Investing in blockchain technology presents a unique opportunity to participate in a potentially revolutionary shift across various industries. However, it's crucial to approach this emerging field with a well-thought-out strategy, understanding the inherent risks and rewards. Before diving in, it's essential to establish a solid foundation of knowledge and identify your personal investment goals and risk tolerance.

The initial step involves educating yourself about blockchain technology itself. Blockchain is essentially a distributed, immutable ledger that records transactions in a secure and transparent manner. Beyond cryptocurrencies, its applications extend to supply chain management, healthcare, voting systems, and many other areas. Comprehending the underlying principles of blockchain, its potential benefits, and its limitations is paramount before considering any investment. Reputable online courses, industry publications, and research reports from established financial institutions can be invaluable resources. Understanding concepts like consensus mechanisms (Proof-of-Work, Proof-of-Stake), smart contracts, and decentralized applications (dApps) will provide a crucial understanding.

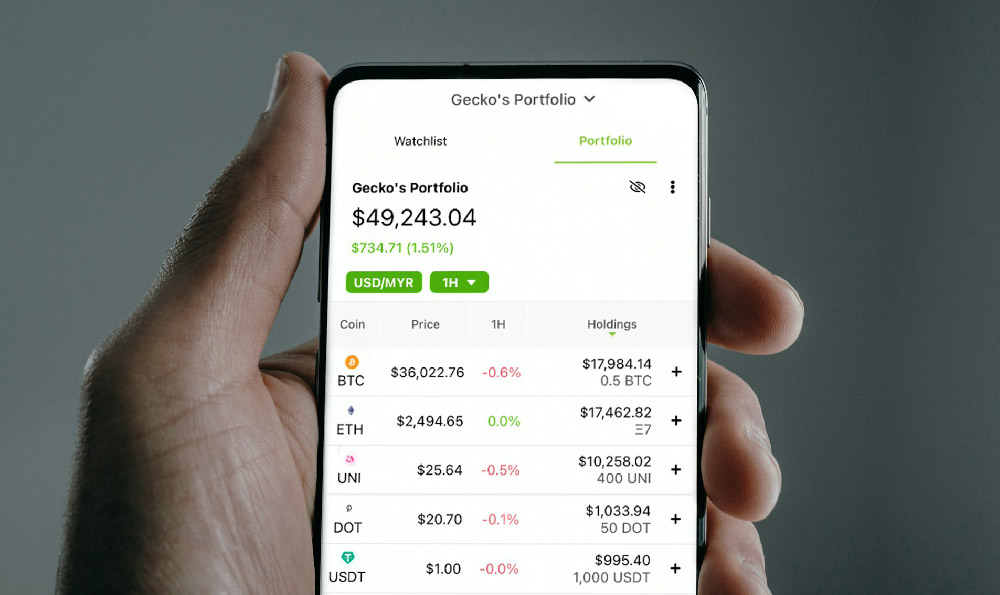

Once you have a grasp of the technology, you can explore various investment avenues related to blockchain. The most commonly known is investing in cryptocurrencies, the digital assets that operate on blockchain networks. Cryptocurrencies like Bitcoin and Ethereum have gained widespread recognition, but there are thousands of other altcoins with varying degrees of utility and risk. It's crucial to conduct thorough research on each cryptocurrency before investing, examining its whitepaper, team, community, and market capitalization. Be wary of coins with vague promises or lacking a strong development team, as many are speculative and susceptible to scams or failures. Remember that the cryptocurrency market is highly volatile, and significant price swings are common. Diversification across several cryptocurrencies can help mitigate risk, but it doesn't eliminate it.

Beyond direct cryptocurrency investments, consider investing in companies that are actively developing or utilizing blockchain technology. These companies might be involved in building blockchain platforms, providing blockchain-based solutions for businesses, or investing in blockchain startups. Research publicly traded companies that have a demonstrable commitment to blockchain and analyze their financial performance, growth potential, and competitive landscape. This approach allows you to gain exposure to blockchain without directly holding volatile cryptocurrencies. Examples include companies involved in cryptocurrency mining, blockchain security, or enterprise blockchain solutions. Evaluating their long-term strategy and the viability of their business model is crucial.

Another option is to invest in blockchain-focused venture capital funds or exchange-traded funds (ETFs). These funds provide a diversified portfolio of blockchain-related companies and projects, allowing you to gain exposure to the industry without having to individually research and select investments. Venture capital funds typically invest in early-stage blockchain startups, offering the potential for high returns but also carrying significant risk. ETFs, on the other hand, provide exposure to a broader range of publicly traded companies involved in blockchain, offering a more diversified and less risky investment option. Carefully review the fund's investment strategy, management team, and fees before investing. Understanding the composition of the fund and its exposure to different segments of the blockchain ecosystem is essential.

Furthermore, consider investing in blockchain infrastructure companies. These are the companies that provide the foundational technologies and services that support the blockchain ecosystem, such as cloud computing providers, data storage solutions, and network infrastructure. These companies are often less directly exposed to the volatility of the cryptocurrency market and can provide a more stable investment option. However, they are still subject to the overall trends and growth of the blockchain industry.

Before making any investment decisions, it's essential to carefully assess your risk tolerance. The blockchain industry is still in its early stages, and many projects are experimental and unproven. Be prepared for the possibility of losing a significant portion of your investment. Only invest what you can afford to lose without impacting your financial stability. Diversification is key to mitigating risk, but it's not a guarantee of success. Consider your investment time horizon as well. Blockchain investments may require a longer-term perspective to realize their full potential.

Equally important is to secure your digital assets properly. Use strong, unique passwords and enable two-factor authentication wherever possible. Store your cryptocurrencies in secure wallets, either hardware wallets (physical devices that store your private keys offline) or reputable software wallets. Be wary of phishing scams and other attempts to steal your private keys. Never share your private keys with anyone.

Staying informed about regulatory developments in the blockchain space is critical. Regulations can significantly impact the value of cryptocurrencies and the viability of blockchain projects. Keep abreast of changes in regulations in your jurisdiction and globally. Understand how these regulations might affect your investments and adjust your strategy accordingly.

Finally, remember that investing in blockchain is a marathon, not a sprint. The industry is constantly evolving, and new technologies and projects are emerging all the time. Continuously educate yourself, adapt your strategy as needed, and be patient. Avoid making impulsive decisions based on hype or fear. Do your own research and seek advice from qualified financial professionals before making any investment decisions. Building a long-term investment strategy based on sound principles and thorough due diligence is crucial for success in the blockchain space.