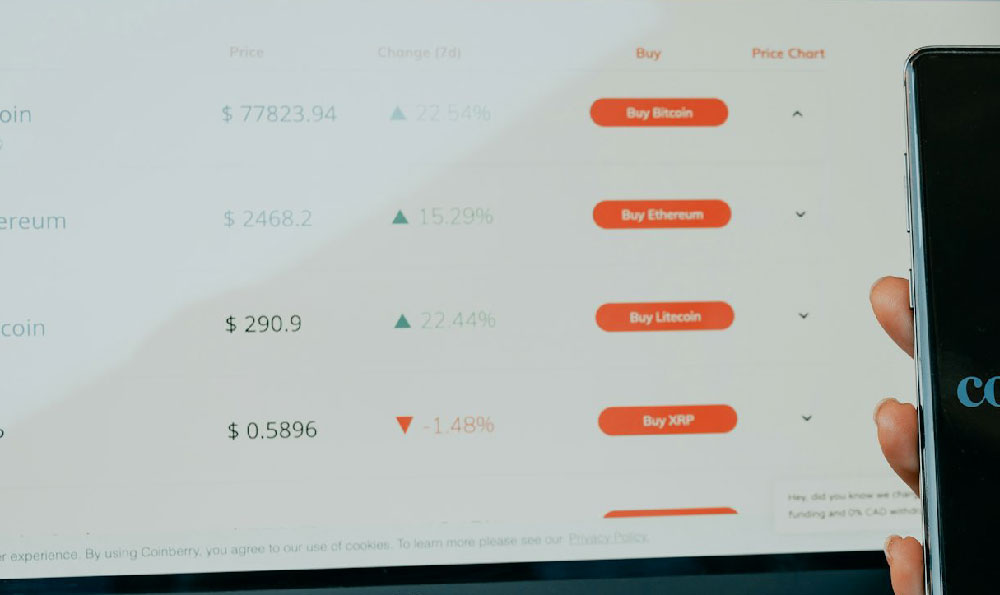

Once the wallet is chosen, integrating it with a secure online platform becomes essential. This process involves configuring API keys for seamless transaction verification while maintaining strict access controls to prevent misuse. Investors must also consider the fees associated with different payment gateways, as recurring transaction costs can erode profits over time. Some platforms offer lower fees for high-volume trades or staking activities, which may be more advantageous for long-term strategies. Additionally, the choice of currency pairing—such as Bitcoin versus stablecoins or altcoins—can significantly impact liquidity and volatility, requiring careful evaluation of market trends and macroeconomic indicators.

A critical component of this setup is implementing advanced authentication protocols. Beyond standard password protection, biometric verification, hardware tokens, and one-time password (OTP) systems can enhance security against phishing attempts and credential theft. It’s also advisable to enable transaction alerts for real-time monitoring, allowing investors to detect suspicious activity promptly. Regularly auditing transaction history and reviewing wallet settings can prevent unnoticed vulnerabilities. Furthermore, establishing a multi-signature system ensures that no single entity can authorize large transactions without consensus, reducing the risk of centralized control breaches.

To optimize returns, integrating financial tools like limit orders and stop-loss mechanisms into the payment process is imperative. Limit orders enable investors to set specific price thresholds for buying or selling assets, ensuring transactions occur at favorable rates without constant manual oversight. Stop-loss orders, conversely, automate the sale of holdings when prices fall below a certain level, limiting potential losses in volatile markets. These features should be configured within the platform’s interface to align with the investor’s risk tolerance and strategic timeframe. For example, day traders might favor quick execution with low slippage, whereas long-term holders could prioritize price stability through market order adjustments.

Monitoring market dynamics is another pivotal aspect of this process. Utilizing tools like blockchain explorers and real-time price tracking software allows investors to analyze network activity, transaction velocities, and market sentiment indicators. By correlating these data points with macroeconomic factors—such as interest rates, inflation rates, or geopolitical events—investors can anticipate price movements and adjust their payment strategies accordingly. For instance, a rise in central bank interest rates might signal a shift toward fiat currencies, prompting investors to reassess their exposure to high-yield assets like staking or yield farming platforms.

A well-rounded investment strategy must also address liquidity management. Allocating funds across diverse digital asset classes—such as equities, commodities, or decentralized finance (DeFi) protocols—ensures resilience against market fluctuations. Leveraging limit orders for diversified buying while maintaining a reserve for emergency transactions can prevent overexposure to single assets. Additionally, managing tax implications through platform-integrated tools or third-party services ensures compliance with evolving regulations. This requires a deep understanding of tax laws in different jurisdictions, as cross-border transactions may involve varying reporting requirements.

Risk management remains the cornerstone of this process. Establishing clear risk parameters—such as maximum investment thresholds per asset or portfolio diversification ratios—helps prevent impulsive decisions during market volatility. Investors should also consider hedging strategies, such as using stablecoins to mitigate exposure to price swings. Regularly reviewing and adjusting these parameters based on market conditions and personal financial goals is essential for sustained success. For example, during bear markets, increasing the allocation to stablecoins and reducing leveraged positions can preserve capital while maintaining long-term growth potential.

Finally, fostering a disciplined approach to continuous learning is vital. Staying updated on technological advancements, regulatory changes, and market innovations ensures that investors adapt their strategies to evolving scenarios. Engaging with reputable sources, such as blockchain whitepapers, financial news outlets, and community forums, provides valuable insights into industry trends. By combining this knowledge with practical implementation, investors can build a resilient financial framework that maximizes returns while minimizing risks in the dynamic world of virtual currency.