Bluesky, a novel decentralized social network project, has emerged as a compelling case study in the evolving landscape of digital communication. As a protocol-independent platform designed to challenge the dominance of centralized social media giants, its unique approach to monetization has sparked significant interest among investors seeking diverse opportunities in the Web3 space. Understanding the nuances of its revenue model and strategic pathways to monetization is essential for evaluating its potential as a long-term investment and navigating the complexities of its ecosystem. The platform's emphasis on user control, data privacy, and censorship resistance sets it apart from traditional social networks, but these principles also shape its financial framework in ways that distinguish it from conventional models.

At the core of Bluesky's monetization strategy lies its dual objective of fostering a trustless environment while maintaining sustainable revenue streams. Unlike centralized platforms that rely on data monetization through targeted advertising, Bluesky's approach is more subdued and focused on value creation through decentralized participation. The project's funding model is anchored in a combination of venture capital investment, strategic partnerships, and a token-based economy. This hybrid structure allows for liquidity while preserving the platform's autonomy. Investors are often drawn to its potential for innovation, as it aims to redefine user engagement through features like decentralized publishing, semantic indexing, and user-friendly interfaces that prioritize authenticity over algorithmic curation.

One of the most intriguing aspects of Bluesky's revenue model is its potential for evolving with the market. While the initial funding came from a $200 million investment by a consortium of tech firms, the platform has not yet established a direct monetization strategy for end-users. However, this absence of an immediate monetization plan does not imply a lack of financial strategy. Instead, it suggests a deliberate focus on building a robust foundation before introducing revenue-generating mechanisms. This approach aligns with the principles of Web3 development, where user adoption often precedes the implementation of monetization layers. As the platform matures, it may introduce subscription models, premium data services, or value-added features that users can pay for, much like how the early days of Bitcoin saw a transition from a conceptual currency to a practical investment asset.

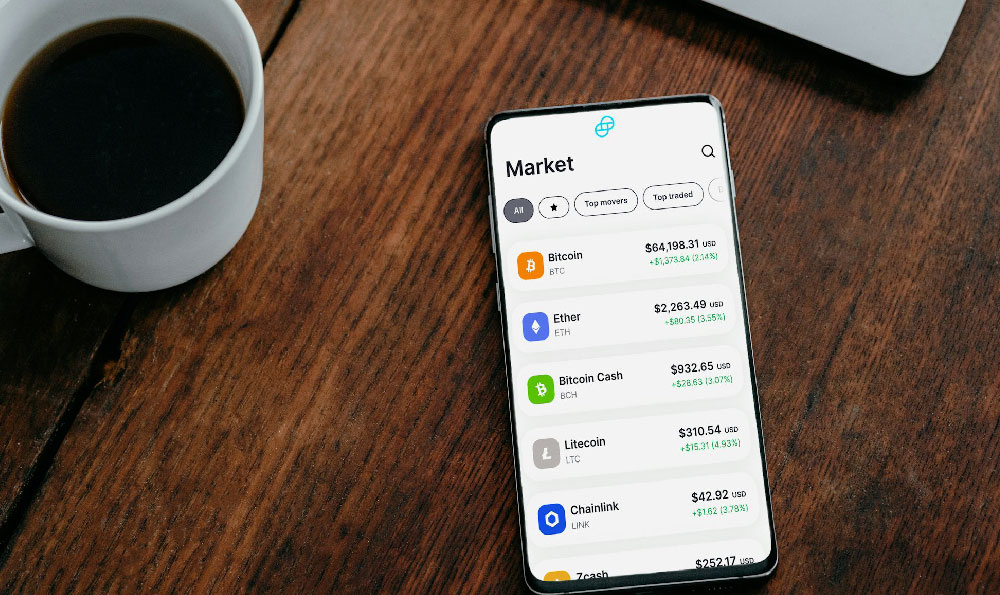

The integration of blockchain technology offers Bluesky an avenue to explore decentralized monetization strategies. By leveraging smart contracts and tokenized incentives, the platform can create a system where user contributions, such as content creation or engagement, are rewarded through native tokens. This not only encourages active participation but also introduces a potential layer of value that could be extracted by users who hold or trade these tokens. However, the success of such a model hinges on the platform's ability to balance decentralization with economic sustainability. The challenge lies in ensuring that tokenomics are structured in a way that prevents exploitation while maintaining user motivation. Investors should closely monitor how the platform addresses this balance, as it could determine the long-term viability of its ecosystem.

Another dimension of Bluesky's monetization potential is its collaborative nature. Unlike traditional platforms where monetization is controlled by a single entity, Bluesky's decentralized structure allows for a more distributed approach. This opens the door for third-party developers to create apps and services that integrate with the platform, potentially generating revenue through transaction fees or commissions. For example, developers could offer analytics tools, content moderation services, or even NFT marketplaces that operate within the Bluesky framework. Such partnerships could serve as a catalyst for additional revenue streams without compromising the platform's core principles. Investors should evaluate the potential for such synergies, as they could unlock new avenues for value creation and diversify the platform's income sources.

Despite its innovative approach, Bluesky's monetization strategy is not without its complexities. The platform's reliance on decentralized infrastructure introduces challenges such as scalability, network congestion, and the risk of market volatility. Additionally, the evolving regulatory landscape for Web3 projects could impact its ability to monetize effectively. Investors must be wary of these potential risks while recognizing the opportunities that arise from the platform's pioneering role in the decentralized internet. The key to successful investment lies in understanding how Bluesky navigates these hurdles while maintaining a clear vision of its financial goals.

Ultimately, Bluesky's revenue model and monetization strategies represent the intersection of technological innovation and financial pragmatism. As the platform continues to develop, its ability to adapt its monetization approach to the needs of its community will be a critical factor in its success. Investors should approach this opportunity with a long-term perspective, recognizing that the platform's value may not be immediately apparent but could grow significantly as it integrates with broader Web3 ecosystems. By staying informed about its development trajectory, investors can position themselves to benefit from its potential while mitigating the inherent risks associated with emerging technologies.