Okay, I understand. Here's an article addressing the question "How do nonprofits generate revenue, and what are their funding sources?" as if written by an investment/financial expert, delving into various methods and sources while avoiding overly structured lists and directive language like "firstly," or repeating the title.

Nonprofits, often driven by a profound mission to address social, environmental, or community needs, operate within a unique financial landscape. Their lifeblood is revenue, fueling their programs and enabling them to achieve their stated goals. Understanding the diverse ways these organizations generate income and the sources from which these funds originate is crucial for anyone seeking to support them, work within them, or even analyze their impact on the world. The picture is far more complex than just charitable donations, and a sophisticated understanding of their financial model reveals a nuanced world of strategy and resourcefulness.

One of the most recognizable avenues for nonprofit revenue generation is, of course, charitable giving. This encompasses a wide spectrum, from individual donations – often the bedrock of many smaller organizations – to major gifts from philanthropists and foundations. Individual giving can be encouraged through various strategies, including direct mail campaigns, online fundraising platforms, peer-to-peer fundraising events, and legacy giving programs (planned gifts through wills or trusts). Effective fundraising hinges on building strong relationships with donors, articulating the organization's impact persuasively, and demonstrating financial transparency.

Foundation grants represent a significant funding source for many nonprofits. These grants, awarded by private or corporate foundations, are typically earmarked for specific projects or programs aligning with the foundation's mission. Securing foundation funding is a competitive process, requiring meticulously crafted proposals that showcase the organization's capacity, the project's potential impact, and a clear plan for evaluation and reporting. The relationships built with foundation program officers are also key to ongoing support.

Beyond donations and grants, many nonprofits are increasingly exploring earned revenue strategies. These involve generating income through the sale of goods or services directly related to their mission. For example, a museum might generate revenue through ticket sales, membership fees, and gift shop sales. An environmental organization could offer consulting services to businesses seeking to improve their sustainability practices. An arts organization might sell artwork created by program participants. This approach not only diversifies revenue streams but also allows nonprofits to become more financially self-sufficient and less reliant on unpredictable philanthropic funding. However, the challenge lies in balancing the pursuit of earned revenue with the organization's core mission and ensuring that commercial activities do not compromise its nonprofit status.

Government funding, in the form of grants and contracts, is another significant source of revenue for some nonprofits, particularly those providing essential social services. These funds may be awarded at the federal, state, or local level and are often tied to specific performance metrics. Securing government funding requires navigating complex application processes and complying with stringent reporting requirements. Furthermore, government funding can be subject to political fluctuations and budget cuts, making it a less reliable source of revenue compared to diversified streams.

In-kind donations, while not directly contributing to monetary revenue, represent a valuable form of resource acquisition for many nonprofits. These donations can include goods, services, or facilities that reduce operating expenses and free up financial resources for other priorities. For instance, a law firm might provide pro bono legal services, a construction company might donate materials for a building project, or a local business might donate office supplies. Effectively managing in-kind donations requires a robust system for valuing and tracking these contributions, ensuring compliance with accounting standards and recognizing the donors appropriately.

Membership fees are a stable, recurring income stream for organizations that offer direct benefits and engagement opportunities to their members. These could be professional associations, environmental advocacy groups, or arts organizations. Membership models create a sense of community and shared purpose, encouraging members to actively support the organization's mission.

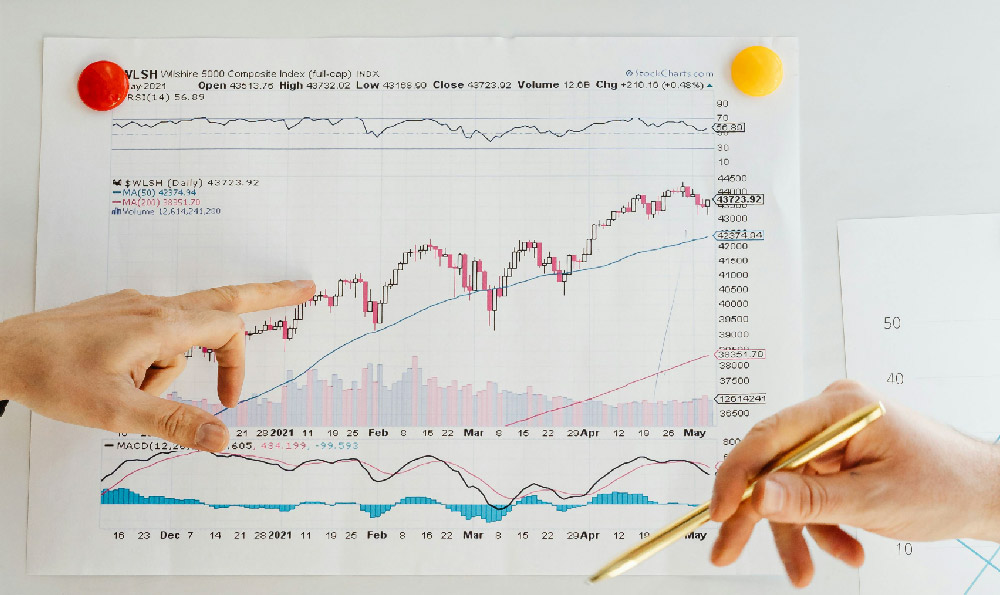

Investment income, derived from endowments or other investment portfolios, can supplement a nonprofit's revenue. Prudent investment management is essential to ensure that these funds are preserved and grown over time, providing a long-term source of support. Nonprofits typically adopt a conservative investment strategy, balancing the need for capital appreciation with the imperative to minimize risk. The specific asset allocation will depend on the organization's risk tolerance, time horizon, and financial goals. The performance of these investments is critical to the long-term sustainability of the organization, requiring careful oversight and strategic decision-making.

Another growing area is social enterprise ventures, where nonprofits create businesses whose primary purpose is to address a social or environmental problem while generating revenue to support their mission. This model requires a strong entrepreneurial spirit and a careful consideration of the potential risks and rewards.

Finally, it is essential to acknowledge the role of volunteers. While they don't provide direct financial revenue, the value of their time and expertise is substantial. Many nonprofits rely heavily on volunteer support to deliver their programs and services, reducing labor costs and expanding their reach. Effectively managing and engaging volunteers requires a dedicated infrastructure and a clear understanding of their skills and motivations.

In conclusion, the revenue generation strategies employed by nonprofits are diverse and multifaceted. A financially healthy nonprofit typically relies on a combination of funding sources, strategically balancing earned revenue, philanthropic support, and government funding. The most effective approach depends on the organization's mission, target audience, and operating environment. Furthermore, sound financial management, transparent reporting, and a commitment to accountability are essential for building trust with donors, funders, and the community at large, ultimately ensuring the organization's long-term sustainability and impact.