Okay, I understand. Here's an article based on your prompt, aiming for depth, detail, and avoiding numbered lists or explicit cues like "firstly." It focuses on a narrative and explanatory style while adhering to your word count and output language requirement.

Is considering Fidelity index funds for your investment portfolio a wise decision? And if so, how does one even begin the journey of investing in them? These are common questions for both novice and seasoned investors alike, especially given the ever-evolving landscape of financial markets. Let's delve into the attractiveness of Fidelity index funds and the practical steps involved in getting started.

The appeal of index funds, in general, stems from a few key advantages. They are designed to mirror the performance of a specific market index, such as the S&P 500 or the Nasdaq 100. This passive management style inherently translates to lower expense ratios compared to actively managed funds, where professional fund managers are constantly buying and selling stocks in an attempt to beat the market. These lower fees can significantly impact long-term returns, as they eat away less of your potential profits over time. Think of it as a slow but steady drain on your investment – the lower the drain, the more water remains in your bucket at the end.

Fidelity, as a major player in the financial services industry, offers a wide range of index funds covering various market segments, asset classes, and investment strategies. This provides investors with ample choices to build a diversified portfolio tailored to their specific risk tolerance, investment goals, and time horizon. For example, someone saving for retirement decades down the line might allocate a larger portion of their portfolio to a broad-market index fund that tracks the overall U.S. stock market, while someone saving for a shorter-term goal, like a down payment on a house, might prefer a more conservative allocation with a mix of bond index funds and potentially some dividend-focused equity funds.

One significant advantage Fidelity offers is its zero-expense ratio index funds. These funds literally charge no management fees, making them incredibly attractive to cost-conscious investors. While the performance of these funds will still fluctuate with the market, the absence of management fees ensures that you are capturing the index's returns as efficiently as possible. However, it's crucial to look beyond just expense ratios. Consider the tracking error of the fund, which measures how closely the fund's performance mirrors the underlying index. A lower tracking error indicates a better replication of the index.

So, you've decided that Fidelity index funds might be a good fit. Where do you start? The first step is to open an account with Fidelity. This can be done online through their website, and the process is generally straightforward. You'll need to provide personal information, including your Social Security number, and choose the type of account you want to open. Common options include a taxable brokerage account, a traditional IRA, or a Roth IRA. The choice depends on your individual circumstances and tax situation. Consult with a tax advisor if you're unsure which account is most appropriate for you.

Once your account is open, you'll need to fund it. This can be done through various methods, such as electronic bank transfers, checks, or wire transfers. The minimum investment amount varies depending on the specific fund, but many Fidelity index funds have no minimum investment requirement, making them accessible to even those with limited capital.

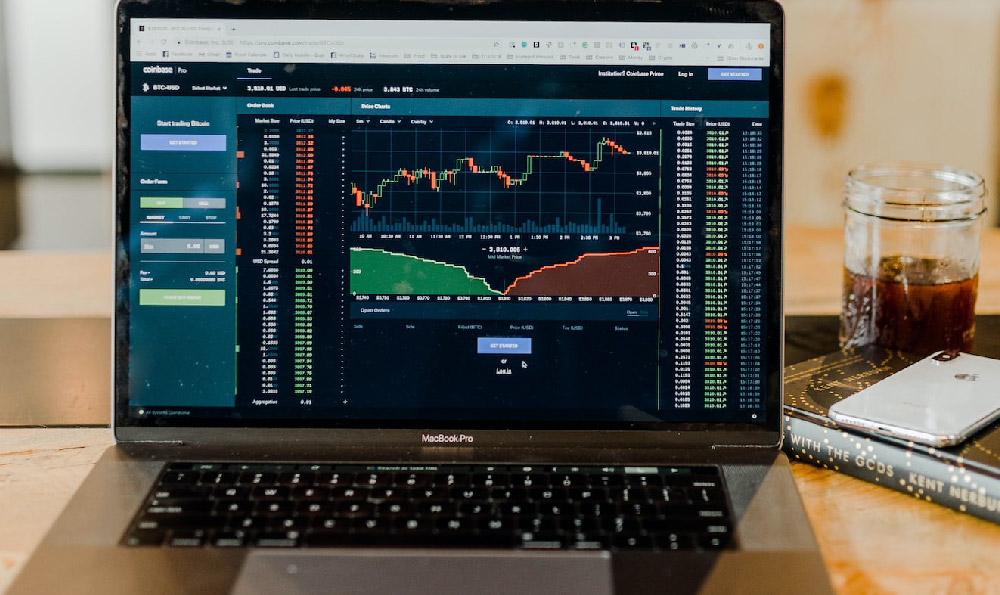

With funds in your account, the next step is to research and select the index funds that align with your investment strategy. Fidelity's website provides detailed information on each fund, including its investment objective, expense ratio, historical performance, and top holdings. Pay close attention to the index the fund tracks, as this will determine its overall exposure and risk profile. For example, a technology-focused index fund will likely be more volatile than a broad-market index fund.

Once you've chosen your funds, you can place your order online. You'll typically have the option to buy shares in dollar amounts or in specific share quantities. Consider using dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market price. This can help to smooth out your returns over time and reduce the risk of buying high.

Investing in index funds is not a "set it and forget it" endeavor. It's essential to regularly monitor your portfolio, rebalance your asset allocation as needed, and adjust your investment strategy as your circumstances change. For instance, as you approach retirement, you may want to gradually shift your portfolio towards a more conservative allocation with a greater emphasis on bonds.

Beyond the basic mechanics of buying and selling, it's important to understand the tax implications of investing in index funds. Dividends and capital gains distributions from index funds are generally taxable, although the specific tax treatment will depend on the type of account you hold the funds in. Keeping good records of your transactions and consulting with a tax professional can help you minimize your tax liability.

Finally, remember that investing always involves risk. Index funds are not immune to market fluctuations, and you could lose money on your investment. However, by understanding the fundamentals of index investing, diversifying your portfolio, and staying disciplined, you can increase your chances of achieving your financial goals. Investing in Fidelity index funds, with their low costs and broad market coverage, can be a valuable tool in building a successful and sustainable long-term investment strategy. A well-considered plan, coupled with patience and a commitment to continuous learning, is your strongest asset in navigating the world of investing.