The allure of cryptocurrency investment is undeniable. The potential for rapid wealth accumulation, coupled with the innovative and decentralized nature of the technology, has drawn in millions. However, the path to cryptocurrency riches is fraught with peril. Blindly chasing gains can easily lead to devastating losses. The key lies in understanding the delicate balance between calculated risk and reckless speculation. This exploration will delve into the crucial considerations for navigating the cryptocurrency landscape, offering a framework for achieving financial success while mitigating the inherent risks.

Understanding the Underlying Technology and Market Dynamics

Before even contemplating an investment, a comprehensive understanding of blockchain technology and the specific cryptocurrency is paramount. Bitcoin, Ethereum, and countless altcoins operate on distinct principles and serve different purposes. Investing without grasping these fundamental differences is akin to gambling.

Begin by thoroughly researching the whitepaper of the cryptocurrency you're considering. Understand the project's goals, the technology behind it, the team developing it, and the community supporting it. Assess the tokenomics – the distribution of tokens, the supply cap, and the mechanisms for incentivizing participation. This due diligence will help you differentiate between promising projects and potential scams.

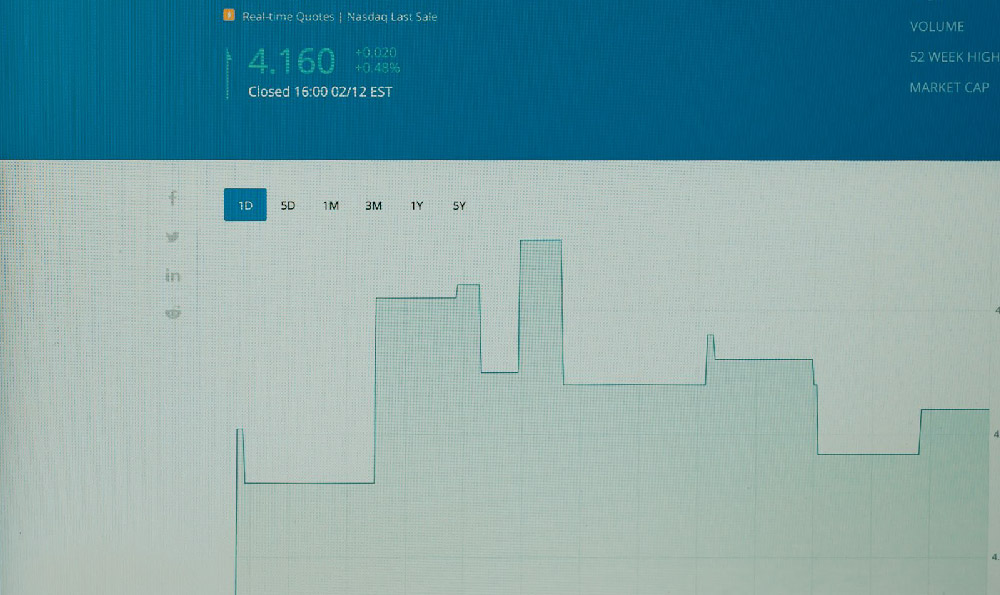

Furthermore, analyzing market dynamics is critical. Cryptocurrency markets are notoriously volatile, driven by factors such as regulatory news, technological advancements, social media sentiment, and overall market trends. Familiarize yourself with technical analysis tools, such as chart patterns, moving averages, and relative strength index (RSI), to identify potential entry and exit points. However, remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Crafting a Robust Investment Strategy

Once you've gained a solid understanding of the technology and market, developing a well-defined investment strategy is essential. This strategy should outline your investment goals, risk tolerance, and investment timeline.

-

Define Your Investment Goals: What are you hoping to achieve through cryptocurrency investment? Are you seeking long-term capital appreciation, passive income through staking, or short-term profits through trading? Clearly defining your goals will help you tailor your investment approach.

-

Assess Your Risk Tolerance: Cryptocurrency investment carries significant risk. Are you comfortable with the possibility of losing a significant portion of your investment? Your risk tolerance should dictate the amount of capital you allocate to cryptocurrency and the types of assets you invest in. If you are risk-averse, consider allocating a smaller percentage of your portfolio to cryptocurrency and focusing on more established coins like Bitcoin and Ethereum.

-

Establish an Investment Timeline: Are you planning to hold your cryptocurrencies for months, years, or even decades? Your investment timeline will influence your investment strategy. Long-term investors may be more willing to weather market volatility, while short-term traders may focus on capturing smaller profits.

-

Diversification is Key: Never put all your eggs in one basket. Diversify your cryptocurrency portfolio by investing in a variety of assets across different sectors and market caps. This will help mitigate the risk of a single investment significantly impacting your overall portfolio.

Risk Management: Protecting Your Capital

Effective risk management is the cornerstone of successful cryptocurrency investment. It involves implementing strategies to minimize potential losses and protect your capital.

-

Set Stop-Loss Orders: A stop-loss order is an instruction to automatically sell your cryptocurrency if it reaches a certain price. This helps limit your potential losses if the market moves against you.

-

Take Profits Regularly: Don't let greed cloud your judgment. When your investments appreciate in value, take profits regularly to secure your gains. This will prevent you from losing your profits if the market retraces.

-

Beware of Scams and Ponzi Schemes: The cryptocurrency space is rife with scams and Ponzi schemes promising unrealistic returns. Be wary of projects that guarantee high profits with little or no risk. Always conduct thorough research and be skeptical of anything that sounds too good to be true.

-

Secure Your Cryptocurrency: Store your cryptocurrency in a secure wallet that you control. Consider using a hardware wallet for added security. Never share your private keys with anyone. Enable two-factor authentication (2FA) on all your cryptocurrency accounts.

Avoiding Common Pitfalls

Many newcomers to the cryptocurrency market fall prey to common pitfalls that can lead to significant losses. Being aware of these pitfalls can help you avoid them.

-

FOMO (Fear of Missing Out): Don't invest in a cryptocurrency simply because everyone else is doing it. FOMO can lead to impulsive decisions and buying at the top of the market.

-

Chasing Pumps and Dumps: Avoid trying to time the market by buying into pumps and selling before dumps. This is a risky strategy that is difficult to execute successfully.

-

Emotional Trading: Don't let your emotions influence your trading decisions. Stick to your investment strategy and avoid making impulsive trades based on fear or greed.

-

Ignoring Regulatory Changes: Stay informed about regulatory changes in the cryptocurrency space. Regulatory uncertainty can significantly impact the market.

The Importance of Continuous Learning

The cryptocurrency landscape is constantly evolving. New technologies, regulations, and market trends emerge regularly. Continuous learning is essential for staying ahead of the curve and making informed investment decisions.

-

Follow Reputable News Sources: Stay up-to-date on cryptocurrency news and analysis from reputable sources.

-

Join Online Communities: Engage with other cryptocurrency investors in online communities. Share your knowledge and learn from others.

-

Attend Conferences and Workshops: Attend cryptocurrency conferences and workshops to learn from industry experts.

When to Get Rich?

There's no guaranteed formula for getting rich in cryptocurrency. However, by following the principles outlined above, you can significantly increase your chances of success. Patience, discipline, and a willingness to learn are crucial for navigating the volatile cryptocurrency market and achieving your financial goals. Focus on building a diversified portfolio of promising projects, managing your risk effectively, and staying informed about the latest developments in the industry.

How to Die Trying?

Dying trying in the cryptocurrency space means neglecting risk management, succumbing to FOMO, and chasing unrealistic returns. It means investing more than you can afford to lose and making impulsive decisions based on emotions. It means failing to learn from your mistakes and ignoring the warning signs of scams and Ponzi schemes. By avoiding these pitfalls, you can protect your capital and increase your chances of long-term success in the cryptocurrency market. The journey to financial independence through cryptocurrency investment requires a cautious and informed approach. It's not about getting rich quick; it's about building wealth strategically and responsibly.