Okay, I understand. I will craft an article based on the provided title "How Can I Invest My HSA, and Should I?" adhering to the specified requirements: an article of at least 800 words, avoiding excessive bullet points or numbered lists, refraining from "firstly/secondly" style transitions, not explicitly repeating the title, and delivering comprehensive advice on the topic, written entirely in English.

Here's the article:

Healthcare is an inevitable expense. Recognizing this, the Health Savings Account (HSA) was created as a powerful tool designed to help individuals save for and manage these costs. While many see the HSA primarily as a spending account for immediate medical bills, it harbors a significant and often underutilized investment potential. The question then becomes, is it wise to invest your HSA funds, and if so, how?

The allure of investing within an HSA stems from its triple tax advantage. Contributions are tax-deductible (or pre-tax if through payroll deduction), earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This combination is incredibly potent, exceeding even the benefits offered by traditional 401(k)s or Roth IRAs in some circumstances. This allows your health savings to compound and grow substantially over time, potentially covering a significant portion of your future healthcare needs, especially in retirement.

However, not all HSAs are created equal when it comes to investment options. Many basic HSA accounts function primarily as checking accounts, offering little or no opportunity for growth beyond minimal interest accrual. Before considering investment, it's crucial to choose an HSA provider that offers a range of investment choices. Typically, these providers allow you to invest in mutual funds, exchange-traded funds (ETFs), and sometimes even individual stocks and bonds, mirroring the investment options available in a traditional brokerage account.

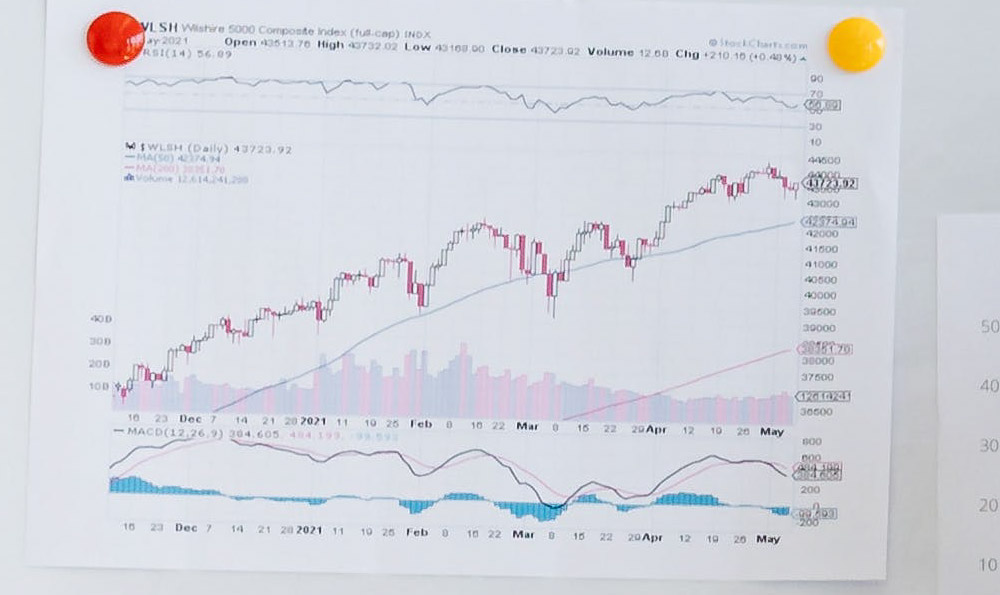

Once you've chosen a suitable HSA provider, the next step is determining your investment strategy. This decision should be based on several factors, including your age, risk tolerance, and time horizon. If you're younger and have a longer time horizon, you can generally afford to take on more risk, potentially allocating a larger portion of your HSA investments to equities (stocks). Stocks have historically offered higher returns than bonds over the long term, but they also come with greater volatility. Conversely, if you're closer to retirement or anticipate needing the funds for near-term medical expenses, a more conservative approach with a higher allocation to bonds or money market funds might be more appropriate. These investments offer lower potential returns but also provide greater stability and principal protection.

Think of your HSA investments as part of your overall financial plan. Consider how your HSA fits in with your other retirement accounts, taxable investments, and savings goals. Don't put all your eggs in one basket. Diversification is key to managing risk. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can help cushion your portfolio against market downturns.

Another important consideration is the minimum balance requirement. Many HSA providers require you to maintain a certain minimum balance in your cash account before you can start investing the excess. This requirement is in place to ensure you have readily available funds to cover immediate medical expenses. Understand these minimums before you begin investing. It might necessitate leaving a larger-than-anticipated amount in cash, slightly diminishing the potential gains from investing the entire account balance.

Timing your investments is also a factor. While trying to time the market is generally not advisable, it's wise to consider making regular contributions and investments rather than trying to predict market peaks and valleys. Dollar-cost averaging, where you invest a fixed amount of money at regular intervals, can help smooth out the fluctuations in the market and potentially reduce your overall cost basis.

Beyond the specific investment strategies, it's also vital to maintain meticulous records of your medical expenses. While withdrawals for qualified medical expenses are tax-free, you may need to provide documentation to the IRS if audited. Keep receipts, explanations of benefits (EOBs), and any other relevant paperwork organized and readily accessible. A well-documented record will provide invaluable peace of mind in the event of an audit.

Now, circling back to the initial question of whether you should invest your HSA: the answer, while dependent on individual circumstances, is generally a resounding yes – with caveats. If you're diligently saving for retirement and have sufficient funds to cover current medical expenses, investing your HSA funds can be a powerful way to grow your wealth and secure your future healthcare needs. The triple tax advantage makes it an incredibly attractive investment vehicle.

However, if you're struggling to pay current medical bills or are not comfortable with the risks associated with investing, it might be more prudent to keep your HSA funds in a cash account. There’s no point in investing if it means neglecting your immediate health or causing undue stress. Consider also the fees associated with different HSA accounts. Some accounts charge maintenance fees, transaction fees, or investment fees, which can eat into your returns. Choose an account with reasonable fees, especially if you're starting with a small balance.

Ultimately, the decision to invest your HSA is a personal one. By carefully considering your financial situation, risk tolerance, and investment goals, you can determine whether investing your HSA is the right move for you. When used wisely, it can be a potent tool for building wealth and securing your future healthcare. Don't hesitate to consult with a financial advisor to get personalized advice tailored to your specific needs.