Klarna has established itself as a prominent player in the buy-now, pay-later (BNPL) sector, leveraging a unique combination of financial innovation and consumer behavior trends to create a sustainable revenue model. At its core, Klarna generates income through a structured approach that balances the interests of merchants, consumers, and financial institutions. The company operates by offering flexible payment solutions that allow customers to defer payments for goods and services, typically without requiring a traditional credit check. This model is not only attractive to consumers seeking alternative financing options but also beneficial for merchants looking to increase sales and reduce cart abandonment. The revenue generation process is multifaceted, involving transaction fees, interest charges, and additional services that cater to both parties in the transaction ecosystem.

One of the primary mechanisms through which Klarna earns revenue is by charging merchants a percentage fee for processing transactions. When a customer selects a BNPL option during online shopping, the purchase is split into installments, and the merchant pays Klarna a fee for facilitating this arrangement. This fee structure is designed to compensate Klarna for the risk of default, the costs of managing the payment process, and the value provided in terms of consumer convenience. However, Klarna’s revenue model extends beyond these transactional fees. The company also generates income by charging interest on late payments, which are typically calculated based on the number of days a customer delays their payment. This interest can be optional or mandatory, depending on the specific payment plan chosen, and it represents a significant portion of Klarna’s overall earnings, especially as consumer demand for deferred payments grows during economic uncertainties. Furthermore, Klarna has introduced a range of additional financial services, such as early payment options and premium subscription models, which allow customers to pay for their purchase in full upfront or access exclusive benefits for a recurring fee. These services not only diversify Klarna’s income streams but also enhance customer retention and deepen engagement with the platform.

In contrast to traditional credit card companies, Klarna’s payment methods are often structured in a way that minimizes the financial burden on consumers while maximizing profitability for the company. One of the most common payment methods is the "split payment" option, where the customer is asked to pay a portion of the total cost immediately and the remaining amount in installments. This method reduces the risk of full default by ensuring that a portion of the payment is received upfront, while still providing flexibility for the rest. Another widely popular approach is the "interest-free installment plan," which allows customers to pay the full amount in equal monthly installments without incurring interest, provided they adhere to the payment schedule. If a customer misses a payment, Klarna may impose interest charges, which serve as a contingency mechanism to cover the risk of non-payment. Additionally, Klarna offers "pay in 4" or similar plans that provide short-term deferral options with minimal financial impact, appealing to budget-conscious consumers who prefer small, manageable payments. These varied payment methods not only cater to different consumer preferences but also allow Klarna to adapt to market conditions, ensuring a steady income flow regardless of economic fluctuations.

Beyond direct transactional fees and interest charges, Klarna’s revenue model is supported by a robust ecosystem that includes partnerships with financial institutions and technology-driven services. The company collaborates with banks and other financial entities to provide installment plans, which are often tied to broader financial products such as loans or credit lines. These partnerships enable Klarna to offer a wide range of payment options, including those with varying interest rates and repayment terms, while also ensuring compliance with financial regulations. Additionally, Klarna generates revenue through its licensing agreements with e-commerce platforms, allowing the company to access a larger customer base and expand its operational reach. The integration of Klarna’s services into platforms like Amazon, Shopify, and Walmart not only increases transaction volume but also enhances the company's ability to innovate and respond to market demands.

Another key aspect of Klarna’s business model is its ability to monetize customer data and behavior patterns. By analyzing transaction data, Klarna can develop targeted marketing strategies, identify high-value customers, and refine its credit risk assessment models. This data-driven approach enables the company to optimize its pricing strategies, tailor payment plans to specific segments of the market, and maintain a competitive edge in the BNPL industry. Moreover, Klarna has expanded its services into new markets and industries beyond e-commerce, including travel, education, and even personal finance, further diversifying its revenue streams.

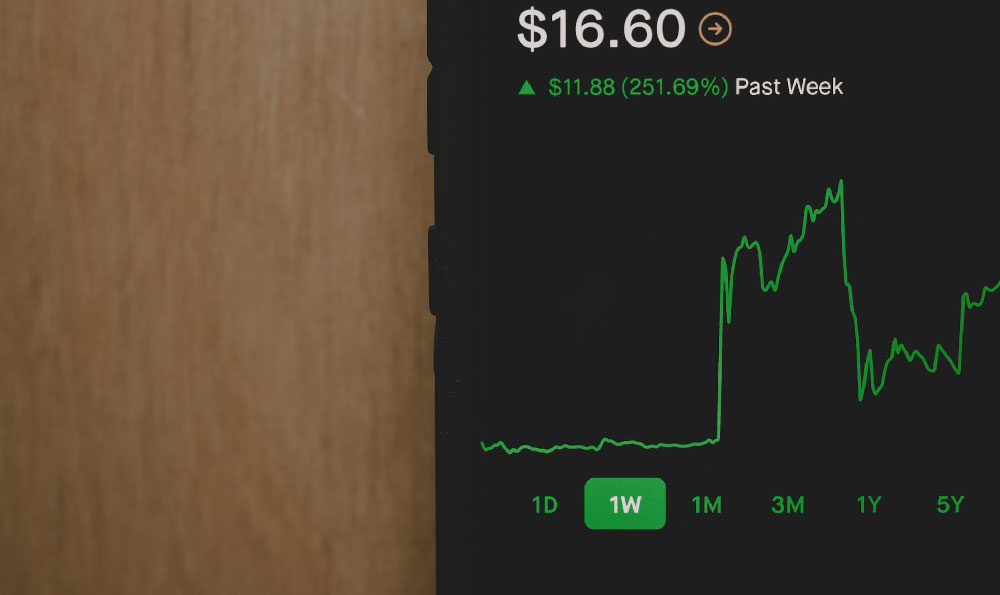

Klarna’s ability to adapt and innovate has been instrumental in its success, but the company also faces several challenges that could impact its long-term profitability. One of the most significant risks is the potential for increased default rates, particularly as economic conditions worsen and consumers become more financially constrained. To mitigate this risk, Klarna employs sophisticated risk assessment algorithms that evaluate a customer’s payment behavior, credit history, and spending patterns to determine eligibility for different payment plans. This approach not only reduces the likelihood of default but also ensures that Klarna can maintain a healthy balance sheet.

Another challenge is the regulatory environment, which varies across different markets and can significantly impact Klarna’s operations. In some regions, BNPL services are subject to stricter regulations, such as requirements for interest disclosure or limitations on the number of installments a customer can access. Klarna has navigated these challenges by ensuring compliance with local regulations while also advocating for the expansion of BNPL services as a legitimate form of financial inclusion. The company’s ability to adapt to regulatory changes is a critical factor in its ongoing success and sustainability.

Finally, the competitive landscape in the BNPL sector continues to evolve, with new entrants and existing competitors vying for market share. To maintain its position as a leading financial services provider, Klarna has invested heavily in technology, customer experience, and strategic partnerships. The company’s mobile application, for example, offers a seamless user experience, allowing customers to manage their payments, track their credit score, and access exclusive promotions. These innovations not only enhance customer satisfaction but also contribute to Klarna’s ability to retain users and generate consistent revenue. As the BNPL market continues to grow, Klarna’s ability to balance profitability with consumer value will be crucial in determining its long-term success.