Okay, I understand. Here's an article responding to the title "CoinPro: High-Value Trade Alerts - Are They Real & Do They Work?", formatted as you requested, and exceeding 800 words:

``` The allure of effortless wealth creation through cryptocurrency trading is undeniable. The promise of receiving precise, high-value trade alerts that consistently generate profits has fueled the rise of numerous services like CoinPro. But beneath the slick marketing and claims of exceptional accuracy lies a complex reality that demands careful scrutiny. Before subscribing to any trade alert service, particularly in the volatile world of crypto, it's crucial to understand the underlying mechanisms, the potential pitfalls, and the factors that contribute to, or detract from, their effectiveness.

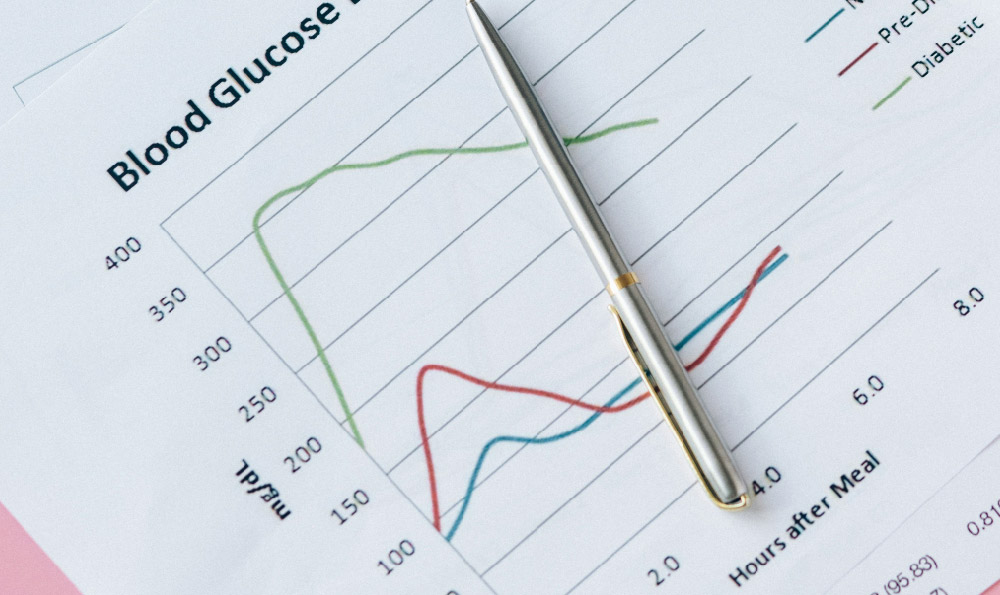

The fundamental concept behind these alert services is simple: experts or algorithms analyze market data, identify potentially profitable trading opportunities, and then disseminate this information to subscribers in the form of buy/sell recommendations. These alerts often include specific details, such as the cryptocurrency pair to trade, the entry price, the target price, and the stop-loss level. The appeal is obvious – individuals lacking the time, expertise, or inclination to conduct their own in-depth market research can theoretically benefit from the knowledge of others.

However, the efficacy of these services hinges on several critical variables, starting with the source of the alerts themselves. Are they generated by seasoned traders with a demonstrable track record of success, or are they the product of automated trading bots programmed with questionable algorithms? Transparency is paramount. Reputable services will provide clear information about the team behind the alerts, their trading methodology, and their historical performance data (though even this data should be viewed with a degree of skepticism). Conversely, services shrouded in secrecy, offering vague descriptions of their approach, or refusing to disclose past performance should raise immediate red flags.

One major challenge stems from the inherent nature of the cryptocurrency market: its extreme volatility. What may appear to be a high-probability trade opportunity at one moment can quickly turn sour due to unforeseen market events, regulatory announcements, or simply a shift in market sentiment. Even the most sophisticated algorithms and experienced traders can be caught off guard by these unpredictable fluctuations. Therefore, relying solely on trade alerts, without exercising independent judgment and implementing robust risk management strategies, is a recipe for disaster.

Another critical consideration is the timing of the alerts. Even if a trade recommendation is theoretically sound, the speed at which it is delivered and acted upon can significantly impact its profitability. Delays in receiving alerts, or slow execution of trades, can result in missed opportunities or, worse, entering a trade at an unfavorable price. High-frequency traders often have a significant advantage in reacting to market movements, leaving slower retail investors at a disadvantage. Furthermore, the very act of broadcasting an alert to a large subscriber base can, paradoxically, undermine its effectiveness. As numerous individuals simultaneously attempt to execute the same trade, the increased buying or selling pressure can distort the market, pushing the price away from the intended entry or exit points. This phenomenon, known as "signal degradation," can render even accurate alerts unprofitable.

Moreover, the inherent biases and conflicts of interest that may exist within these services should not be overlooked. Some providers may have affiliations with specific cryptocurrency exchanges or projects, leading them to promote certain assets regardless of their true investment merit. Others may engage in "pump-and-dump" schemes, using their subscriber base to artificially inflate the price of a particular cryptocurrency before selling off their own holdings for a profit. These practices are unethical and illegal, but unfortunately, they are not uncommon in the unregulated corners of the crypto world.

The "realness" of high-value trade alerts is therefore a nuanced question. While some services may genuinely provide insightful and profitable recommendations, many others are simply scams or ineffective marketing ploys. The key to discerning the difference lies in conducting thorough due diligence, exercising critical thinking, and understanding the inherent limitations of relying on external signals in a highly volatile market.

To maximize the chances of success, consider the following:

- Research the provider: Investigate the team, their methodology, and their historical performance data. Look for independent reviews and testimonials.

- Understand the risks: Be aware of the volatility of the cryptocurrency market and the potential for significant losses.

- Implement risk management: Set stop-loss orders to limit potential losses and diversify your portfolio to reduce overall risk.

- Use alerts as a complement, not a substitute: Do not rely solely on trade alerts. Conduct your own research and analysis to make informed trading decisions.

- Be wary of guarantees: Any service promising guaranteed profits is likely a scam.

- Start small: If you decide to subscribe to a trade alert service, start with a small amount of capital and gradually increase your investment as you gain confidence.

- Track your results: Carefully monitor your trading performance to assess the effectiveness of the alerts.

- Be prepared to unsubscribe: If the alerts are not consistently profitable, do not hesitate to cancel your subscription.

Ultimately, the decision of whether or not to subscribe to a trade alert service is a personal one. There is no magic bullet for achieving success in cryptocurrency trading. However, by approaching these services with a healthy dose of skepticism, conducting thorough research, and implementing robust risk management strategies, investors can increase their chances of making informed decisions and potentially generating profits. Remember, the most valuable asset you have is your own knowledge and critical thinking ability. Use it wisely. ```