Retirement. The very word conjures images of serene beaches, leisurely strolls, and perhaps finally tackling that long-abandoned hobby. But behind this idyllic vision lies a crucial question: How much can your retirement savings realistically earn, and what level of income can you truly expect to sustain your desired lifestyle? The answer, of course, isn't a simple one. It depends on a complex interplay of factors, including your current savings, investment choices, time horizon, and even your tolerance for risk.

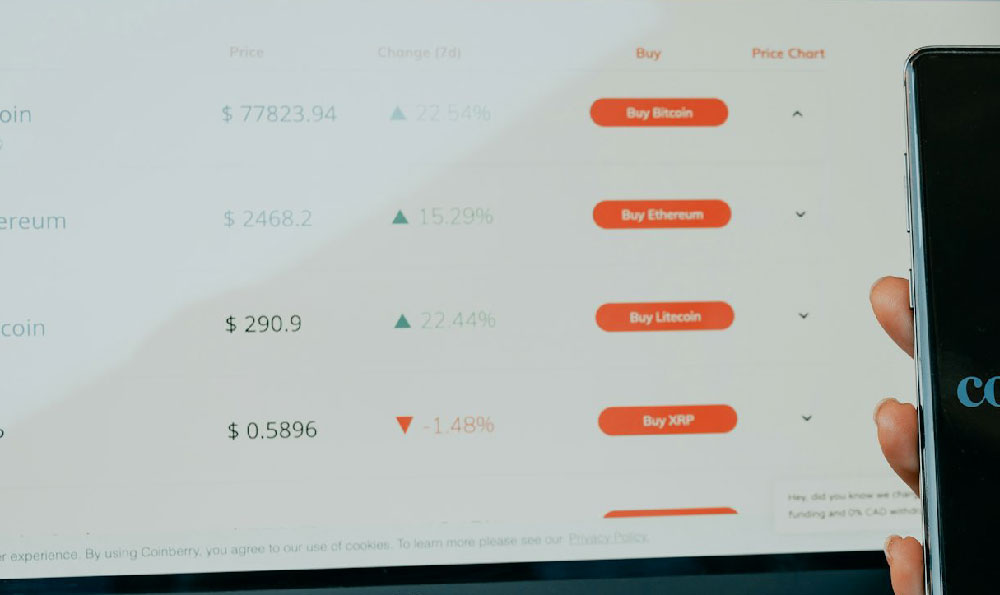

Understanding the potential earnings from your retirement savings requires a grounded perspective on investment returns. The historical performance of various asset classes provides a valuable framework, but it's crucial to remember that past performance is not indicative of future results. Equities (stocks), for example, have historically offered higher average returns than bonds, but they also come with greater volatility. Bonds, on the other hand, tend to be more stable but offer lower potential growth. A balanced portfolio, typically a mix of stocks and bonds, aims to provide a reasonable combination of growth and stability.

So, what kind of return can you realistically expect? Many financial professionals suggest using a long-term average return of around 5-7% for a diversified portfolio. This figure already accounts for inflation, representing a real return. However, this is just an average. In some years, your portfolio might experience significantly higher returns, while in others, it might suffer losses. The key is to stay disciplined and maintain a long-term perspective, avoiding the temptation to make rash decisions based on short-term market fluctuations.

Beyond the average return, several other factors significantly influence the income your retirement savings will generate. The amount you've already saved is paramount. The larger your initial principal, the more potential there is for it to grow through compounding interest. Compounding is the process of earning returns not only on your initial investment but also on the accumulated interest or gains. Over time, compounding can dramatically accelerate the growth of your retirement savings.

The time horizon until retirement also plays a crucial role. The longer you have until retirement, the more time your investments have to grow and compound. This is why starting early is so important. Even small contributions made consistently over many years can accumulate into a substantial sum due to the power of compounding. Furthermore, a longer time horizon allows you to take on more risk, potentially allocating a larger portion of your portfolio to equities for higher growth potential.

Your investment choices are, of course, critical. Selecting the right asset allocation strategy based on your risk tolerance and time horizon is essential. If you're comfortable with more risk, you might choose a portfolio with a higher allocation to stocks. If you're more risk-averse, you might prefer a portfolio with a larger allocation to bonds. Diversification is also key. Spreading your investments across different asset classes, industries, and geographic regions can help to reduce risk and improve overall returns.

Furthermore, the fees associated with your investments can significantly impact your returns. High fees can eat into your profits and reduce the amount of income you have available in retirement. Therefore, it's crucial to be aware of the fees you're paying and to choose investments with reasonable expense ratios. Consider low-cost index funds or exchange-traded funds (ETFs), which typically have lower fees than actively managed funds.

Projecting your retirement income requires careful planning and realistic assumptions. A common rule of thumb is the 4% rule, which suggests that you can safely withdraw 4% of your retirement savings each year without depleting your principal. However, this rule is not a guarantee, and it's important to consider your individual circumstances and needs. Factors such as your desired lifestyle, anticipated healthcare costs, and other sources of income (such as Social Security) should be taken into account.

Social Security benefits can provide a significant source of income for many retirees. However, it's important to understand how Social Security works and to plan accordingly. The amount of your Social Security benefit depends on your earnings history and the age at which you begin claiming benefits. Claiming benefits earlier will result in a lower monthly payment, while delaying benefits until age 70 will result in a higher payment.

Beyond Social Security, other sources of income may also be available in retirement. These could include pensions, part-time work, or rental income. It's important to factor in all sources of income when projecting your retirement income.

Ultimately, determining how much your retirement savings can earn and the income that awaits you is a personalized process. It requires careful planning, realistic assumptions, and a disciplined approach to investing. Consulting with a financial advisor can be invaluable in developing a comprehensive retirement plan that meets your specific needs and goals. A financial advisor can help you assess your risk tolerance, develop an appropriate asset allocation strategy, and project your retirement income based on various scenarios. They can also provide ongoing guidance and support to help you stay on track and make informed decisions throughout your retirement journey. Remember, a secure and comfortable retirement is within reach with careful planning and a proactive approach to managing your finances. Don't delay – start planning for your future today!