Investing in real estate has long been considered a reliable way to build wealth and generate passive income. However, the traditional approach of buying property outright can be daunting for many, requiring significant capital, ongoing maintenance, and tenant management. Fortunately, there are numerous alternative strategies to gain exposure to the real estate market without directly owning property. These options offer varying levels of risk, reward, and liquidity, allowing investors to tailor their approach to their individual financial goals and risk tolerance.

One of the most accessible alternatives is investing in Real Estate Investment Trusts (REITs). REITs are companies that own, operate, or finance income-producing real estate across a range of sectors, including commercial properties, residential buildings, healthcare facilities, and infrastructure. By purchasing shares in a REIT, investors can effectively own a small portion of a diverse portfolio of properties without the complexities of direct ownership. REITs are typically traded on major stock exchanges, making them highly liquid and easy to buy and sell. Furthermore, REITs are required to distribute a significant portion of their taxable income to shareholders in the form of dividends, providing a consistent stream of income. There are different types of REITs, including equity REITs (which own and operate properties), mortgage REITs (which finance properties through mortgages), and hybrid REITs (which combine both strategies). It's crucial to research and understand the specific focus and performance of a REIT before investing.

Another avenue for real estate investment without direct ownership is real estate crowdfunding. Online platforms have emerged that connect investors with real estate developers seeking capital for projects. Through crowdfunding, investors can pool their funds with others to finance a specific property or development, earning a share of the profits generated by the project. This approach allows investors to participate in projects that may have been previously inaccessible to individual investors, such as large-scale commercial developments or multi-family housing projects. Real estate crowdfunding platforms typically offer detailed information about each project, including its projected returns, risk factors, and the developer's track record. However, it's important to note that real estate crowdfunding investments are often illiquid, meaning it may be difficult to sell your investment before the project is completed. Thorough due diligence is essential, as the success of the investment is highly dependent on the developer's execution and market conditions.

Real estate mutual funds and Exchange-Traded Funds (ETFs) provide another way to diversify your real estate exposure. These funds invest in a portfolio of REITs and other real estate-related companies, offering instant diversification and professional management. Real estate mutual funds are actively managed by portfolio managers who select and adjust the fund's holdings based on their market outlook and investment strategy. ETFs, on the other hand, typically track a specific real estate index, providing a more passive and cost-effective way to gain exposure to the market. Real estate mutual funds and ETFs are highly liquid and can be easily bought and sold through a brokerage account. They offer a convenient way to invest in real estate without the need to research and select individual REITs.

Real estate limited partnerships (RELPs) are another option, offering a more direct ownership experience than REITs but without the full responsibilities of managing a property. RELPs typically involve a general partner who manages the property and limited partners who contribute capital and receive a share of the profits. RELPs can offer attractive tax benefits, such as the ability to deduct depreciation expenses. However, they are often illiquid and require a longer-term commitment.

Beyond these more established options, consider exploring mortgage-backed securities (MBS). While indirectly tied to real estate, these securities are essentially bonds backed by a pool of mortgages. Investors receive payments from the underlying mortgages, making it a way to participate in the real estate market's financing aspect. However, MBS can be complex and are subject to prepayment risk, where homeowners refinance their mortgages early, reducing the investor's future income.

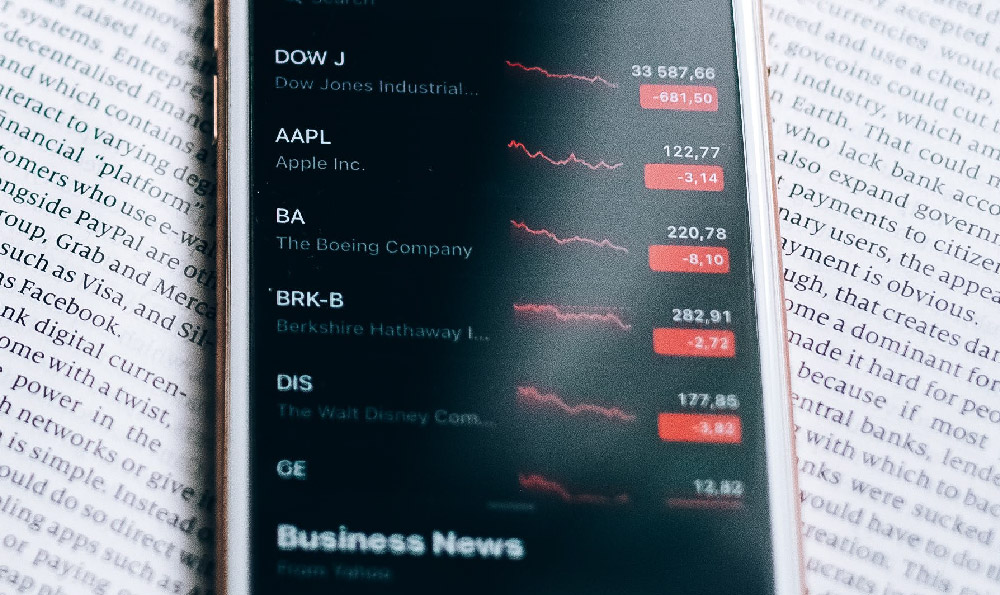

Finally, a less direct but potentially lucrative alternative is investing in companies that are heavily involved in the real estate sector, such as construction companies, home improvement retailers, or real estate technology (PropTech) firms. The success of these businesses is often closely tied to the overall health of the real estate market, offering a way to profit from the sector's growth without owning physical properties. Thorough research into the company's financial performance, competitive landscape, and management team is crucial before investing.

When considering any of these alternatives, it's important to conduct thorough research, understand the risks involved, and diversify your portfolio. Each option has its own set of advantages and disadvantages, and the best approach will depend on your individual circumstances and investment goals. Consider your risk tolerance, investment horizon, and liquidity needs before making any decisions. Furthermore, seeking advice from a qualified financial advisor can help you navigate the complexities of real estate investment and develop a strategy that aligns with your overall financial plan. Remember, investing in real estate, even without buying property directly, requires careful consideration and a long-term perspective. It's not a get-rich-quick scheme, but a strategic approach to building wealth over time.