Art investment, often perceived as a realm of the elite and the aesthetically inclined, straddles the line between a sophisticated financial maneuver and a precarious gamble. Understanding whether art truly belongs in a diversified investment portfolio requires a deep dive into its unique characteristics, potential benefits, and inherent risks. It's not simply about possessing a keen eye for beauty; it demands a pragmatic approach, thorough research, and a realistic assessment of one's financial goals and risk tolerance.

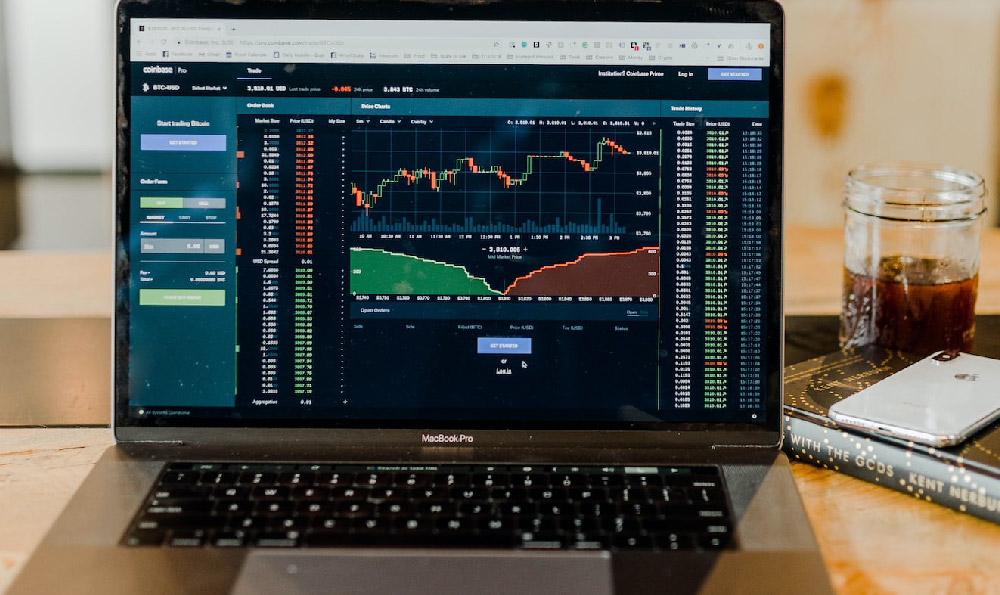

The allure of art as an investment stems from several factors. First, art can serve as a hedge against inflation. Unlike traditional assets such as stocks and bonds, art's value isn't directly correlated with market fluctuations. In times of economic uncertainty and rising inflation, investors often flock to tangible assets, driving up demand and consequently, the prices of art. This makes art a potential store of value, preserving wealth during turbulent economic periods.

Second, the finite supply of certain artworks, particularly those created by renowned and deceased artists, contributes to their long-term appreciation. As time passes and the availability of these masterpieces remains limited, their scarcity increases, driving up their prices. This scarcity factor makes art a potentially lucrative investment for patient investors willing to hold onto their assets for the long haul. Think of iconic paintings by Van Gogh or Monet, their value steadily appreciating over decades, far exceeding returns from traditional investment vehicles.

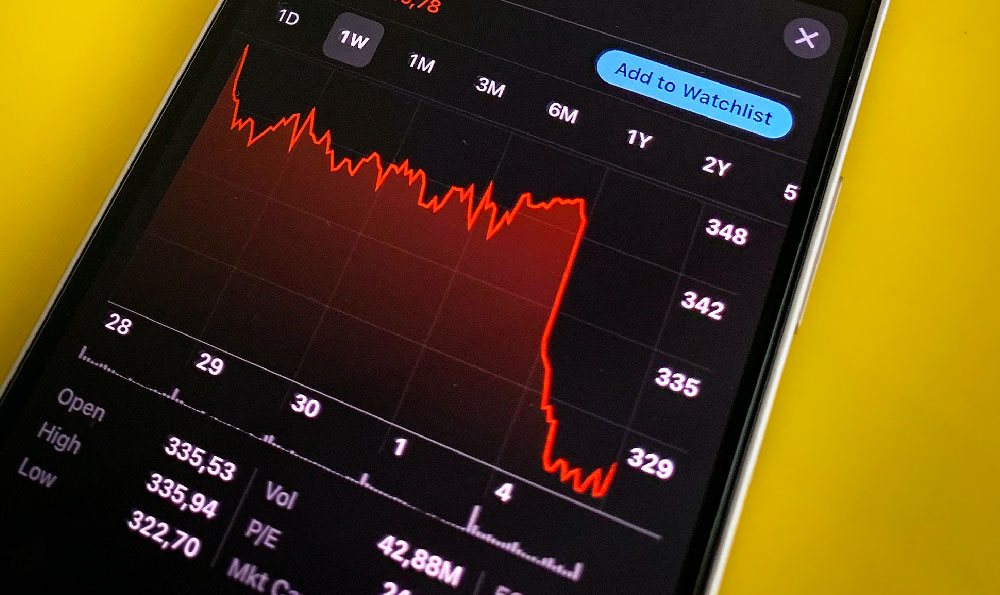

Third, art can provide diversification benefits to a portfolio. Its low correlation with other asset classes means that art's performance is unlikely to mirror the performance of stocks, bonds, or real estate. This diversification effect can help to reduce overall portfolio volatility and improve risk-adjusted returns. In essence, adding art to a portfolio can smooth out the bumps during market downturns, providing a cushion against losses.

However, the path to art investment is fraught with challenges and risks that must be carefully considered. Liquidity is a major concern. Unlike stocks or bonds that can be easily bought and sold on exchanges, art is a relatively illiquid asset. Finding a buyer willing to pay the desired price can take time, and transaction costs, including auction fees and commissions, can be significant. This lack of liquidity makes art investment unsuitable for those who may need to access their capital quickly.

Furthermore, the art market is notoriously opaque and subjective. Valuation is not based on objective metrics like earnings or cash flow, but rather on factors such as provenance, condition, rarity, and artistic merit. These factors are often subject to interpretation and can be influenced by trends and tastes, making it difficult to accurately assess the value of an artwork. What is considered a masterpiece today might fall out of favor tomorrow, leading to a significant decline in value.

Authentication and provenance are also critical considerations. Ensuring that an artwork is genuine and has a verifiable history is essential to protect against fraud and forgeries. This requires engaging with reputable art experts and conducting thorough due diligence to verify the artwork's authenticity and ownership history. The art world is rife with fakes and forgeries, and purchasing an inauthentic artwork can result in a complete loss of investment.

Storage, insurance, and maintenance are additional costs associated with art investment. Artwork requires proper storage conditions, including climate control and security, to prevent damage and deterioration. Insurance is also necessary to protect against theft, damage, or loss. These ongoing costs can eat into potential returns and should be factored into the investment decision.

The art market can also be influenced by economic cycles and geopolitical events. During periods of economic recession or political instability, demand for art may decline, leading to lower prices. Conversely, during periods of economic boom and increased wealth, demand for art may increase, driving up prices. Understanding these macroeconomic factors is crucial for making informed investment decisions.

For those considering art investment, a cautious and informed approach is paramount. Start by educating yourself about the art market and the different genres and styles of art. Attend art fairs, visit museums and galleries, and read art publications to develop your knowledge and understanding. Seek advice from reputable art advisors who can provide guidance on valuation, authentication, and market trends.

It's crucial to diversify your art holdings and avoid concentrating your investment in a single artist or style. This will help to mitigate risk and increase the chances of long-term success. Only invest what you can afford to lose, as the art market can be volatile and unpredictable. Treat art investment as a long-term endeavor and be prepared to hold onto your assets for several years, or even decades, to realize their full potential.

Ultimately, whether art investment is a smart move or a risky gamble depends on the individual investor's circumstances, knowledge, and risk tolerance. It's not a suitable investment for everyone. However, for those with the passion, resources, and expertise, art can offer a unique and rewarding investment opportunity, providing both financial returns and the enjoyment of owning beautiful and culturally significant objects. A measured, informed, and diversified approach is the key to navigating the complexities of the art market and turning what might seem like a gamble into a potentially smart investment strategy. The crucial ingredient is treating it like a business, not solely as a hobby fueled by passion.