The landscape of cryptocurrency investment is perpetually shifting, and the emergence of sophisticated AI tools, often dubbed "AI 2.0," has further complicated and simultaneously enriched the possibilities. Navigating this evolving terrain requires a blend of fundamental understanding, technological awareness, and a healthy dose of skepticism. Where does one begin, and what constitutes the optimal approach to investing in this AI-enhanced era?

Embarking on any investment journey, particularly one involving the volatile realm of cryptocurrency, necessitates a foundation of knowledge. This doesn't mean becoming a coding expert or a cryptography whiz overnight. Rather, it involves comprehending the underlying principles of blockchain technology, the mechanisms that drive price fluctuations, and the regulatory environment governing digital assets. Begin by familiarizing yourself with the different categories of cryptocurrencies: those designed as stores of value (like Bitcoin), those facilitating decentralized applications (like Ethereum), and those focusing on specific niches (like supply chain management or decentralized finance - DeFi). Understand their respective use cases, the teams behind them, and the potential for long-term adoption. Reputable online resources, academic papers, and well-regarded cryptocurrency news outlets are invaluable tools in this initial phase.

Once you've grasped the fundamentals, it's time to explore how AI is impacting the cryptocurrency space. AI 2.0, characterized by more advanced machine learning models and natural language processing capabilities, manifests in several ways. One prominent application is algorithmic trading. AI-powered bots can analyze vast amounts of market data, identify patterns invisible to the human eye, and execute trades automatically. While the allure of automated profits is strong, caution is paramount. These bots are only as good as the data they're trained on and the algorithms that govern their actions. A poorly designed or backtested bot can lead to significant losses. Therefore, if you're considering using such tools, thoroughly research their developers, understand their methodologies, and ideally, begin with a small amount of capital to test their performance in a live trading environment.

Another area where AI is making waves is in sentiment analysis. AI algorithms can scour social media, news articles, and other online sources to gauge public sentiment towards particular cryptocurrencies. A surge in positive sentiment could indicate a potential price rally, while a wave of negativity might signal an impending correction. Again, these tools are not foolproof. Sentiment is often manipulated, and relying solely on it for investment decisions can be risky. It's best to use sentiment analysis as one piece of the puzzle, complementing other technical and fundamental indicators.

Furthermore, AI is playing an increasing role in cybersecurity within the cryptocurrency ecosystem. AI-powered security systems can detect and prevent fraudulent activities, such as phishing attacks and exchange hacks. As the value of digital assets grows, so does the sophistication of cybercriminals. Therefore, understanding how AI is being used to protect your investments is crucial. This includes choosing exchanges with robust security measures, utilizing hardware wallets to store your cryptocurrencies offline, and being vigilant against phishing attempts.

Now, let's address the best approach to investing in this AI-influenced market. There's no one-size-fits-all answer, as the ideal strategy depends on your risk tolerance, investment goals, and time horizon. However, certain principles remain universally applicable.

Firstly, diversification is key. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies and asset classes to mitigate risk. Consider allocating a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, while reserving a smaller portion for more speculative altcoins with higher growth potential. Remember that altcoins are inherently riskier, and their prices can be highly volatile.

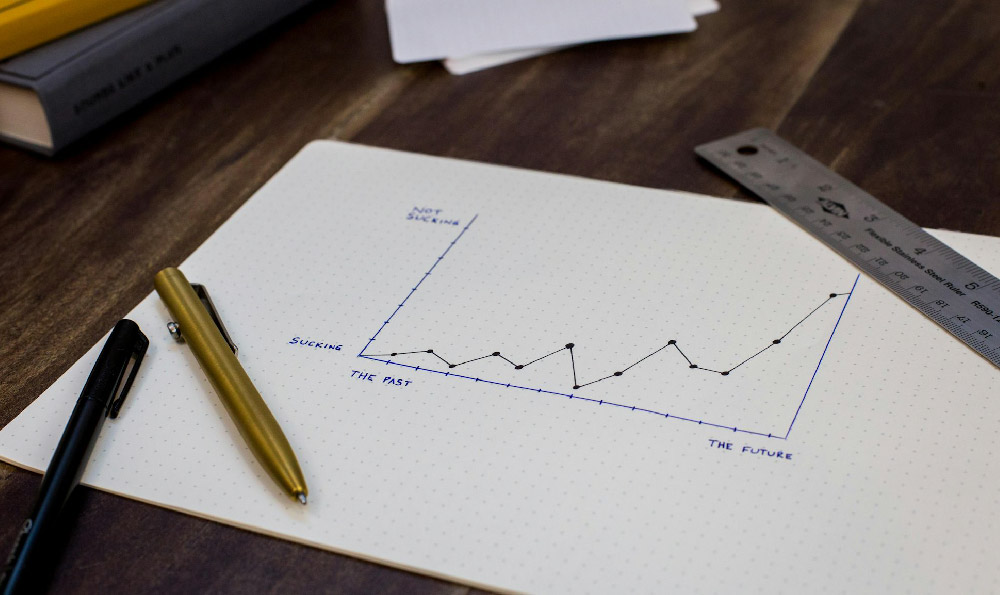

Secondly, implement a dollar-cost averaging (DCA) strategy. This involves investing a fixed amount of money at regular intervals, regardless of the price. DCA helps to smooth out the volatility and reduces the risk of buying at the peak. Whether the price is high or low, you're consistently adding to your position, which can lead to better long-term returns.

Thirdly, stay informed and adapt your strategy as needed. The cryptocurrency market is constantly evolving, and new technologies and regulatory developments emerge frequently. Continuously educate yourself, monitor market trends, and be prepared to adjust your investment strategy accordingly. Don't be afraid to cut your losses if an investment is not performing as expected.

Fourthly, manage your emotions. Fear and greed are powerful emotions that can cloud judgment and lead to irrational investment decisions. Avoid making impulsive decisions based on short-term price fluctuations. Stick to your predetermined investment plan and avoid letting your emotions dictate your actions.

Finally, be wary of scams and high-yield investment programs (HYIPs). The cryptocurrency space is rife with scams promising guaranteed returns and easy riches. If something sounds too good to be true, it probably is. Do your due diligence before investing in any project and be skeptical of anyone promising unrealistic returns. Always prioritize security and protect your private keys.

Investing in the age of AI 2.0 offers unprecedented opportunities, but it also presents unique challenges. By combining a solid understanding of the fundamentals with a cautious approach to AI-powered tools and a commitment to risk management, you can navigate this exciting frontier and potentially achieve your financial goals. Remember that investing in cryptocurrency involves inherent risks, and you should only invest what you can afford to lose. Consulting with a qualified financial advisor is always recommended before making any investment decisions.