The release of James Cameron’s Avatar in 2009 marked a watershed moment in cinematic history, not only for its groundbreaking use of 3D technology but also for its extraordinary financial performance. With a box office gross of over $2.7 billion globally, the film became the highest-grossing movie of all time, surpassing Titanic and setting a precedent that would influence both the entertainment industry and broader investment markets. While the statistics of Avatar’s success offer a fascinating case study in traditional media, they also provide valuable parallels to the principles of investing in virtual currencies—a field that shares similarities with the allure and volatility of a blockbuster film’s financial trajectory. As investors navigate the complexities of digital assets, understanding how Avatar’s legacy can inform strategies for wealth growth and risk mitigation becomes both insightful and instructive.

The global phenomenon of Avatar demonstrated the power of innovation to captivate audiences and generate unprecedented returns. Cameron’s decision to prioritize immersive storytelling and cutting-edge visual effects coincided with a growing appetite for high-budget, visually stunning films. The film’s ability to transcend cultural and lingual barriers, coupled with its massive marketing campaign, highlighted how strategic foresight and audience engagement can drive financial success. This mirrors the dynamics of virtual currency markets, where pioneers and early adopters must anticipate technological shifts and consumer demand to capitalize on emerging opportunities. Investors in crypto projects often emulate the film industry’s approach to innovation, seeking out developments that promise to redefine user experiences or unlock new market segments. For instance, the rise of non-fungible tokens (NFTs) in 2021 paralleled the shift to 3D cinema, as both sectors relied on novel technologies to capture public interest and create value. However, the film’s success also underscores the importance of timing—Avatar launched at a moment when 3D technology was becoming increasingly viable, whereas many crypto ventures have faced skepticism or regulatory hurdles that delayed their mainstream acceptance. This teaches investors that even the most promising ideas require alignment with market maturity and consumer readiness, a lesson that remains critical in the volatile crypto landscape.

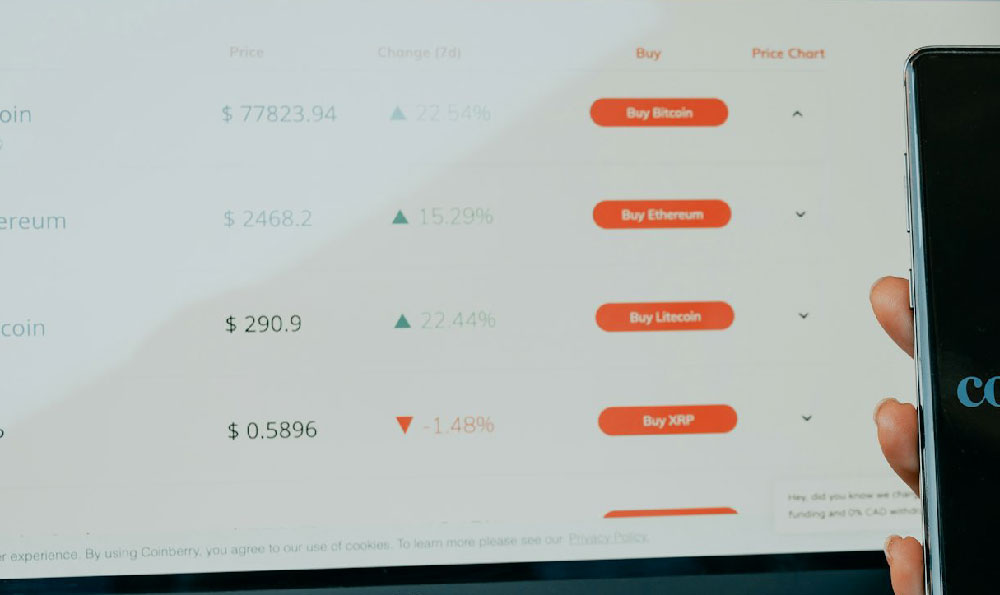

Beyond innovation, Avatar exemplified the role of long-term vision in financial success. Cameron’s commitment to storytelling and its underlying themes of environmental stewardship and cultural exchange resonated with audiences beyond its immediate entertainment value, fostering a loyal fanbase that sustained interest long after initial releases. This echoes the mindset of crypto investors who must balance short-term price fluctuations with the long-term potential of blockchain-based assets. Unlike traditional markets, where performance is often measured by quarterly earnings or yearly returns, the crypto sector demands patience. Projects like Bitcoin or Ethereum, for example, have shown exponential growth over years, even as their price trajectories were marked by sharp corrections. The Avatar case reinforces the idea that financial success hinges on staying invested through cycles, rather than succumbing to panic during market downturns. For newcomers to crypto, this principle is vital: the market’s volatility is a natural byproduct of its speculative nature, but consistent, informed engagement can yield outsized rewards. Just as Cameron’s vision for Avatar required perseverance against early resistance to 3D filmmaking, crypto investors must navigate skepticism and short-term volatility to realize their goals.

Critically, Avatar’s financial success was not without challenges. The film faced production delays, budget overruns, and skepticism about its 3D format, yet these obstacles were leveraged to build anticipation and justify its eventual profitability. Similarly, virtual currency investments often involve overcoming entrenched skepticism, particularly around regulatory frameworks, security protocols, and scalability concerns. In 2009, the global economic climate was still grappling with the aftermath of the financial crisis, yet Avatar became a symbol of resilience and optimism. This duality is also evident in the crypto market, where early adopters faced a world still wary of decentralized systems, yet their patience paid off as blockchain technology proved its utility in finance, supply chain, and identity management. Investors who recognize that market skepticism often precedes value creation are better equipped to avoid the pitfalls of “fear of missing out” (FOMO) and make disciplined decisions. For example, the 2020 surge of Bitcoin amid global uncertainty showcased how systemic issues can create opportunities for those who remain冷静 and focused on fundamentals rather than hype.

The Avatar narrative also serves as a cautionary tale about the risks of overconfidence and market saturation. Its success temporarily dominated global box office charts, but the subsequent dominance of other blockbuster films, such as the Harry Potter series or Marvel franchises, demonstrated that no single project can sustain perpetual growth. This mirrors the cryptocurrency market’s tendency for rapid innovation and overcrowded paradigms, where early leaders like Bitcoin and Ethereum face challenges from altcoins and new protocols. Similarly, NFT platforms and DeFi projects have seen cycles of overhype and subsequent corrections, often driven by speculation rather than intrinsic value. Investors must therefore adopt a diversified approach, much like how the film industry fragments its risks across genres and studios. Holding a mix of established cryptocurrencies and promising emerging projects reduces exposure to single-point failures while ensuring participation in multiple growth narratives.

Technological evolution remains a cornerstone of both Avatar’s success and crypto investment opportunities. The film’s 3D format was revolutionary in 2009, but its long-term impact lies in its ability to redefine the industry’s standards. Similarly, disruptive technologies in crypto—such as smart contracts, decentralized finance (DeFi), and quantum-resistant algorithms—can reshape financial systems. However, the transition from novelty to mainstream adoption is not guaranteed. Investors must assess the technological maturity, utility, and adoption rates of projects, much like how studios evaluate a film’s feasibility before greenlighting production. For instance, the integration of blockchain into real-world applications, such as cross-border payments or digital art ownership, has begun to validate the technology’s staying power. Yet, as with Avatar’s early challenges, these transitions are often slow and require persistence to navigate.

Ultimately, the story of Avatar’s 2009 profitability offers investors a framework for balancing ambition with realism. The film’s creators understood that technical excellence alone was insufficient to guarantee success—they needed to align their vision with market demands and cultural shifts. In crypto, this means prioritizing projects that address real-world problems, exhibit strong governance, and boast sustainable ecosystems. At the same time, the film’s ability to maintain relevance through merchandise, theme parks, and sequels illustrates the value of long-term asset management, a concept that applies equally to crypto portfolios. By analyzing historical cases like Avatar, investors can better appreciate the interplay between creativity, timing, and strategic patience—principles that remain as relevant in digital markets as they were in the 2009 cinema landscape. While the path to financial growth may be fraught with uncertainty, the lessons from Avatar remind us that true success often hinges on the courage to invest in the future, even when the present seems hesitant.