Okay, I understand. Here's an article addressing the question of how holding companies generate revenue and their profit models, written in an informative and comprehensive style, avoiding numbered lists or sequential transition words and focusing on depth of explanation.

``` Holding companies, by their very nature, exist to control other companies. Unlike operating businesses that directly produce goods or services, a holding company’s primary function is to own a controlling interest in the stock of other companies, known as subsidiaries. The ways in which these entities derive revenue and ultimately turn a profit are diverse, and often intricately linked to the performance and activities of those underlying subsidiaries.

The most straightforward revenue stream for a holding company is through dividends. Subsidiaries, when profitable, may declare dividends to their shareholders, including the holding company. The amount received is directly proportional to the holding company's ownership stake. A 100% ownership would translate into the holding company receiving all declared dividends, while a smaller percentage would yield a correspondingly reduced portion. The regularity and size of these dividend payments are contingent upon the subsidiary's financial health, profitability, and internal capital allocation policies. A mature, stable subsidiary generating consistent profits is far more likely to provide a steady dividend income than a rapidly growing startup reinvesting all earnings back into the business.

Beyond dividends, management fees represent another significant source of revenue. Holding companies often provide strategic guidance, operational expertise, and administrative support to their subsidiaries. This assistance could range from financial planning and legal counsel to marketing strategies and human resource management. In exchange for these services, the holding company charges a management fee, typically calculated as a percentage of the subsidiary's revenue, assets, or profits. This arrangement allows the holding company to leverage its expertise across multiple businesses, generating a consistent income stream regardless of individual subsidiary performance fluctuations, provided the subsidiaries as a whole remain viable. The fees are structured to be mutually beneficial: providing essential services to the subsidiaries while ensuring the holding company's financial stability.

Furthermore, royalties and licensing fees can contribute substantially to a holding company’s income. If the holding company owns valuable intellectual property – patents, trademarks, copyrights, or proprietary technology – it can license these assets to its subsidiaries. The subsidiaries, in turn, pay royalties to the holding company for the right to use this IP in their operations. This model is particularly prevalent in industries where intellectual property is a core component of competitive advantage, such as pharmaceuticals, technology, and consumer goods. The royalty rates are negotiated based on the value of the IP, the scope of its usage, and the expected revenue generated by the subsidiary through its application. This arrangement allows the holding company to monetize its intangible assets across its portfolio of businesses.

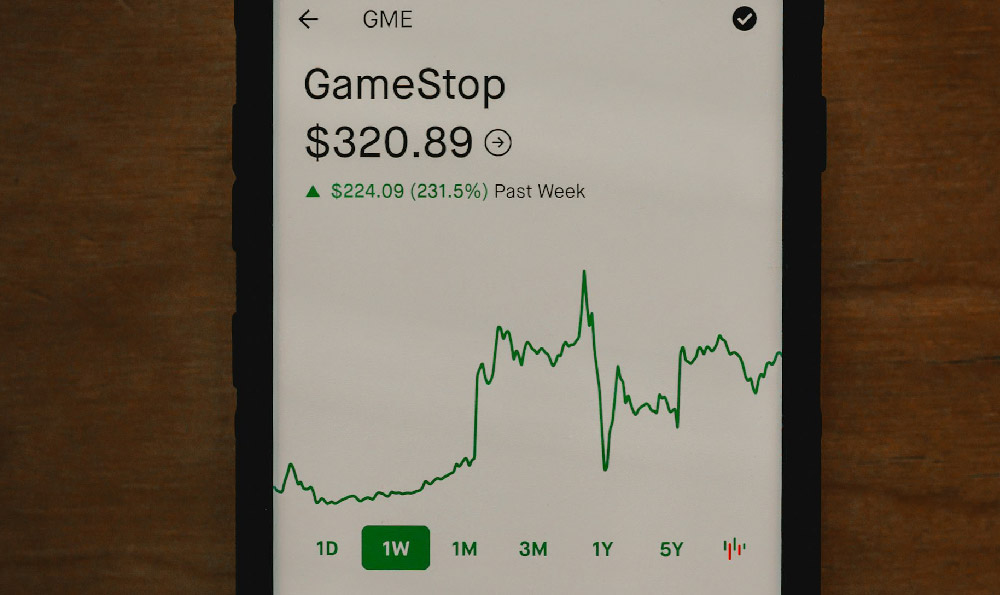

Capital gains represent a less frequent but potentially significant revenue source. Holding companies may strategically buy and sell subsidiaries to optimize their portfolio. If a subsidiary is sold for a price exceeding its initial purchase cost (or its carrying value on the holding company's books), the holding company realizes a capital gain. These gains can be substantial, especially if the subsidiary has experienced significant growth and appreciation under the holding company's ownership. However, capital gains are not a consistent or predictable source of income, as they depend on market conditions, strategic divestment decisions, and the overall performance of the subsidiary. This form of revenue generation often reflects a long-term strategic vision and a deep understanding of market dynamics.

Looking at profit models, understanding that they are intertwined with the revenue generation strategies, we see several dominant approaches. One common model revolves around cost arbitrage and synergy. Holding companies often centralize certain functions, such as accounting, IT, and legal services, across their subsidiaries to achieve economies of scale and reduce overall costs. By leveraging their collective bargaining power, they can negotiate better deals with suppliers and vendors. This centralized approach translates into lower operating expenses for the subsidiaries and increased profitability for the holding company as a whole.

Another prevalent profit model focuses on value creation through strategic guidance and operational improvements. The holding company’s management team, possessing a broad view of the industry and market trends, can provide valuable insights and strategic direction to its subsidiaries. They might identify opportunities for growth, expansion, or diversification, or suggest improvements to operational efficiency and profitability. By actively engaging with their subsidiaries and providing expert guidance, the holding company can drive significant value creation and enhance the overall performance of its portfolio.

Furthermore, some holding companies adopt a private equity-style approach, actively acquiring underperforming businesses, implementing turnaround strategies, and then selling them for a profit after improving their operations and financial performance. This model requires a high degree of expertise in identifying undervalued assets, executing operational improvements, and managing the exit process. The holding company essentially acts as an active investor, seeking to maximize the return on its investment through strategic management and value creation.

Finally, it's important to recognize that many holding companies utilize a hybrid approach, combining elements of several different models. They might generate revenue through a combination of dividends, management fees, and royalties, while simultaneously pursuing strategic acquisitions and divestments to optimize their portfolio. The specific profit model adopted will depend on the holding company's overall strategy, the industry in which it operates, and the characteristics of its subsidiaries.

In conclusion, holding companies generate revenue and profit through a variety of mechanisms directly related to the management and control of their subsidiaries. These mechanisms range from passive income streams like dividends to active strategies like providing centralized services, licensing intellectual property, and strategically acquiring and selling businesses. The success of a holding company hinges on its ability to effectively manage its portfolio of subsidiaries, generate consistent revenue streams, and create value through strategic guidance and operational improvements, ultimately resulting in sustained profitability. ```