AtomBeam: Navigating the Hype to Assess Investment Potential

The cryptocurrency landscape is a volatile and often perplexing terrain, riddled with projects promising revolutionary solutions and astronomical returns. Discerning legitimate opportunities from fleeting hype is a critical skill for any investor. AtomBeam, with its focus on data compression and transmission efficiency for IoT devices, presents an intriguing case study. To assess its investment worth, we must delve beyond the surface and analyze its technology, market position, team, and potential risks.

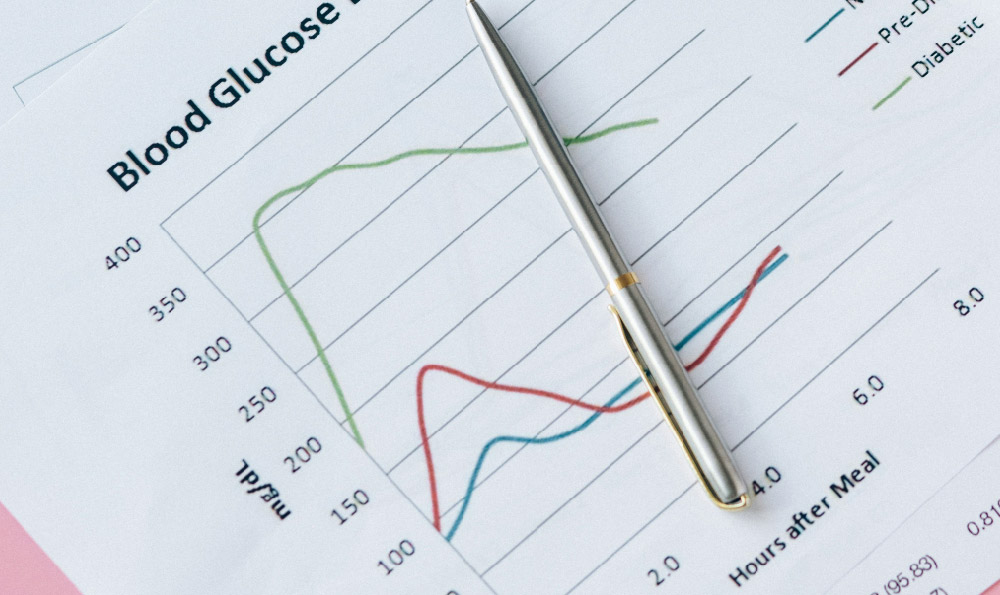

At its core, AtomBeam's value proposition lies in its proprietary data compression technology. The increasing proliferation of IoT devices necessitates efficient data transmission, especially in resource-constrained environments. If AtomBeam's technology delivers on its promises of significantly reducing data size without compromising accuracy, it could unlock substantial cost savings and improve performance for a wide range of applications, including smart cities, industrial automation, and healthcare.

However, evaluating the technology requires careful scrutiny. Investors should seek independent verification of AtomBeam's compression ratios and efficiency gains. Are these claims substantiated by peer-reviewed research or third-party audits? Furthermore, how does AtomBeam's technology compare to existing compression algorithms and emerging competitors? The market for data compression is not stagnant, and AtomBeam must demonstrate a clear and sustainable technological advantage to justify its valuation. Understanding the technical nuances and competitive landscape is crucial before committing any capital.

Beyond the technology itself, the market potential is a vital consideration. The IoT market is undeniably massive and continues to grow exponentially. This provides a fertile ground for companies offering solutions that address the challenges of data management and transmission. However, market size alone does not guarantee success. AtomBeam needs to effectively penetrate target markets and secure strategic partnerships. This requires a well-defined go-to-market strategy and a proven ability to attract and retain customers. Investors should carefully examine AtomBeam's partnerships, customer acquisition costs, and overall market traction. Are they gaining significant adoption within their target industries? Are they effectively competing with established players in the field?

The team behind AtomBeam is another crucial factor to assess. Do they possess the technical expertise, business acumen, and experience necessary to navigate the complexities of the cryptocurrency and IoT markets? A strong team with a track record of success can significantly increase the likelihood of project success. Investors should research the backgrounds of the key team members and advisors, evaluating their qualifications and previous accomplishments. Furthermore, consider the governance structure of the project. Is decision-making transparent and decentralized? Are there mechanisms in place to protect the interests of token holders?

Of course, any investment in cryptocurrency carries inherent risks, and AtomBeam is no exception. The volatility of the cryptocurrency market can significantly impact the value of AtomBeam's token. Furthermore, regulatory uncertainties surrounding cryptocurrencies can pose a threat to the project's long-term viability. Liquidity can also be a concern, especially for smaller projects. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly. Never invest more than you can afford to lose.

Specific risks associated with AtomBeam include potential technological obsolescence, competitive pressures, and execution challenges. The rapid pace of innovation in the technology sector means that AtomBeam's technology could become outdated if they fail to adapt and evolve. Competitors may emerge with superior solutions, eroding AtomBeam's market share. Furthermore, even with a strong technology and a capable team, AtomBeam may face challenges in executing its business plan and achieving its goals.

To mitigate risks, investors should conduct thorough due diligence, stay informed about market developments, and carefully manage their position. This includes actively monitoring AtomBeam's progress, tracking its partnerships and customer acquisition, and analyzing its tokenomics. Pay attention to the project's community and social media channels to gauge sentiment and identify any potential red flags.

Before investing in AtomBeam, consider the tokenomics of the project. How are the tokens distributed? What is the total supply? What are the vesting schedules for team members and early investors? These factors can significantly impact the long-term value of the token. A high concentration of tokens in the hands of a few individuals or a poorly designed token distribution model can create downward pressure on the price.

In conclusion, whether AtomBeam represents a worthwhile investment opportunity or a significant risk depends on a multitude of factors. Its potential lies in its innovative data compression technology and the growing demand for efficient data transmission in the IoT market. However, investors must carefully assess the technology's competitive advantage, the team's capabilities, the market's dynamics, and the inherent risks associated with cryptocurrency investments. Thorough due diligence, a clear understanding of the project's fundamentals, and a well-defined risk management strategy are essential for making informed investment decisions. Treat any information encountered with a degree of skepticism. Do not rely on marketing materials or promises of quick returns. Instead, focus on independent research, critical analysis, and a long-term perspective. Only then can you determine whether AtomBeam aligns with your investment goals and risk tolerance. Remember, past performance is not indicative of future results, and investing in cryptocurrencies always carries the risk of losing capital. Approach with caution, conduct thorough research, and make informed decisions based on your own individual circumstances.