Okay, I'm ready. Here's an article addressing the question of investing in Bitcoin-related stocks, aiming for depth, comprehensive coverage, and avoiding rigid structures and numbered points.

``` The allure of Bitcoin, the digital gold that seemingly sprung from the ether, has captivated investors worldwide. But direct ownership of Bitcoin isn't the only way to participate in this evolving financial landscape. Bitcoin stocks, companies whose fortunes are tied to the performance or infrastructure of the cryptocurrency, offer an alternative avenue, one that promises potential exposure without the direct technical complexities of managing digital wallets and cryptographic keys. However, the question remains: are these stocks a prudent investment, or are they simply a higher-stakes gamble masked as diversification?

Understanding the landscape is paramount. "Bitcoin stocks" isn't a monolith. They represent a diverse spectrum of businesses, each with its own risk profile and correlation to the price of Bitcoin. Mining companies, for example, dedicate immense computing power to validate transactions on the blockchain, earning Bitcoin as a reward. Their profitability is intrinsically linked to the price of Bitcoin, but also to factors like energy costs, the difficulty of mining (which increases as more miners join the network), and their ability to upgrade and maintain their hardware. A sudden drop in Bitcoin price, or an unexpected increase in electricity rates, can significantly impact their bottom line.

Then there are technology companies that provide services or infrastructure related to Bitcoin. Think of companies building cryptocurrency exchanges, developing blockchain solutions for enterprises, or offering secure custody services for digital assets. These companies are less directly tied to the daily fluctuations of Bitcoin's price, but their long-term success hinges on the continued adoption and growth of the cryptocurrency ecosystem. Regulatory hurdles, technological advancements in competing blockchains, and the emergence of newer, more efficient platforms all pose potential threats.

A third category includes companies that have simply embraced Bitcoin as part of their balance sheet. MicroStrategy, for example, has made significant investments in Bitcoin, effectively turning its stock into a leveraged play on the cryptocurrency's price. While a rising Bitcoin price can boost the company's perceived value and attract investors, a sharp downturn can lead to significant losses and potentially trigger margin calls. These companies often carry a higher degree of idiosyncratic risk, as their performance is also influenced by the overall health of their core business and the management's strategic decisions.

Before diving into any Bitcoin stock, meticulous due diligence is crucial. Simply seeing "Bitcoin" associated with a company's name should not be a signal to invest. Investors need to thoroughly research the company's business model, financial health, competitive landscape, and management team. What are their revenue streams? How profitable are they? What are their growth prospects? How well are they managing risk? Are they facing any regulatory challenges? These are just some of the questions that need to be answered.

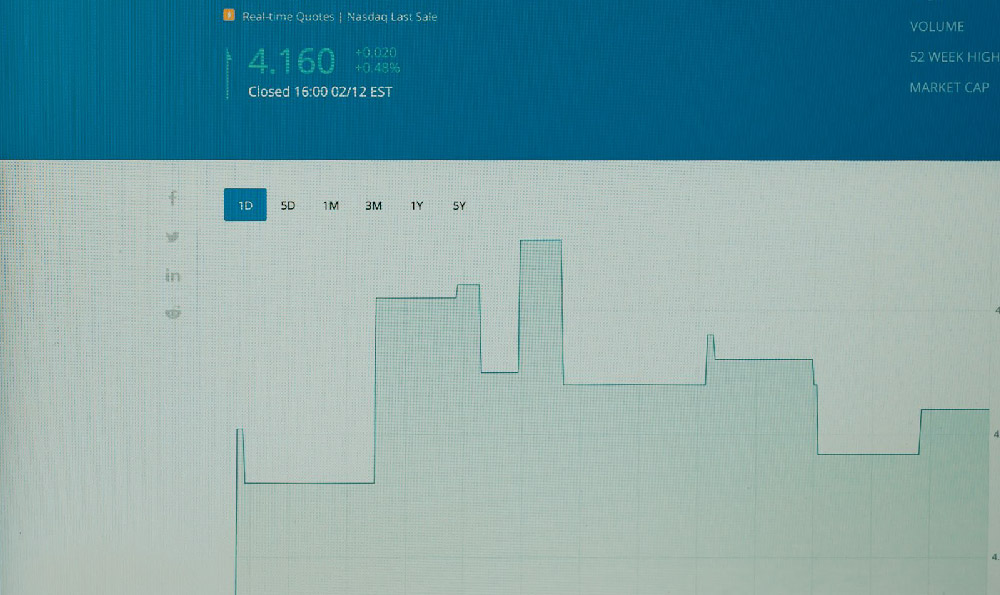

Furthermore, understanding the correlation between the stock's price and the price of Bitcoin is essential. While some stocks may move in lockstep with Bitcoin, others may exhibit a weaker correlation, influenced by factors specific to the company or the broader market. Investors should analyze historical data to assess the degree of correlation and understand how the stock is likely to perform under different market conditions.

One of the key arguments in favor of investing in Bitcoin stocks is that they offer a more accessible and regulated way to gain exposure to the cryptocurrency market. Buying and storing Bitcoin directly can be complex and requires a certain level of technical expertise. Bitcoin stocks, on the other hand, can be easily bought and sold through traditional brokerage accounts, and they are subject to regulatory oversight. This can provide a sense of security for investors who are new to the world of cryptocurrencies.

However, this accessibility comes at a cost. Bitcoin stocks often trade at a premium compared to the underlying value of Bitcoin, reflecting the perceived convenience and security they offer. This premium can erode potential returns, especially if the stock's price fails to keep pace with the growth of Bitcoin itself.

Another risk to consider is the potential for fraud and manipulation in the cryptocurrency market. While regulations are slowly catching up, the industry remains relatively unregulated compared to traditional financial markets. This can make it easier for unscrupulous actors to engage in pump-and-dump schemes or other fraudulent activities that can harm investors.

Ultimately, the decision of whether to invest in Bitcoin stocks depends on an individual's risk tolerance, investment goals, and understanding of the cryptocurrency market. For those who are comfortable with the volatility and potential risks associated with Bitcoin, and who have a long-term investment horizon, Bitcoin stocks can be a potentially rewarding addition to a diversified portfolio. However, for those who are risk-averse or who lack a deep understanding of the market, it may be wise to steer clear.

It's important to remember that investing in Bitcoin stocks is not a guaranteed path to riches. Like any investment, it carries inherent risks, and there is always the possibility of losing money. Before investing, it's essential to consult with a qualified financial advisor who can help you assess your risk tolerance and develop an investment strategy that is aligned with your goals. The crypto space is constantly evolving, and staying informed and adaptable is key to navigating this complex and potentially lucrative landscape. Don't let FOMO (fear of missing out) drive your decisions; instead, rely on thorough research and a disciplined approach to investing. ```