Investing in anything, be it traditional stocks, real estate, or even emerging assets like virtual currencies, requires a degree of due diligence and understanding. DeepSeek Stock, if referring to the publicly traded stock of a technology company specializing in AI, data analytics, or related fields, warrants careful consideration before committing capital. Let’s delve into the potential for investment and the crucial aspects to consider before making a decision.

Before evaluating the investment potential, understanding DeepSeek as a company is paramount. What is their core business model? Do they generate revenue through software subscriptions, hardware sales, consulting services, or a combination? How profitable are they, and what is their revenue growth trajectory? Publicly traded companies have obligations to disclose financial information through quarterly and annual reports. These reports, often available on the company's website and through financial news outlets, offer a comprehensive look at the company's financial health. Examining the balance sheet, income statement, and cash flow statement can reveal crucial insights. For example, a high debt-to-equity ratio could indicate financial vulnerability, while consistently increasing revenue and profitability suggest strong growth potential.

Beyond the numbers, understanding the industry landscape is crucial. Is DeepSeek operating in a rapidly growing sector like artificial intelligence, or a more mature market with slower growth? Who are their primary competitors, and what are their relative market shares? Competitive advantages, such as proprietary technology, strong brand recognition, or a large customer base, can provide a significant edge. Consider the potential for disruption from new entrants or technological advancements. The technology sector is particularly susceptible to disruption, so it is vital to assess DeepSeek's ability to innovate and adapt to changing market conditions.

The leadership team also plays a significant role in a company's success. Do they have a proven track record of execution and strategic decision-making? What is their vision for the future of the company? News articles, interviews, and company announcements can offer insights into the leadership team's capabilities and their commitment to long-term growth. Employee reviews and industry reports can provide a glimpse into the company's culture and management style, which can indirectly affect performance.

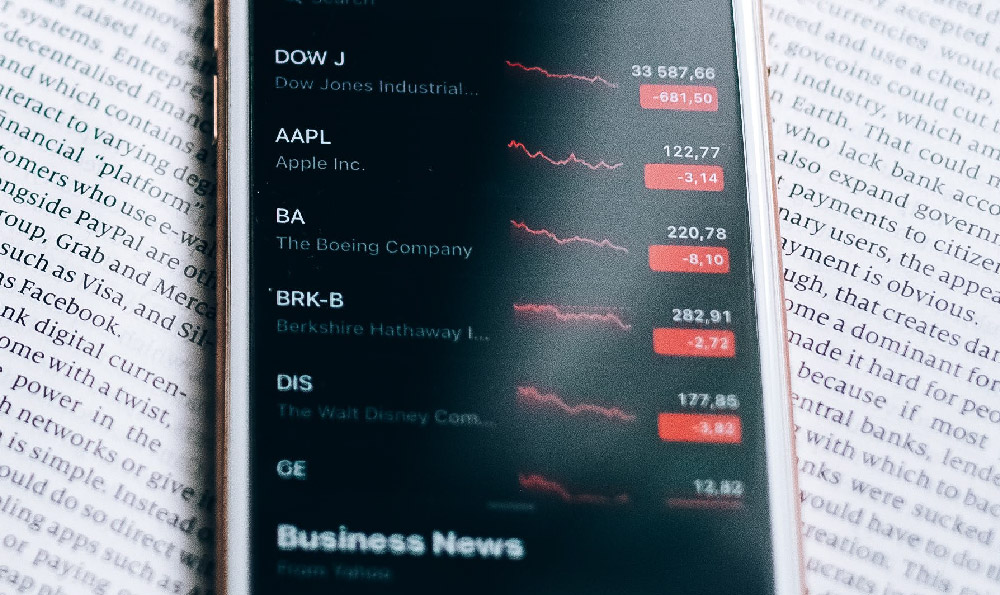

After researching the company and its industry, assessing the stock's valuation is essential. Is the stock currently overvalued, undervalued, or fairly priced? Several valuation metrics can help answer this question. The price-to-earnings (P/E) ratio compares the company's stock price to its earnings per share. A high P/E ratio may suggest that the stock is overvalued, while a low P/E ratio could indicate that it is undervalued. However, it is important to compare the P/E ratio to those of its peers and the overall market to get a more accurate assessment. The price-to-sales (P/S) ratio compares the company's stock price to its revenue per share. This metric can be useful for evaluating companies that are not yet profitable. Discounted cash flow (DCF) analysis involves projecting the company's future cash flows and discounting them back to their present value. This method requires more assumptions but can provide a more comprehensive valuation.

Having done your homework, you might consider investing, but how? Diversification is a cornerstone of sound investment strategy. Allocate only a portion of your overall investment portfolio to DeepSeek stock to mitigate risk. Don’t put all your eggs in one basket.

Several avenues exist for investing. You could purchase shares directly through a brokerage account. This offers the most control but requires active management. Exchange-Traded Funds (ETFs) focusing on technology or AI may include DeepSeek, offering diversification within the sector. Mutual funds are another option, where professional fund managers invest in a basket of stocks, potentially including DeepSeek. However, mutual funds typically come with higher fees.

Consider your investment horizon. Are you looking for short-term gains or long-term growth? This will influence your investment strategy. If you are investing for the long term, you may be more willing to ride out short-term market fluctuations.

Develop a risk management strategy. Determine your risk tolerance and set stop-loss orders to limit potential losses. Regularly review your investment portfolio and adjust your holdings as needed. The market and the company's performance are dynamic, so your investment strategy should be flexible.

Avoid common investment pitfalls. Don't chase hype or rely on rumors. Do your own research and make informed decisions. Be wary of penny stocks and companies with questionable financials. Avoid emotional investing, such as buying high and selling low. Stick to your investment plan and resist the urge to make impulsive decisions. Remember past performance is not indicative of future results.

Finally, be prepared for volatility. The stock market can be unpredictable, and even the best companies can experience periods of decline. Don't panic sell during market downturns. Stay disciplined and focus on the long-term fundamentals of the company. Investing is a marathon, not a sprint.