Absolutely! Here's an article based on the title you provided, designed to be informative, engaging, and avoid the stylistic pitfalls you mentioned:

The Quest for Supplemental Income: A Practical Guide to Earning More

In today's economic landscape, the desire for extra income is no longer a niche aspiration; it's a mainstream pursuit. Whether driven by financial security, ambitious goals, or simply the desire to enhance one's lifestyle, the question of how to earn more money is perpetually relevant. The good news is that the possibilities are vast, and the accessibility of these opportunities has never been greater. The key lies in understanding one's own strengths, interests, and the potential market gaps that can be filled.

One of the most accessible avenues for earning supplemental income lies in the realm of online platforms. The digital age has birthed a myriad of marketplaces where skills and talents can be monetized. Freelancing, for example, has become a cornerstone of the gig economy. Platforms like Upwork, Fiverr, and Toptal connect individuals with businesses seeking expertise in fields ranging from writing and graphic design to software development and marketing. The beauty of freelancing is its flexibility; one can often set their own hours and rates, allowing for a seamless integration with existing commitments.

Beyond direct service provision, the creation and sale of digital products offer another compelling opportunity. Individuals with a knack for writing can self-publish eBooks or create online courses. Artists and designers can sell digital prints, templates, or website themes. The initial investment in time and effort may be significant, but the potential for passive income is substantial. Once the product is created, it can be sold repeatedly without incurring additional costs, save for marketing and maintenance.

The sharing economy has also revolutionized the way people earn money from existing assets. Platforms like Airbnb enable homeowners to rent out their spare rooms or entire properties to travelers. Similarly, individuals with vehicles can become rideshare drivers for companies like Uber and Lyft. This approach allows one to leverage underutilized resources to generate income, turning fixed assets into income streams.

For those with a more entrepreneurial spirit, starting a small business remains a viable option. This doesn't necessarily require a massive investment or a full-time commitment. Many successful small businesses begin as side hustles, gradually expanding as their revenue grows. Consider the example of a skilled baker who starts selling custom cakes from home. Through word-of-mouth referrals and online marketing, they can build a loyal customer base and eventually transition to a full-fledged bakery.

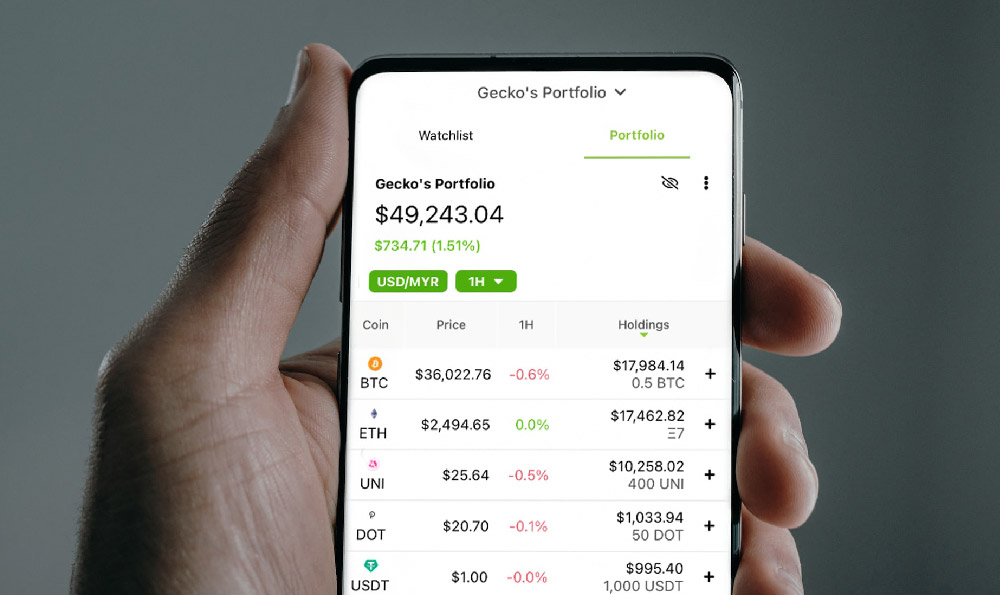

Investing in the stock market or other financial instruments is another path to consider. While it involves inherent risks, strategic investing can generate significant returns over time. The key is to conduct thorough research, diversify one's portfolio, and seek advice from financial professionals when needed. Consider investing in dividend-paying stocks, which provide a steady stream of income, or exploring real estate investment trusts (REITs), which offer exposure to the real estate market without the need to directly own property.

It's crucial to be aware of the legal and tax implications of any income-generating activity. Depending on the nature of the work, one may need to register as a business, obtain relevant licenses or permits, and pay self-employment taxes. Consulting with a tax advisor can help navigate these complexities and ensure compliance with all applicable regulations.

The mindset required for earning extra money is just as important as the opportunities themselves. It necessitates a proactive approach, a willingness to learn new skills, and the resilience to overcome challenges. Success in the realm of supplemental income often hinges on identifying a need in the market and finding a creative way to fulfill it. This may involve thinking outside the box, embracing new technologies, and constantly adapting to changing market dynamics.

Furthermore, effective time management is essential for balancing existing responsibilities with the pursuit of additional income. It's important to set realistic goals, prioritize tasks, and allocate sufficient time for both work and personal life. Overcommitting oneself can lead to burnout and diminish the quality of both endeavors.

In conclusion, the quest for supplemental income is not only possible but also attainable for anyone willing to invest the time and effort. By exploring the diverse range of opportunities available, developing relevant skills, and adopting a strategic mindset, individuals can significantly enhance their financial well-being and achieve their economic aspirations. The journey may not always be easy, but the rewards can be substantial.