Here's an article designed to answer the question "How to cash out USDT on Trust Wallet? Keepbit Platform Options?", optimized for SEO and readability:

Cashing Out Your USDT on Trust Wallet: A Comprehensive Guide & Exploring Keepbit's Role

Trust Wallet has become a popular choice for cryptocurrency enthusiasts, providing a secure and user-friendly platform to store and manage digital assets, including USDT (Tether). However, holding USDT is only one piece of the puzzle; eventually, you'll likely want to convert it back to fiat currency (like USD, EUR, etc.) and access those funds in your traditional bank account. This guide walks you through the common methods for cashing out USDT from Trust Wallet, and explores how platforms like Keepbit can potentially simplify this process.

Understanding the Basics: USDT and Trust Wallet

Before diving into the specifics, let's briefly recap what USDT and Trust Wallet are:

- USDT (Tether): A stablecoin pegged to the US dollar. This means that one USDT is designed to be worth approximately one USD. It's a popular choice for traders and investors seeking a stable store of value within the often-volatile cryptocurrency market.

- Trust Wallet: A mobile cryptocurrency wallet that supports a wide range of cryptocurrencies, including USDT. It allows you to store, send, and receive crypto directly from your smartphone. Importantly, Trust Wallet is a non-custodial wallet, meaning you control your private keys and therefore your assets.

Methods for Cashing Out USDT from Trust Wallet

Several options are available for converting your USDT back to fiat currency. Each has its own advantages and disadvantages, so it's important to choose the method that best suits your individual needs and preferences.

1. Centralized Cryptocurrency Exchanges (CEXs): The Traditional Route

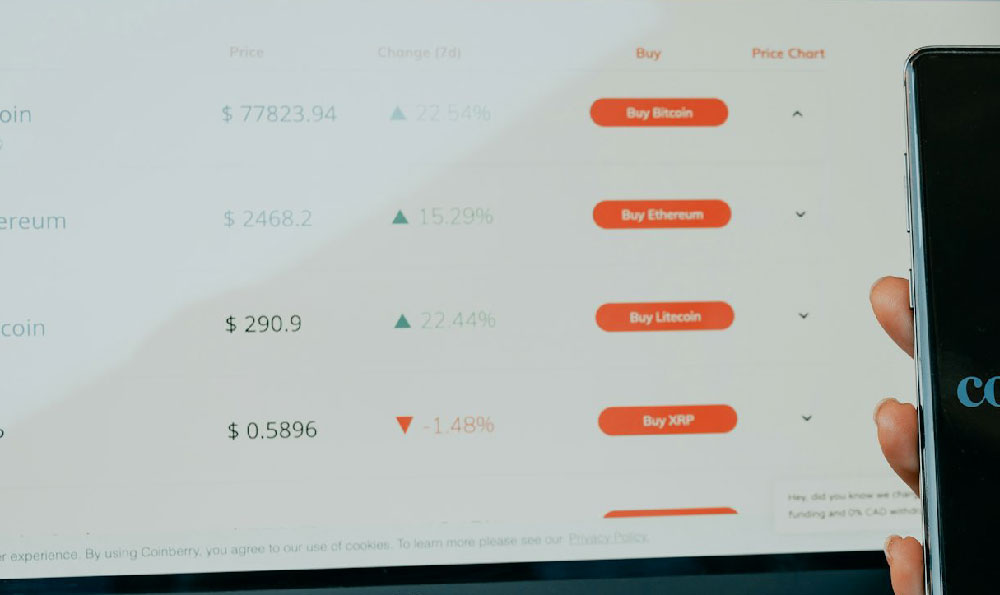

The most common method involves transferring your USDT from Trust Wallet to a centralized cryptocurrency exchange like Binance, Coinbase, Kraken, or KuCoin. Here's a general overview of the process:

- Choose a Reputable Exchange: Select an exchange that supports USDT and your desired fiat currency. Consider factors like trading volume, fees, security, and geographic availability.

- Create an Account and Complete KYC: You'll need to create an account on the chosen exchange and typically complete Know Your Customer (KYC) verification. This involves providing personal information and documentation to comply with regulatory requirements.

- Transfer USDT to the Exchange: Generate a USDT deposit address on the exchange and carefully copy it. In Trust Wallet, navigate to your USDT balance, select "Send," and paste the deposit address. Double-check the address for accuracy before confirming the transaction. Small errors can lead to lost funds.

- Sell USDT for Fiat Currency: Once your USDT arrives on the exchange, you can sell it for your desired fiat currency (e.g., USD, EUR). This is usually done through a spot market where you can place a market order (to sell immediately at the best available price) or a limit order (to sell at a specific price).

- Withdraw Fiat Currency to Your Bank Account: After selling your USDT, you can withdraw the fiat currency to your bank account. The withdrawal process and associated fees will vary depending on the exchange. Expect to provide your bank account details.

Pros of Using CEXs:

- High liquidity, making it easier to buy and sell USDT quickly.

- Generally secure, although exchange hacks can occur.

- Often offer a wide range of trading pairs and features.

Cons of Using CEXs:

- Requires KYC verification, which some users may find intrusive.

- Withdrawal fees can sometimes be significant.

- Subject to regulatory scrutiny and potential account freezes.

2. Peer-to-Peer (P2P) Platforms: A Direct Connection

P2P platforms connect buyers and sellers directly, allowing you to trade USDT for fiat currency with other individuals. Popular P2P platforms include Binance P2P, Paxful, and LocalCryptos.

- Find a Reputable P2P Platform: Select a platform with a good reputation and a high number of users in your region.

- Create an Account: You'll likely need to create an account and complete some basic verification.

- Browse Advertisements: Look for buyers who are willing to purchase USDT for your desired fiat currency and payment method.

- Initiate a Trade: Once you find a suitable buyer, initiate a trade. The platform will usually hold the USDT in escrow until the buyer confirms they have sent the payment.

- Release the USDT: After you receive the payment and verify that it's correct, release the USDT from escrow to the buyer.

Pros of Using P2P Platforms:

- Potentially higher prices compared to centralized exchanges.

- More flexible payment options.

- Can be more private than using a centralized exchange (depending on the platform's verification requirements).

Cons of Using P2P Platforms:

- Risk of scams and fraud. It's crucial to choose reputable traders with good feedback.

- Lower liquidity compared to centralized exchanges.

- Requires more vigilance and careful transaction management.

3. Crypto Debit Cards: Spending Directly from Your Wallet

Some cryptocurrency companies offer debit cards that allow you to spend your crypto directly. These cards typically convert your crypto to fiat currency at the point of sale. While less direct than cashing out, it can be a convenient way to use your USDT for everyday purchases.

- Research Crypto Debit Card Providers: Companies like Crypto.com and Binance offer crypto debit cards. Research their terms and conditions, fees, and supported cryptocurrencies.

- Order a Card: If you find a suitable card, order it and complete the necessary verification steps.

- Fund the Card: Transfer USDT to the card provider's wallet.

- Spend Your Crypto: Use the card like a regular debit card at merchants that accept Visa or Mastercard.

Pros of Using Crypto Debit Cards:

- Convenient for spending crypto directly.

- Avoids the need to constantly convert crypto to fiat currency.

Cons of Using Crypto Debit Cards:

- Fees can be higher than other methods.

- May be subject to transaction limits.

- Subject to the card provider's terms and conditions.

Keepbit: An Alternative Perspective & Platform Options

The provided title mentions "Keepbit Platform Options." While without direct access to information about the Keepbit platform specifically, it's important to consider what a platform like Keepbit might offer in the context of cashing out USDT. Such a platform could potentially focus on streamlining the process through:

- Aggregating Exchange Rates: A platform might aggregate exchange rates from various exchanges to find the best available price for your USDT.

- Automated Transfers: It could automate the process of transferring USDT to an exchange and withdrawing fiat currency.

- Simplified Interface: Aim for a simpler, more user-friendly interface compared to traditional exchanges, making the process more accessible to novice users.

- Enhanced Security: Prioritize security measures to protect users' funds and data.

- Faster Withdrawals: Focus on providing faster withdrawal times compared to some other platforms.

Important Considerations and Risks

No matter which method you choose, keep these important considerations in mind:

- Security: Always prioritize security. Use strong passwords, enable two-factor authentication, and be cautious about phishing scams.

- Fees: Be aware of the fees associated with each method, including transaction fees, withdrawal fees, and potential exchange rate markups.

- Taxes: Cryptocurrency transactions are often subject to taxes. Consult with a tax professional to understand your tax obligations.

- Regulations: Cryptocurrency regulations vary by country. Be aware of the regulations in your jurisdiction.

- Volatility: While USDT is a stablecoin, the value of other cryptocurrencies can fluctuate significantly. Be prepared for potential price volatility if you're trading between USDT and other cryptos.

- Due Diligence: Always do your research before using any platform or service. Read reviews, check the platform's reputation, and understand the risks involved.

Conclusion: Finding the Right Approach

Cashing out USDT from Trust Wallet requires careful consideration of your individual needs and preferences. Centralized exchanges, P2P platforms, and crypto debit cards each offer different advantages and disadvantages. Explore these options thoroughly, weighing the pros and cons of each before making a decision. Explore how platforms like Keepbit (or similar emerging platforms) may provide simplified and potentially more efficient alternatives. By understanding the process and taking necessary precautions, you can safely and effectively convert your USDT back to fiat currency. Remember to always prioritize security and due diligence to protect your funds.