Okay, I'm ready. Here's an article on "How to make extra money? Or is it possible?" focusing on practical strategies and diverse income streams, while avoiding an overly structured format and fulfilling the length requirement.

The Quest for Additional Income: Pathways to Financial Augmentation

The allure of extra money is a universal one. Whether it's to accelerate debt repayment, pad an emergency fund, fuel an investment portfolio, or simply afford a few more luxuries, the desire to augment one's income is a powerful motivator. The question then becomes not whether it's possible to make extra money, but rather how to do it effectively and sustainably. The landscape of opportunities is vast and ever-evolving, demanding adaptability and a willingness to explore different avenues.

One fundamental starting point lies in leveraging existing skills and resources. What are you already good at? Can you teach it, consult on it, or offer it as a service? The gig economy thrives on this principle, connecting individuals with specific talents to those who need them. Consider freelance writing, editing, graphic design, web development, or social media management. Platforms like Upwork, Fiverr, and Guru provide marketplaces for these skills, enabling you to bid on projects that match your expertise and availability. The advantage here is flexibility – you can often set your own hours and work from anywhere with an internet connection.

Beyond the digital realm, consider tangible assets. Do you have a spare room, an unused parking space, or even valuable items gathering dust? Renting out a room on Airbnb, offering parking on a platform like SpotHero, or selling unwanted possessions on eBay or Craigslist can generate surprisingly consistent income. The key is to assess what you already own that could be monetized. This approach requires minimal upfront investment and can provide a steady stream of revenue.

Venturing beyond existing skillsets and possessions opens doors to entrepreneurial endeavors. Start a small online business. E-commerce is booming, and platforms like Shopify make it relatively easy to set up an online store. The products you sell could be handmade crafts, curated vintage items, or even dropshipped goods (where you don't hold any inventory yourself). Success in e-commerce requires a solid business plan, marketing savvy, and a commitment to customer service, but the potential for growth is significant.

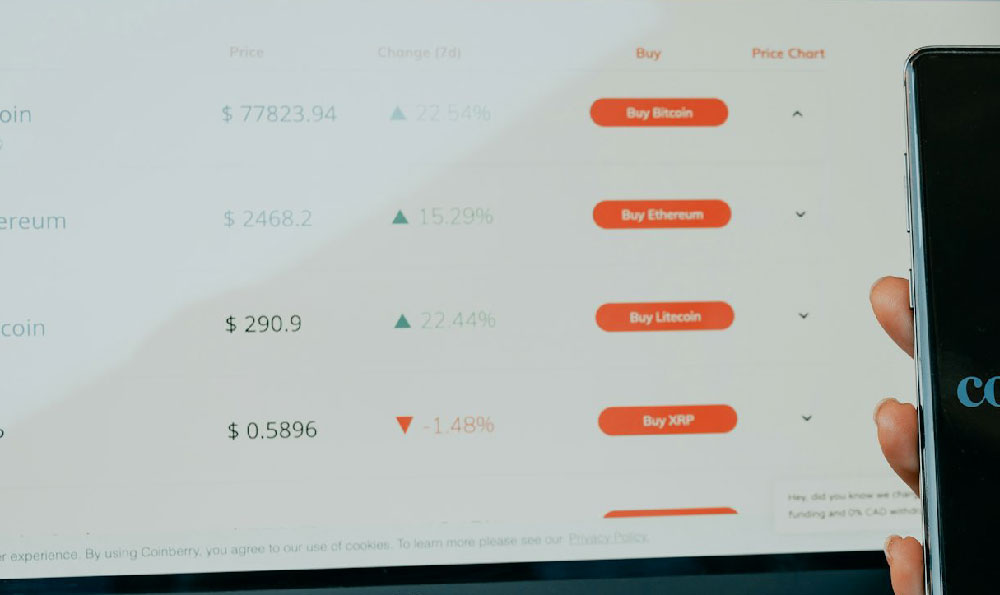

Another increasingly popular option is investing. While investing always carries risk, it also presents the potential for significant returns over time. Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate. Consider low-cost index funds or exchange-traded funds (ETFs) for broad market exposure. Real estate investing can take various forms, from buying rental properties to participating in real estate investment trusts (REITs). Remember that financial markets fluctuate, and a long-term perspective is crucial for navigating volatility.

Passive income streams are the holy grail for many seeking extra money. This involves creating systems that generate income with minimal ongoing effort. Examples include writing and selling an e-book, creating an online course, developing a mobile app, or investing in dividend-paying stocks. Building a passive income stream requires significant upfront effort, but the long-term rewards can be substantial. The idea is to create an asset that continues to generate income even while you're not actively working on it.

It's equally important to examine your current spending habits. Are there areas where you can cut back on expenses? Small savings can accumulate over time and free up funds for investment or other income-generating activities. Review your subscriptions, negotiate better rates on your insurance policies, and explore ways to reduce your energy consumption. Every dollar saved is effectively a dollar earned.

Beyond individual endeavors, consider exploring opportunities within your current workplace. Can you take on extra projects, volunteer for new responsibilities, or pursue professional development opportunities that could lead to a raise or promotion? Building your skills and expertise within your existing job can be a reliable way to increase your income.

The pursuit of extra money requires a multifaceted approach. It's not about finding a single magic bullet, but rather about exploring different options, identifying opportunities that align with your skills and interests, and committing to consistent effort. Whether it's leveraging existing talents, exploring entrepreneurial ventures, or investing in assets that generate passive income, the possibilities are virtually limitless. The key is to remain adaptable, proactive, and persistent in your quest for financial augmentation. Remember to do your research, understand the risks involved in any investment or business venture, and never put all your eggs in one basket. Diversification and a long-term perspective are essential for building a sustainable financial future. Moreover, always be mindful of tax implications and seek professional advice when needed.