Hedge funds occupy a somewhat mysterious corner of the investment world, often perceived as exclusive and high-risk, yet also capable of generating impressive returns. Understanding their nature, function, and accessibility is crucial for any investor considering diversifying their portfolio.

Essentially, a hedge fund is a privately managed investment pool that employs a wide array of complex and often unconventional strategies to generate returns. Unlike traditional mutual funds, which typically focus on long-only investments in stocks and bonds, hedge funds have the freedom to invest in virtually any asset class and utilize techniques like short selling, leverage, arbitrage, and derivatives to profit from both rising and falling markets. This flexibility allows them to potentially generate positive returns even in periods of market downturn, which is often their main selling point.

The “hedge” in hedge fund refers to the initial goal of many of these funds: to hedge, or protect, against market risk. The original hedge funds aimed to achieve absolute returns, meaning they sought to generate positive returns regardless of the overall market performance. While many funds still strive for this objective, the industry has evolved significantly, and the strategies employed today are far more diverse and, in some cases, far riskier than their initial counterparts.

The operational model of hedge funds is distinct from typical investment vehicles. They are usually structured as limited partnerships, meaning that investors become limited partners, contributing capital to the fund, while the fund manager, or general partner, makes all the investment decisions. Hedge fund managers typically charge a performance-based fee, often referred to as the "2 and 20" model, meaning they charge 2% of the fund's assets under management as a management fee and 20% of any profits generated above a certain benchmark. This fee structure incentivizes fund managers to generate high returns, but it also means that investors pay a significant price for their expertise.

The strategies employed by hedge funds are extremely varied and complex. Some common approaches include:

-

Equity Long/Short: This involves taking long positions in stocks expected to increase in value and short positions in stocks expected to decrease. The aim is to profit from both positive and negative market movements.

-

Event-Driven Investing: This strategy focuses on profiting from corporate events such as mergers, acquisitions, bankruptcies, and restructurings.

-

Fixed Income Arbitrage: This involves exploiting price discrepancies in fixed-income securities, such as government bonds, corporate bonds, and mortgage-backed securities.

-

Global Macro: This strategy involves taking positions based on macroeconomic trends and events, such as interest rate changes, currency fluctuations, and political developments.

-

Relative Value: This strategy seeks to profit from the mispricing of related securities.

Given the complexity and risk associated with hedge fund investments, they are generally restricted to accredited investors, who are considered to be financially sophisticated and able to bear the potential losses. The specific requirements for accreditation vary depending on the jurisdiction, but typically involve meeting certain income or net worth thresholds. This regulatory restriction is in place because of the inherent risks associated with these investments, which may not be suitable for less experienced or less affluent investors.

So, how can one invest in hedge funds? Traditionally, access to hedge funds was limited to institutional investors and high-net-worth individuals due to the regulatory requirements and the high minimum investment amounts, often running into hundreds of thousands or even millions of dollars. However, the investment landscape is evolving.

Several avenues exist for accessing hedge fund-like strategies:

-

Funds of Funds: These are investment vehicles that invest in a portfolio of hedge funds. This offers diversification across multiple strategies and managers but also adds another layer of fees.

-

Managed Accounts: This involves a direct relationship with a hedge fund manager who manages a separate account on behalf of the investor. This allows for greater control and customization but typically requires a substantial investment.

-

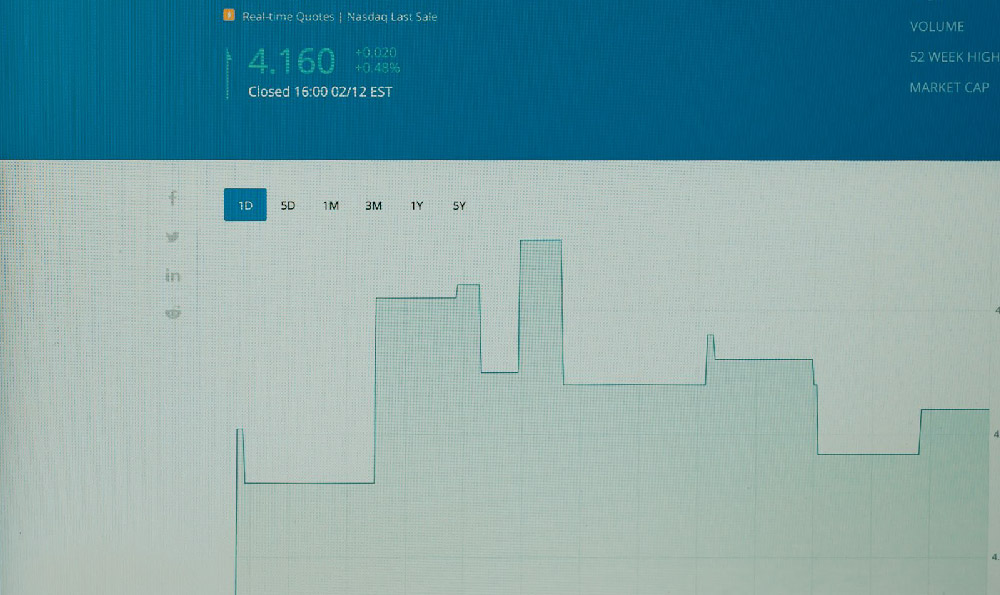

Liquid Alternative Mutual Funds (or ETFs): These are publicly traded mutual funds or exchange-traded funds that employ hedge fund-like strategies but within the regulatory framework of traditional investment funds. They offer lower minimum investment amounts and greater liquidity but may not fully replicate the performance of hedge funds due to regulatory constraints.

-

Platforms Offering Fractional Ownership: Some online platforms are emerging that allow smaller investors to access hedge fund strategies through fractional ownership. While still a relatively new development, these platforms can lower the barrier to entry.

Before investing in any hedge fund or hedge fund-like product, it is essential to conduct thorough due diligence. This involves evaluating the fund manager's track record, investment strategy, risk management processes, and fee structure. It is also important to understand the fund's liquidity terms, which may restrict the ability to withdraw funds. Furthermore, consult with a qualified financial advisor to determine if hedge fund investments are appropriate for your individual circumstances and risk tolerance.

Investing in hedge funds is not a guaranteed path to wealth. They are complex and risky investments that require a high degree of understanding and careful consideration. However, for sophisticated investors who are able to meet the eligibility requirements and are willing to accept the risks, hedge funds can offer the potential for higher returns and portfolio diversification. The key is to approach these investments with caution, conduct thorough research, and seek professional advice before committing any capital.